Copyright infringement not intended

Picture Courtesy: THE HINDU

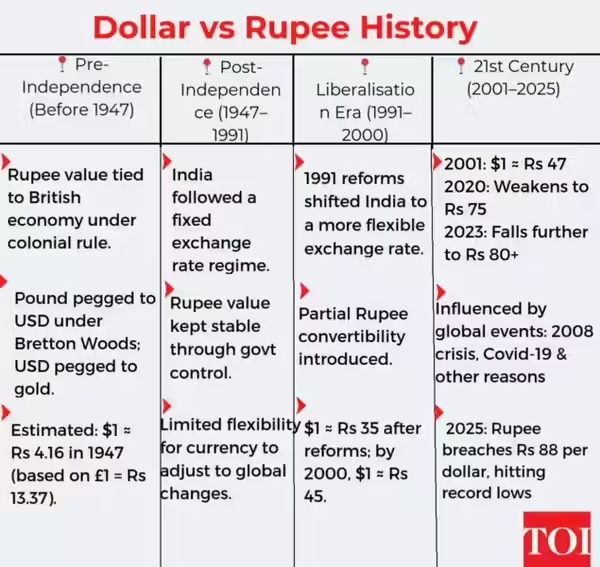

As of mid-December 2025, the Indian rupee has hit a new low of 90.05 against the US dollar, extending its downward trend.

|

Read all about: RUPEE DEPRECIATION : CAUSES, IMPACTS & INSTITUTIONAL RESPONSE l RBI PLAN ON RUPEE DEPRECIATION l RUPEE DEPRECIATION AND RBI'S INTERVENTION l DEPRECIATION OF RUPEE |

Depreciation of the rupee refers to the decrease in the value of the Indian currency relative to one or more foreign currencies, such as the US dollar (USD) or the euro (EUR).

In a free-floating exchange rate system, depreciation is caused by market forces of supply and demand for the currency, without central bank intervention.

|

Devaluation vs Depreciation:

|

External Factors

Strong US Dollar: U.S. Federal Reserve's aggressive monetary tightening to control inflation has strengthened the dollar globally, pressuring emerging market currencies like the Rupee.

High Crude Oil Prices: India imports over 85% of its crude oil. Rising global oil prices increase India's import bill, boosting demand for US dollars and depreciating the rupee.

Foreign Portfolio Outflows (FPI): Rising US interest rates made American markets more appealing, causing FPIs to pull a record ₹1.59 lakh crore from Indian shares in 2025. (Source: NSDL)

Global Economic Uncertainty: Geopolitical tensions and concerns about a global slowdown make investors risk-averse, leading them to move capital to safer assets like the US dollar.

Domestic Factors

Widening Trade Deficit: India's imports have consistently outpaced its exports. The merchandise trade deficit surged to a record high of $41.68 billion in October 2025. This high demand for dollars to pay for imports weakens the rupee.

Current Account Deficit (CAD): India's Q2 2025-26 Current Account Deficit moderated to $12.3 billion, or 1.3% of GDP, although the net importer status (imports $>$ exports) continues to be a concern, weakening the rupee due to higher demand for foreign currency.

RBI's Forex Intervention: The Reserve Bank of India (RBI) manages severe market fluctuations by selling dollars from its foreign exchange reserves, which helps temporarily stabilize the rupee but depletes the reserves.

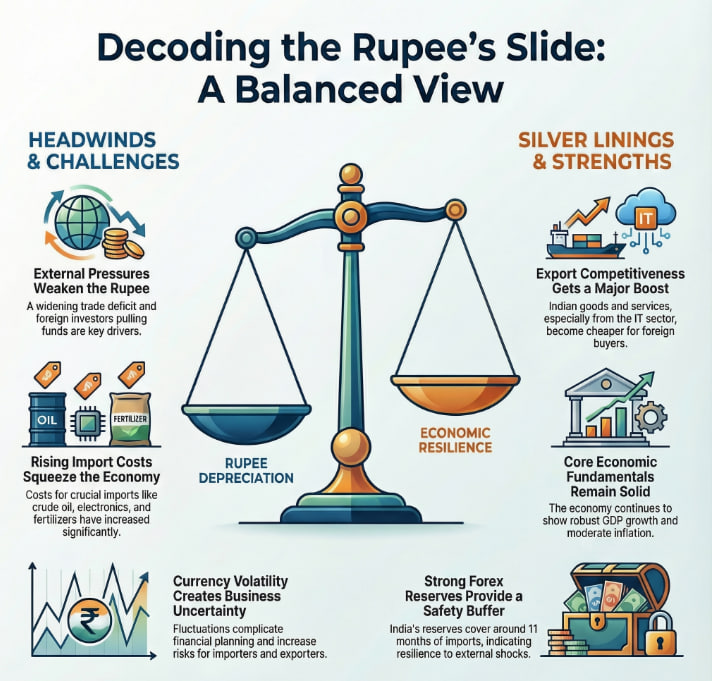

While a depreciating currency can be a concern, India's macroeconomic fundamentals remain relatively strong, suggesting the current trend is driven more by global factors than structural weakness.

