Description

Disclaimer: Copyright infringement not intended.

Context

- The Securities and Exchange Board of India (SEBI), responding to the increase in ESG investing and the demand by investors for information on ESG risks, substantially revised the annual Business Responsibility and Sustainability Report (BRSR) required by the 1,000 largest listed companies in India.

What is ESG and why is it important?

- “Environmental, Social and Governance” (“ESG”) refers to a set of criteria to determine how a company performs in preserving the natural environment, managing relationships with its stakeholders, and also how it deals with matters including the company’s leadership, internal controls, and shareholder’s rights. These standards are used by socially and environmentally conscious investors to screen their potential investments.

- Environmental, social, and corporate governance (ESG) is a strategic framework for activities ranging from the company’s carbon footprint and commitment to sustainability to its workplace culture and commitment to diversity and inclusion to its overall ethos regarding corporate risks and practices.

- It’s an organizational construct that’s become increasingly important, especially to socially responsible investors who want to invest in companies that have a high ESG rating or score.

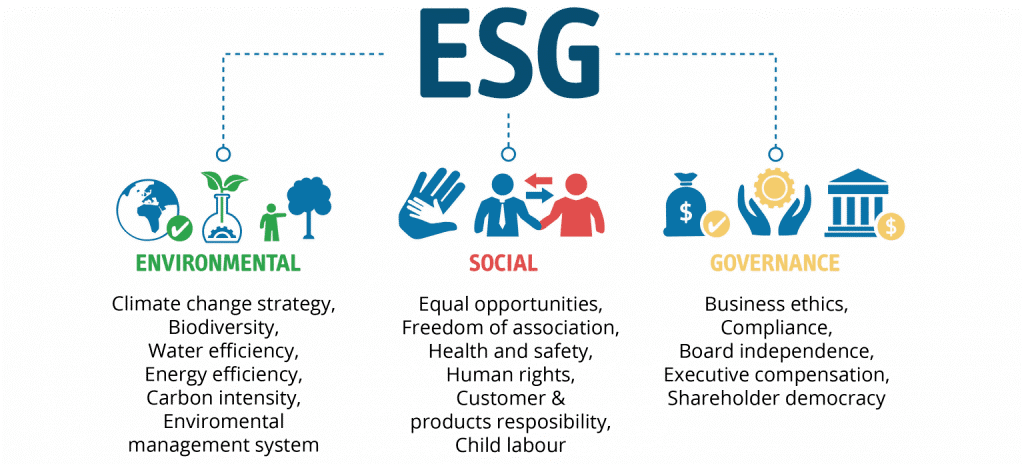

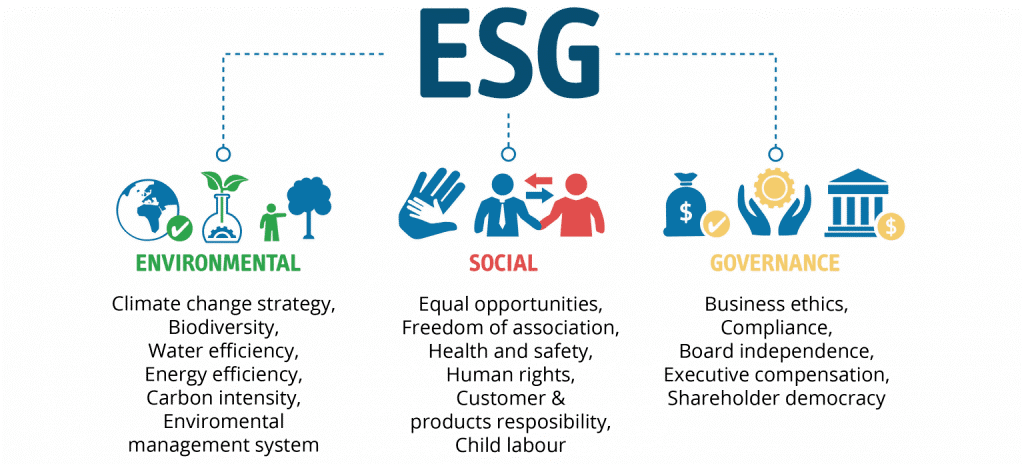

Pillars of ESG

The three main pillars of ESG include:

- Environmental commitment: This includes everything around a company’s commitment to sustainability and the impact it has on the environment, including its carbon emissions and footprint, energy usage, waste, and environmental responsibility.

- Social commitment: This covers a company’s internal workplace culture, employee satisfaction, retention, diversity, workplace conditions, and employee health and safety. Companies with happy and healthy employees perform better and are viewed as a stronger investment.

