Copyright infringement not intended

Picture Courtesy: THE HINDU

Innovation and technological leadership are key to 'Viksit Bharat' by 2047, but the R&D deficit poses a major obstacle.

Research and Development (R&D) in India

Stagnant Gross Expenditure on R&D (GERD)

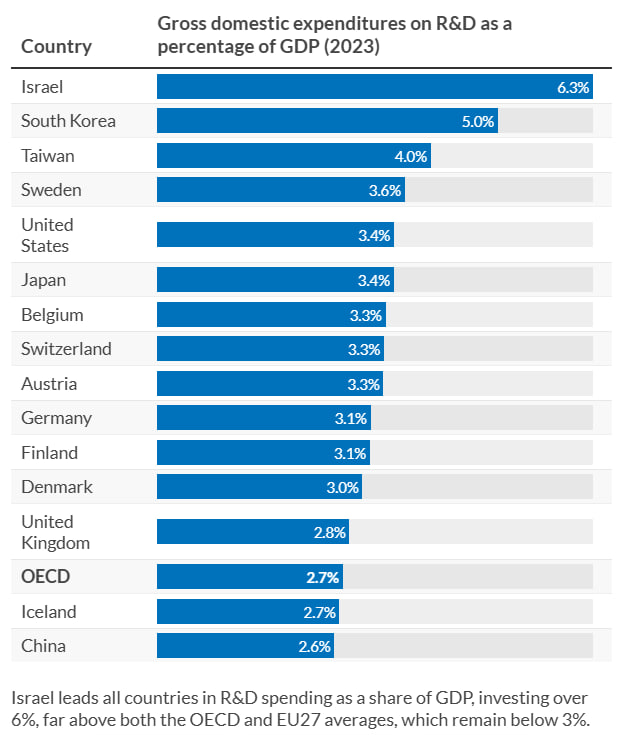

India's Gross Expenditure on R&D (GERD) has stalled at a low 0.64% of GDP for over a decade, significantly trailing major economies like China (2.6%), the US (3.4%), South Korea (5%), and Israel (6.3%).

Domination of Government Sector in Funding

Domination of Government Sector in Funding

A key weakness is the private sector's low contribution. India's funding landscape is inverted compared to developed nations.

Modest Performance in Intellectual Property

Private Sector Disengagement

Government & Bureaucratic Bottlenecks

While the government provides the bulk of funding, the utilization of these funds is often inefficient.

The Academia-Industry Disconnect

A "Valley of Death" exists between laboratory research and market application.

Human Capital Challenges

Funding & Institutional Reforms

Research, Development, and Innovation (RDI) Scheme: Launched with outlay of ₹1 lakh crore over six years. It provides long-term, low-interest or interest-free loans and equity for high-risk, private-sector projects, especially in deep-tech and "sunrise" sectors.

Anusandhan National Research Foundation (ANRF): Acts as the apex body for strategic R&D direction.

Strategic National Missions

India Semiconductor Mission (ISM): Backed by a ₹76,000 crore incentive plan, supporting fabrication and design.

IndiaAI Mission: Allocated ₹10,372 crore to build sovereign AI compute capacity (procuring 18,693 GPUs) and research hubs.

National Quantum Mission: A ₹6,003 crore initiative to position India among global leaders in quantum computing.

BioE3 Policy: Approved in 2024 and expanding in 2025, it focuses on high-performance biomanufacturing and biofoundries.

Startup and Tax Incentives

Income Tax Holidays: Under Section 80-IAC, eligible startups incorporated until March 31, 2026 (extended in 2025) enjoy a 100% tax exemption on profits for three out of their first ten years.

Angel Tax Exemption: Recognized startups remain exempt from the "Angel Tax", facilitating easier domestic and foreign capital flow.

Patent Support: Startups receive an 80% rebate on patent filing fees and access to fast-track examination to protect IP rapidly.

Sector-Specific R&D Push

Defence R&D: The government now reserves 25% of the defence R&D budget for private industry, startups, and academia.

Deep-Tech Policy: The National Deep Tech Startup Policy (NDTSP) provides dedicated risk capital and simplified regulatory pathways for hardware-intensive research.

Space Sector: The 2025 budget includes a ₹1,000 crore venture capital fund specifically for the space economy, encouraging private-led R&D in satellite and launch technology.

Scale Up R&D Investment: Create a time-bound roadmap to increase India's GERD to at least 2% of GDP within the next five to seven years.

Catalyze Private Sector Participation: Introduce powerful incentives like enhanced tax credits, co-funding mechanisms, and simplified regulations to encourage the private sector to contribute at least 50% of the total R&D expenditure.

Bridge the Lab-to-Market Gap: Implement structured frameworks for university-industry collaboration, such as joint research parks, industry-sponsored PhD programs, and efficient technology transfer offices.

University Transformation: Transitioning higher education institutions from "teaching-only" to "research-centric" models, where faculty performance metrics give equal weight to patents and technology transfers alongside publications.

Deep-Tech & AI: Leveraging the IndiaAI Mission and National Quantum Mission to build sovereign compute capacity and secure intellectual property in generative AI and quantum materials.

Promote a Robust IP Culture: Simplify the patent filing process, ensure strong enforcement of IPR, and provide financial incentives for the commercialization of patents to encourage a culture of innovation.

Global Mobility: Expanding schemes like the VAIBHAV Fellowship to facilitate a "brain gain," bringing Indian diaspora scientists back to lead high-impact domestic projects.

To realize India's 2047 global innovation potential, strategic public investment, robust private sector involvement, and strong political will are needed to overcome the research deficit and address R&D weaknesses.

Source: THE HINDU

|

PRACTICE QUESTION Q. Evaluate the impact of 'Brain Drain' on India's scientific progress and suggest policy measures to reverse this trend. 150 words |

India's GERD has stagnated at around 0.64% of its GDP, which is significantly lower than other major economies like China (2.4%) and the US (3.5%).

The ANRF is an apex body established by the Government in 2023 to provide strategic direction, funding, and collaboration opportunities for scientific research across disciplines, especially in universities and colleges.

Private sector investment is low due to a risk-averse industrial culture that prioritizes immediate returns over long-term R&D, a lack of strong academia-industry linkages, and a focus on technology licensing rather than disruptive innovation. The private sector contributes only about 36.4% of total R&D spending.

© 2026 iasgyan. All right reserved