Description

Disclaimer: Copyright infringement not intended.

Disclaimer: Copyright infringement not intended.

In News

- The Karnataka High Court recently invalidated a 15-year-old amendment to the law allowing the inclusion of foreign workers in the Employees’ Provident Fund (EPF), deeming it "unconstitutional and arbitrary."

- This decision pertains to the provisions outlined in paragraph 83 of the Employees’ Provident Funds Scheme, 1952 (EPF Scheme) and paragraph 43A of the Employees’ Pension Scheme, 1995 (EP Scheme).

Understanding the Employees Provident Fund (EPF)

- The Employees’ Provident Fund Scheme Act, 1952, the Employees’ Deposit Linked Insurance Scheme Act, 1976, and the Employees’ Pension Scheme Act, 1995 are the three Acts that govern the EPF programme, benefiting over 5 billion individuals through monthly contributions from both employees and employers. It serves as a cornerstone of social security, ensuring financial stability for employees post-retirement.

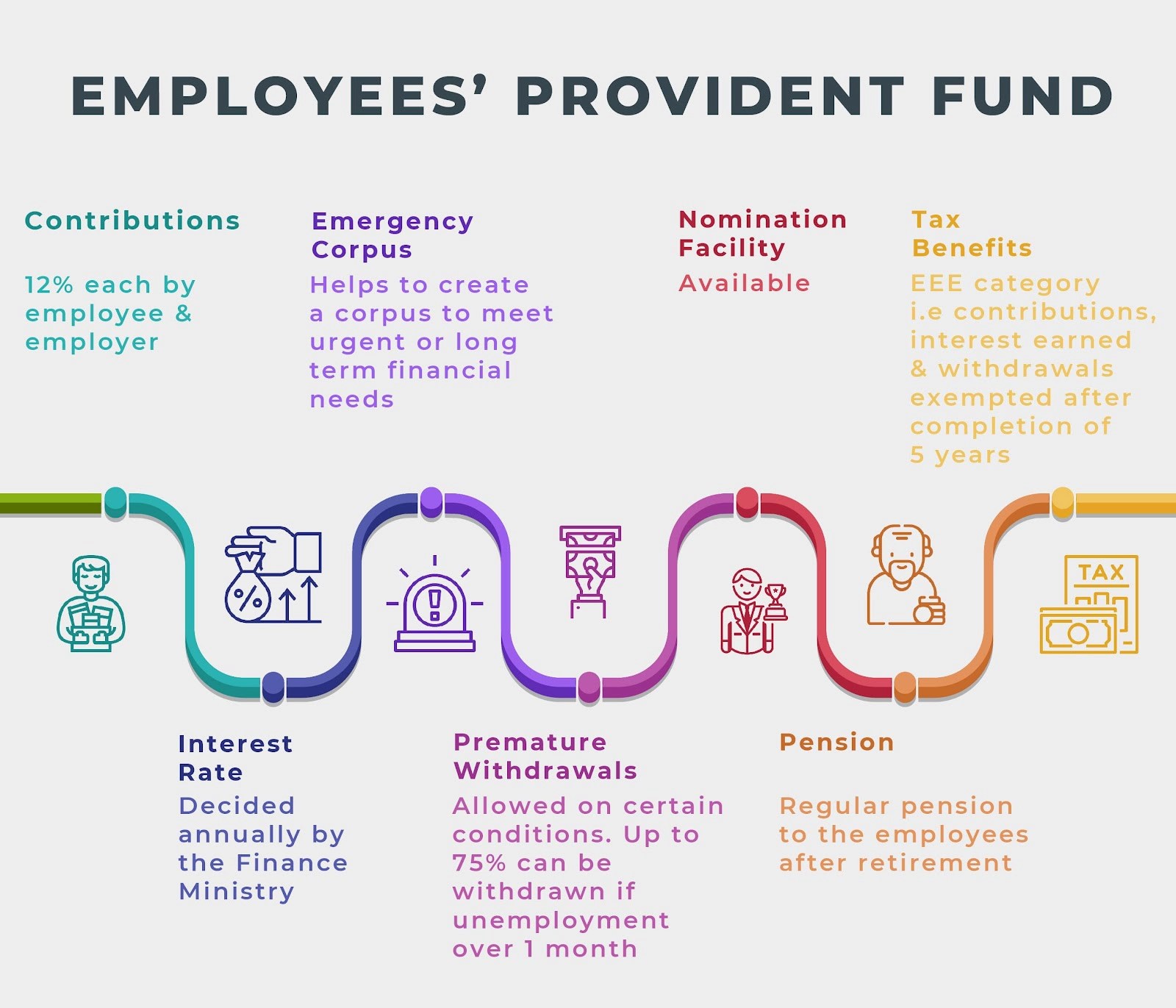

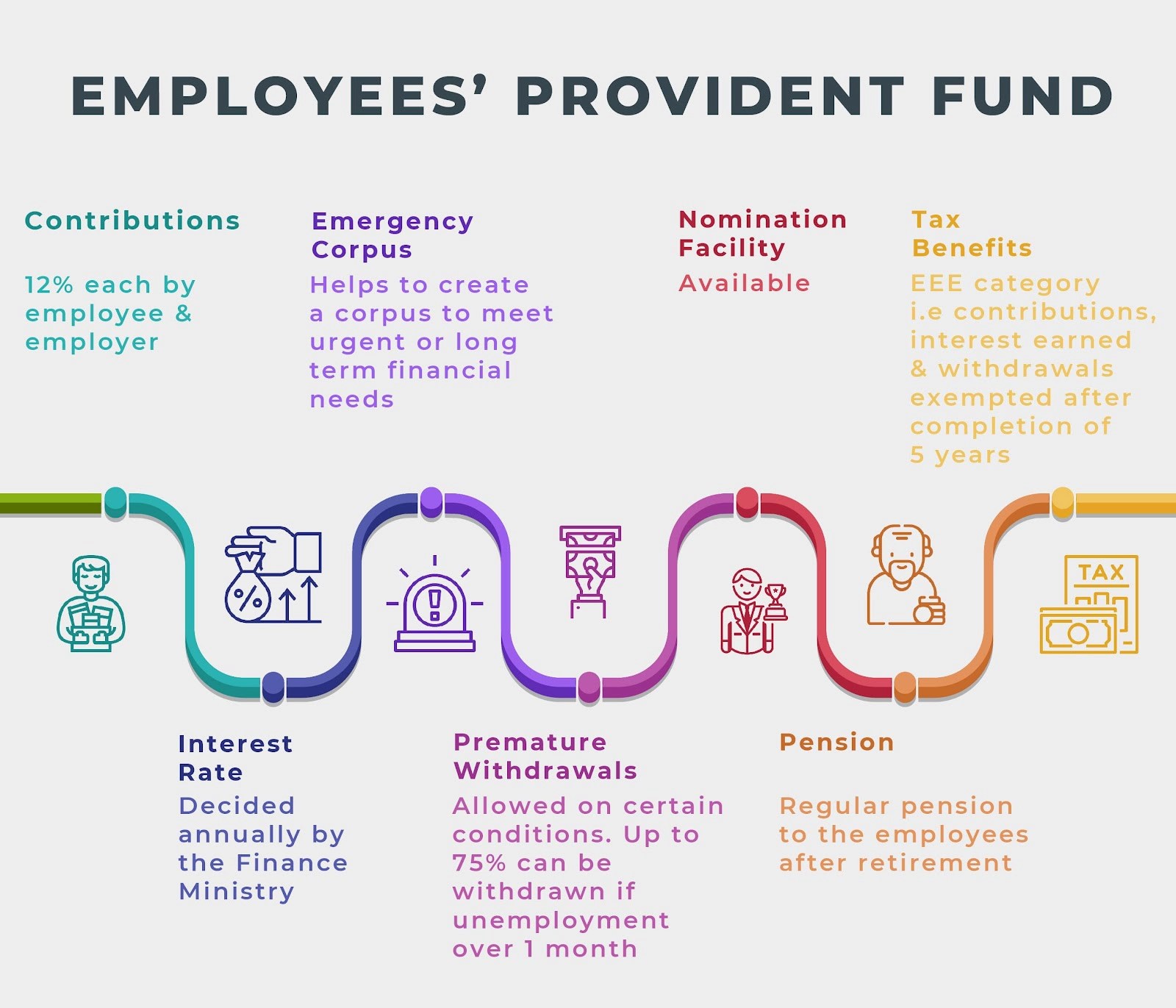

- Contributions: Both employees and employers contribute 12% of the employees’ monthly salaries towards the EPF fund, accumulating interest over time. This contribution is a vital component of employees' retirement planning, providing a reliable source of income after they cease active employment.