- Corporate governance: A company’s commitment to governance includes compliance, the internal corporate culture, pay ratios, the company ethos, and transparency and accountability in leadership. Investors are interested in companies that can keep up with changing laws and regulations, and that have a commitment to equity and equality in the workplace.

.jpeg)

ESG Legal Regime in India

- While there are various laws that have been introduced in India for the protection of the environment, equitable treatment and overall well-being of employees and for corporate governance, there has not been any single piece of legislation covering all elements of ESG or standards for ESG related criteria on a uniform basis.

- Even though in the last 10-12 years, various initiatives have been introduced to focus on ESG-related compliances, this has been done in a fragmented manner and often on a voluntary basis.

- But in India, if we talk about sustainability, there have been two watershed moments—Corporate Social Responsibility (CSR) reporting and spending, the first such initiative globally, being made mandatory under the Companies Act, 2013; and the Securities and Exchange Board of India (SEBI) making the Business Responsibility and Sustainability Report (BRSR) mandatory for the top 1,000 listed companies by market capitalization.

- The setting up of the Select Focus Group (SFG) by the RBI, recognition by RBI of the importance of green finance in India, and release of a consultation paper by SEBI on 'Environmental, Social and Governance Rating Providers for Securities Markets' that proposes a framework to regulate ESG rating providers in India make it amply clear that the Indian regulatory authorities are now catching up on the ESG trends that have been ongoing at a global level.

Need for legislation on ESG

- As the hope of restricting global warming to 1.5 degrees Celsius recedes rapidly, there is a dire need for companies to reorganize their business processes to contain the worst excesses of climate change.

- The value that ESG creates for businesses as consumers become more aware of their carbon footprint and its potential positive impact on business performance.

- Studies prove that a focus on ESG helps organizations increasingly access new pools of capital, build a strong reputation among consumers and ensure a sustainable growth path — from policymakers, and consumers to investors, ESG matters to all.

- Although the attention paid to ESG by Indian companies is on the rise, it is still not sufficient. A possible solution would be to include ESG related regulations in the Indian Companies Act, 201370, to give ESG the importance and enforcement mechanisms that requires in order to reduce the environmental and social risks that India is currently facing.

Why is ESG relevant in India?

- India has long had a number of laws and bodies regarding environmental, social and governance issues, including the Environment Protection Act of 1986, quasi-judicial organisations such as the National Green Tribunal, a range of labour codes and laws governing employee engagement and corporate governance practices.

- The penalty for violations can be substantial. In June 2022, for example, the National Green Tribunal imposed an ₹520 million ($63.7 million) penalty on the Udupi Power Corporation Ltd., a subsidiary of a major Indian conglomerate, for violating environmental laws and polluting its surroundings.

- While these laws and bodies provide important environmental and social safeguards, new initiatives in India go further, establishing guidelines that emphasise monitoring, quantification and disclosure, akin to ESG requirements found in other parts of the world. The Securities and Exchange Board of India (SEBI), responding to the increase in ESG investing and the demand by investors for information on ESG risks, substantially revised the annual Business Responsibility and Sustainability Report (BRSR) required by the 1,000 largest listed companies in India. SEBI describes the current report format as a “notable departure” from previous disclosure requirements, which are aligned with evolving global standards and place “considerable emphasis on quantifiable metrics” to allow companies to engage meaningfully with stakeholders and to enhance investor decision making. Disclosures range from greenhouse gas emissions to the company’s gender and social diversity.

- Further legislation regarding ESG are likely, given the increased emphasis by the Indian government on ESG issues, which can be seen in India’s more active role in global climate forums.

What are the implications for Indian companies?

- Compliance with ESG regulations — both originating in India and elsewhere around the world — thus, pose a significantly different challenge than India’s CSR regulations. In particular, compliance by Indian companies with the ESG regulations of the U.S., the U.K., the European Union and elsewhere will be critical if India is to take full advantage of the growing decoupling from China and play a more prominent role in global supply chains and the global marketplace overall.

- As Indian companies look to expand their ESG risk management, thorough due diligence will play a key role. However, this requires more than having sub-suppliers fill out a questionnaire. Due diligence that can stand up to scrutiny means going deeper.

- Depending on the situation, this can include looking at company records, interviewing former employees and making discreet visits to observe operations to ensure that the measures to comply with international ESG standards are in effect.

- This is particularly true when the supplier’s own supply chains have several layers. Ownership that is obscured through shell companies can present additional challenges. Further, ESG due diligence needs to be supported within the company with detailed procedures for assessing risks and controls for assuring that no corners are cut.

- Companies that wish to maximise their opportunities in the global economy need to embrace these new requirements and adjust their organisations accordingly.

https://www.thehindu.com/opinion/op-ed/explained-the-rise-of-the-esg-regulations/article66610907.ece