Robust GDP Growth: India continues to be the fastest-growing major economy. The IMF has projected a growth rate of 6.6% for FY 2025-26.

Manageable Inflation: Headline CPI inflation remained low at 0.71% in November 2025, staying within the RBI's tolerance band and allowing for monetary policy flexibility.

Strong Forex Reserves: India's foreign exchange reserves were approximately $687 billion in early December 2025, enough to cover over 11 months of imports.

Fiscal Prudence: Government targets FY 2024-25 fiscal deficit at 4.9% of GDP.

Impact of a Depreciating Rupee

Impact of a Depreciating Rupee

Negative Impacts

Imported Inflation: A weaker rupee increases the cost of imports (oil, electronics, fertilizers), fueling domestic price hikes (cost-push inflation).

Higher Import Bill & Deficits: As India heavily imports oil and gold, a weaker rupee inflates the import bill, worsening trade and current account deficits.

Increased Foreign Debt Burden: A weaker rupee increases the repayment burden for domestic entities with foreign-currency loans.

Costlier Foreign Travel & Education: A weaker rupee makes overseas education, travel, and foreign goods more expensive for individuals.

Capital Flight Risk: Sustained depreciation may reduce foreign investor confidence, causing capital outflows and further weakening the rupee.

Positive Impacts

Boosts Exports: A weaker rupee makes Indian goods and services, such as IT, pharmaceuticals, and textiles, cheaper and more competitive globally, boosting demand for "Made in India" products.

Higher Remittances: Non-Resident Indians (NRIs) sending money home get more rupees for each dollar, encouraging higher remittance inflows.

Encourages Domestic Tourism & Production: Higher costs for international travel and imports can boost domestic tourism and demand for locally-made products (import substitution).

Attracts Foreign Investment: A weaker rupee lowers the cost of Indian assets (stocks, bonds) for foreign investors, potentially drawing in long-term FDI and FPI looking for value.

Short-Term Stabilization Measures

Foreign Exchange Market Intervention: The RBI can sell US dollars from its reserves to increase market supply, curbing volatility and slowing depreciation.

Encourage Capital Inflows: Government and RBI can attract more foreign currency by:

Monetary Policy Adjustments: RBI may adjust policy rates (e.g., repo rate) to attract foreign investment, increasing rupee demand.

Manage Non-Essential Imports: To ease current account deficit pressure, the government can temporarily restrict or tax imports of non-essential goods, such as gold and luxury items, to curb dollar demand.

Long-Term Structural Reforms

Diversify Exports and Markets: Strengthen external sector by diversifying export base towards high-value manufacturing and services, making Indian goods more competitive globally.

Reduce Import Dependence: Boost domestic production of critical items like semiconductors, electronics, defense equipment, and energy sources (especially renewable energy) to lower the import bill.

Attract Stable Foreign Direct Investment (FDI): Improving the ease of doing business and ensuring consistent policy frameworks will help attract stable, long-term FDI, reducing reliance on volatile Foreign Portfolio Investment (FPI) flows.

Internationalize the Rupee: Promoting the use of the rupee for international trade settlements through mechanisms like Special Rupee Vostro Accounts (SVRAs) can reduce dependence on the US dollar for trade transactions.

Maintain Macroeconomic Stability: Meeting fiscal consolidation targets, keeping inflation within the target range, and maintaining adequate foreign exchange reserves to build overall economic resilience and investor confidence.

Encourage Risk Management: Exporters and importers, particularly MSMEs, should be encouraged to use hedging instruments to manage currency risks inherent in international trade.

A falling rupee is manageable due to India's strong economy, large forex reserves, and RBI's controlled depreciation, representing a management issue rather than a crisis.

Source: THE HINDU

|

PRACTICE QUESTION Q. A depreciating rupee is often described as a "double-edged sword" for an emerging economy like India. Critically analyze. 250 words |

The rupee's fall is caused by a combination of factors: the strengthening of the US Dollar due to the US Fed's monetary policy, significant capital outflows as Foreign Portfolio Investors (FPIs) sell Indian assets, and a widening trade deficit where India's imports are exceeding its exports.

No, it's a double-edged sword. While it makes imports (like crude oil) more expensive, leading to inflation, and increases the cost of foreign debt, it also makes Indian exports more competitive on the global market, benefiting sectors like IT and pharmaceuticals.

A strong US Dollar, often driven by higher interest rates in the US, makes American markets more attractive for global investors. This leads them to pull money out of emerging markets like India (capital outflow), sell rupees to buy dollars, and thus weaken the rupee.

© 2026 iasgyan. All right reserved