Objectives of EPF:

- Single EPF Account: The EPF aims to ensure each employee has a single EPF account, streamlining administrative processes and facilitating ease of management for both employees and employers.

- Ease of Compliance: One of the primary goals is to make compliance with EPFO laws and regulations as straightforward as possible, reducing administrative burdens for employers and ensuring employees receive their entitled benefits seamlessly.

- Business Compliance: The EPF programme places a strong emphasis on ensuring businesses consistently comply with EPFO requirements, fostering a culture of regulatory adherence and accountability in the corporate sector.

- Infrastructure Improvement: Infrastructure enhancement and ensuring the reliability of internet services are essential aspects of the EPF's objectives, as these elements are crucial for facilitating smooth transactions and interactions between stakeholders.

- Online Accessibility: Providing online access to all member accounts is a key initiative aimed at empowering employees to manage their EPF accounts conveniently and access essential services without physical barriers.

- Claim Settlement: Reducing the claim settlement period from 20 days to 3 days signifies the EPF's commitment to expediting processes and ensuring prompt disbursal of benefits to eligible beneficiaries.

- Voluntary Compliance: Promoting and encouraging voluntary compliance with EPF regulations is essential for fostering a culture of transparency, accountability, and trust among stakeholders, contributing to the overall effectiveness and integrity of the EPF programme.

Eligibility for EPF:

- Employees in public and private sectors are eligible to participate in the EPF programme, ensuring that workers across various industries and sectors have access to essential social security benefits.

- Companies with a workforce of at least 20 employees are responsible for providing EPF benefits, reflecting the programme's inclusivity and reach across different scales of enterprises.

Universal Account Number (UAN):

- A 12-digit UAN provides online access to PF accounts, offering employees the convenience of managing their EPF affairs from anywhere, at any time.

- UAN remains constant even when employees change jobs, ensuring continuity and ease of access to EPF-related services throughout an individual's career.

- Employees must activate their UAN for online services, underscoring the importance of digital authentication and security in modern-day financial transactions.

Interest on EPF:

- Interest earned on active PF accounts is tax-free, providing employees with an attractive investment avenue that offers competitive returns and long-term wealth accumulation opportunities.

- Taxation depends on the employee's tax bracket, ensuring that EPF benefits are aligned with prevailing income tax regulations and contribute to overall financial well-being.

- Employees become eligible for a pension from the accumulated amount at age 58, further enhancing the EPF's appeal as a comprehensive retirement planning tool.

EPF Calculation:

- The EPF calculator estimates the accumulated amount at retirement, taking into account various factors such as the employee's current age, salary, contributions, and retirement age.

- By providing a comprehensive estimate of EPF funds available upon retirement, the calculator empowers individuals to make informed financial decisions and plan effectively for their post-retirement years.

Advantages of Employees Provident Fund (EPF)

