Copyright infringement not intended

Picture Courtesy: THE HINDU

India's economic relationship with China is a complex paradox of intensifying strategic rivalry and growing bilateral trade, prompting the policy question of how India can leverage this engagement to strengthen its own competitive capabilities.

|

Read all about: INDIA-CHINA RELATIONSHIP l ABOUT MODI AND XI'S MEETING AT BRICS l INDIA AND CHINA BORDER TALKS l CHINDIA: NEW ERA OF INDIA-CHINA DIPLOMACY |

Widening Trade Deficit

In 2025, the India-China trade deficit hit a record $116.12 billion. Total bilateral trade reached $155.62 billion, but a surge in Indian imports of Chinese goods like electronics and machinery (exceeding $135 billion) surpassed India's exports.

Sector-Specific Dependencies

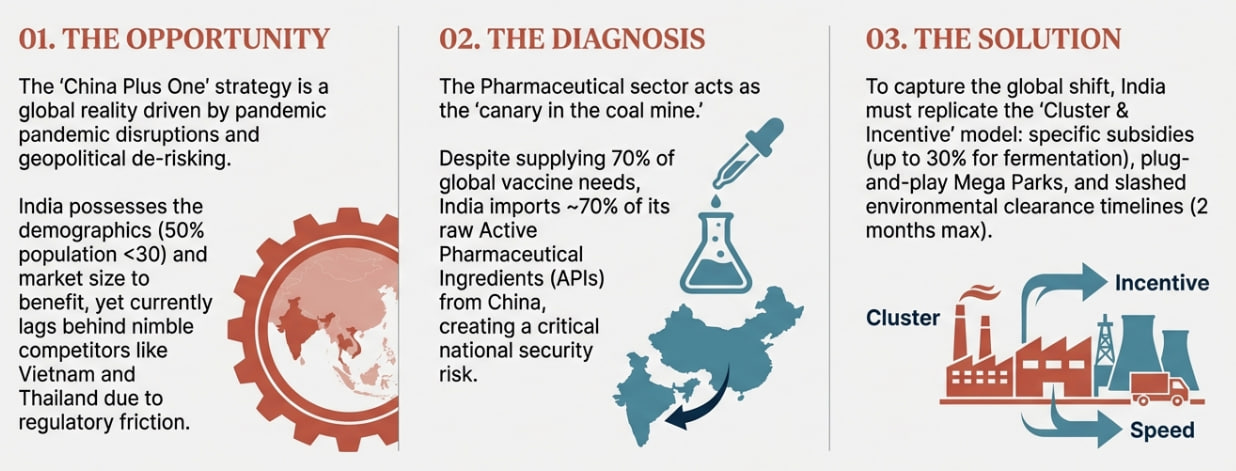

India's deep reliance on China across various sectors, including critical industries, makes it highly vulnerable to supply chain disruptions.

Active Pharmaceutical Ingredients (APIs): India, the 'Pharmacy of the World,' is heavily dependent on China for drug manufacturing raw materials.

Electronics & Telecom Hardware: Critical for India's digital economy.

Renewable Energy (Solar): India's ambitious clean energy goals are heavily reliant on Chinese imports.

Electric Vehicles (EVs) and Batteries: The transition to e-mobility is critically dependent on the Chinese supply chain for essential components.

Electric Vehicles (EVs) and Batteries: The transition to e-mobility is critically dependent on the Chinese supply chain for essential components.

Supply Chain Disruption: Concentrated supply chains from China are fragile, as seen during the COVID-19 pandemic; geopolitical conflicts or internal crises could paralyze Indian industries dependent on these critical goods.

Strategic Leverage for China: Dependence on critical items like APIs gives Beijing potential leverage to influence India's policies or retaliate during diplomatic standoffs.

Strategic Leverage for China: Dependence on critical items like APIs gives Beijing potential leverage to influence India's policies or retaliate during diplomatic standoffs.