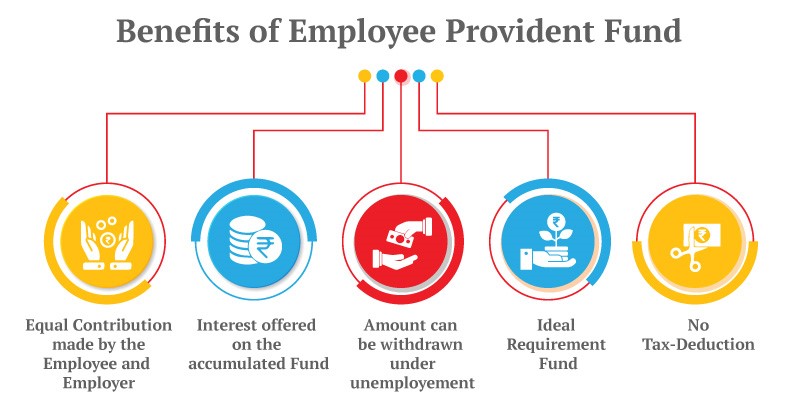

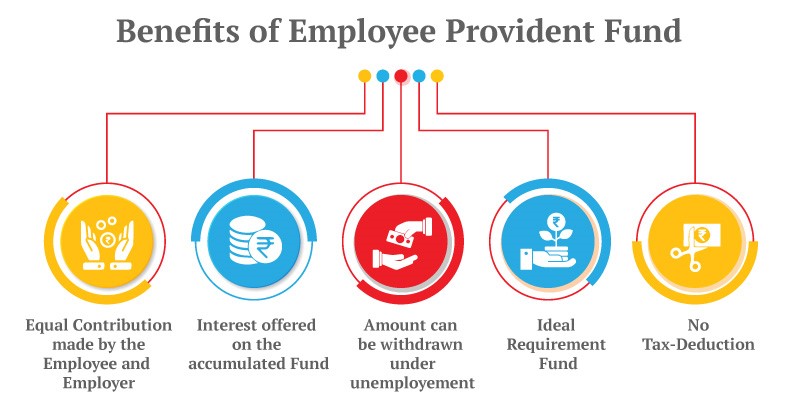

The Employees’ Provident Fund (EPF) programme offers numerous advantages to participants, instilling a sense of financial security and stability. Here are some key benefits:

- Advances and Withdrawals: EPF participants can avail themselves of advances and withdrawals under specific circumstances, providing them with financial flexibility when needed.

- Nominee Benefits: In the unfortunate event of a member's demise, nominees or legal heirs are entitled to the PF amount, ensuring financial protection for the family.

- Pension Benefits: In addition to PF contributions, employers also contribute to the employee’s pension, which becomes accessible post-retirement, ensuring a steady income stream during the twilight years.

- Insurance Coverage: EPF participants are covered under the Employees' Deposit Linked Insurance (EDLI) Scheme, guaranteeing a lump sum payment to beneficiaries in the event of the member's death while in employment.

- Tax-Free Returns: EPF contributions offer tax benefits under the EEE (Exempt, Exempt, Exempt) tax regime, ensuring that returns earned on the fund are tax-free, enhancing overall wealth accumulation.

- Interest Income: EPF savings earn interest, further augmenting the member's savings and providing additional financial growth opportunities.

- Portability: EPF accounts are portable, enabling seamless transfer of funds when a member switches employment, ensuring continuity of savings and benefits.

Employee Provident Fund Withdrawal (EPF)

- EPF withdrawals can be made under specific circumstances, either partially or fully, providing financial support when needed. Here are some situations where withdrawals are permitted:

- Full Withdrawal: Available upon retirement, prolonged unemployment (more than two months), or transitioning between jobs.

- Partial Withdrawal: Permissible for purposes such as marriage, education, home construction or purchase, debt repayment, renovation, or in case of extended unemployment exceeding one month.

Key Considerations Regarding EPF Contribution

- Employer Contribution Breakdown: Employers contribute 12% of the employee’s monthly salary, comprising 8.33% towards the Employees’ Pension Scheme (EPS) and 3.67% towards the Employees’ Provident Fund (EPF).

- Administrative Charges: Employers are required to pay additional administrative charges for the EDLI and EPF, ensuring smooth management of the fund.

- Eligibility Criteria: Small organizations with 20 or fewer employees, those with substantial losses, or those classified as sick by the Board for Industrial and Financial Reconstruction may be eligible for a reduced EPF share.

- Withdrawal at Age 58: Members become eligible for a complete settlement from their EPF account upon reaching the age of 58, ensuring financial security during retirement.

EPF Benefits for Foreign Workers:

- Overview of EPF Legislation: The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, is a crucial social security law in India governing the EPF Scheme, EP Scheme, and the Employees’ Deposit-Linked Insurance Scheme, 1976. These schemes are administered by the Employees’ Provident Fund Organisation (EPFO).

- Incorporation of Foreign Workers: In 2008, an amendment was introduced to extend EPF benefits to international workers or expatriates working in India for a minimum of six months. This required them to contribute 12% of their total salary to the PF, matched by a contribution from their employer.

- Exception to Wage Ceiling: Unlike domestic workers, international workers were not subjected to the ₹15,000 per month wage ceiling for availing PF benefits.