Stifling Domestic Industry: Cheap Chinese imports pose a challenge to Indian domestic manufacturers, potentially stunting the growth of India's industrial sector.

National Security Concerns: To curb security risks and "opportunistic takeovers" of Indian companies, the government has taken several steps:

Production Linked Incentive (PLI) Schemes

Launched in 2020 with an outlay of ₹1.97 lakh crore across 14 key sectors. The scheme aims to boost domestic manufacturing and exports. By March 2025, it had attracted investments of ₹1.76 lakh crore, with significant success in mobile phone manufacturing. (Source: PIB)

'Make in India' & 'Aatmanirbhar Bharat'

Aim to transform India into a global manufacturing hub, with a target of increasing manufacturing's share of GDP to over 25%. (Source: NITI Aayog)

Infrastructure Development

Focus on creating industrial corridors and electronics manufacturing clusters to provide the necessary ecosystem for large-scale production.

PM Gati Shakti: A digital platform integrating 16 ministries to coordinate infrastructure planning, ensuring that industrial nodes are directly connected to railways, highways, and ports.

Diversifying Supply Chains

Collaborating with partners through forums like the Quad, EU and the Indo-Pacific Economic Framework (IPEF) to build alternative, resilient supply chains with trusted partners like Japan, Taiwan, and South Korea.

Major Trade Agreement Signed : India-EFTA Trade & Economic Partnership Agreement (TEPA) (March 2024, involving Switzerland, Norway, Iceland, and Liechtenstein), India-UK Comprehensive Economic and Trade Agreement (CETA) (2025), India-Oman CEPA (2025), agreements with the UAE (CEPA) and Australia (ECTA).

India requires a pragmatic, strategic approach, balancing economic needs with strategic imperatives, aiming for balanced interdependence over dependency.

Focus on Selective Decoupling ('De-risking')

Instead of a blanket ban, India should identify the most critical sectors (e.g., APIs, semiconductors, telecom) and strategically build domestic capacity in these areas, while allowing trade to continue in less sensitive domains.

Boost Domestic Competitiveness

Success of 'Aatmanirbhar Bharat' depends on making Indian industries globally competitive, not on protectionism. This requires improving the ease of doing business, ensuring access to affordable capital, and investing heavily in R&D and skill development.

Consider Strategic Recoupling

In certain areas, building a domestic ecosystem may require attracting Chinese investment and expertise, especially in non-strategic parts of the value chain. This can be done under strict government oversight to manage security risks.

Strengthen Strategic Alliances

India must accelerate collaboration with partners like the USA, Japan, Australia, and the EU to build reliable and resilient alternative supply chains. These alliances can provide the necessary capital, technology, and market access.

Learn from Global Lessons in 'De-risking'

Other countries offer valuable lessons in managing economic dependence on China through a strategy of "de-risking" rather than complete decoupling.

To become a global power, India must use economic ties with China to build its own industry and mitigate vulnerabilities. The goal is to recalibrate the relationship, not sever it, to secure India's long-term strategic autonomy.

Source: THE HINDU

|

PRACTICE QUESTION Q. "Economic engagement with China is no longer a choice but a strategic necessity for India’s manufacturing ambitions." Critically analyze. 150 words |

India's trade deficit with China reached a record high of approximately $116.12 billion for the 2025 calendar year, driven by surging imports of electronics and machinery. Despite a modest rise in Indian exports, the trade imbalance continues to widen, with total imports from China far exceeding India's outbound shipments.

India's dependency is highest in critical sectors such as Electronics (for components like integrated circuits), Pharmaceuticals (for about 70% of Active Pharmaceutical Ingredients or APIs), Capital Goods (machinery for factories), and Renewable Energy (components for solar panels).

The PLI scheme was launched in 2020 with an outlay of ₹1.97 lakh crore across 14 strategic sectors. It aims to boost domestic manufacturing and reduce import dependence by providing financial incentives to companies on incremental sales of products manufactured in India.

© 2026 iasgyan. All right reserved