- Withdrawal Conditions: Withdrawal of PF accumulations by international workers in India was allowed upon retirement from service after the age of 58, due to permanent incapacity, or as per the terms of existing Social Security Agreements (SSAs).

Social Security Agreements (SSAs):

- Definition: SSAs are bilateral agreements established to safeguard the social security interests of workers deployed in foreign countries.

- Purpose: When Indian employees are sent abroad by their Indian employers, they typically continue to contribute to social security schemes in India while also potentially being subject to similar obligations under the host country's laws. However, due to limitations on withdrawals and the duration of their stay, they often do not fully benefit from contributions made abroad.

- Preventing Double Coverage: SSAs aim to prevent double coverage under both the domestic social security laws of the home country (India) and those of the host country.

- Key Features: These agreements address issues such as the coordination of social security contributions, the portability of benefits, and the resolution of disputes arising from overlapping coverage.

- India's SSAs: Currently, India has SSAs with 21 countries, facilitating smoother transitions for Indian workers deployed overseas and ensuring that their social security contributions are effectively managed and utilized.

Analysis of the recent Ruling:

- Interpretation of the 1952 Act: The Karnataka High Court emphasized that the primary objective of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 was to provide retirement benefits to workers, particularly those in lower salary brackets. It clarified that the law was not intended to universally extend PF benefits to all employees regardless of their salary levels.

- Discriminatory Treatment: Justice K.S. Hemalekha highlighted the discriminatory nature of paragraph 83 of the EPF Scheme, which imposed PF contributions on foreign workers based on their entire salary, unlike Indian employees working abroad. This disparate treatment, according to the court, violated Article 14 of the Constitution of India, which guarantees the right to equality before the law.

- Absence of Justification: The court rejected the government's argument that special benefits for international workers were a result of existing international obligations. It found no rational basis or reciprocity in treating foreign employees differently based on their country of origin or the presence of SSAs. Additionally, the court noted the lack of information regarding the treatment of Indian employees in non-SSA countries, further questioning the justification for demanding contributions on the entire salary of foreign employees.

- Constitutional Concerns: The ruling raises constitutional concerns regarding the classification and treatment of foreign workers under the EPF Scheme. It underscores the importance of ensuring equality and fairness in social security provisions, particularly in the context of international workers' contributions and benefits.

EPFO's Response and Implications:

- EPFO's Evaluation: The Ministry of Labour and Employment, through the EPFO, is actively assessing the situation and preparing for future actions in response to the Karnataka High Court's ruling. They are considering appealing the decision and are consulting with representatives of both employers and employees to address concerns.

- Purpose of Special Provisions: The EPFO intends to argue that the special provisions in the scheme are designed to protect the interests of Indian workers abroad. They emphasize that these provisions serve specific purposes and are essential for ensuring uninterrupted social security coverage during international employment, especially in light of India's agreements with 21 countries.

- Legal Implications: While the ruling may have persuasive value outside of Karnataka, PF authorities may continue to enforce these provisions in other states temporarily. This could lead to employers having to comply with provident fund requirements for international workers in certain regions until the matter is resolved.

- Need for Rationale: There is a need for a rationale behind the classification of foreign employees from non-SSA countries differently from Indian employees in terms of PF contributions. India should consider amending laws to ensure parity between expatriates and domestic workers to attract foreign investments.

- Impact on SSAs: The ruling is expected to impact India's existing SSAs with other countries. If upheld by the Supreme Court, India may need to amend its laws to maintain reciprocal arrangements outlined in these agreements.

Conclusion:

- The response from the EPFO underscores the complexity of the issue and the need for careful consideration of legal and policy implications.

- The ruling's potential impact on international workers, foreign investments, and India's international agreements highlights the importance of resolving the matter effectively and in accordance with principles of equity and fairness.

READ ABOUT EPFO: https://www.iasgyan.in/daily-current-affairs/epfo#:~:text=Employee's%20contribution%20towards%20EPF%20%2D12,the%20employee's%20salary%20towards%20EPF.

|

PRACTICE QUESTION

Q. How do Social Security Agreements (SSAs) benefit India's globally employed workforce? Provide concise insights into the role of SSAs in ensuring social security coverage and protecting the interests of Indian workers abroad.

|

SOURCE: THE HINDU

Disclaimer: Copyright infringement not intended.

Disclaimer: Copyright infringement not intended.