Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

Context

Agricultural subsidies need to be rationalized due to high fiscal cost, environmental impact, and market distortion, shifting focus toward targeted investment.

|

Read all about: FACTORS BEHIND GOVERNMENT SUBSIDY BILL SURGE l CLIMATE CHANGE AND SUBSIDIES l WTO AGRICULTURAL SUBSIDIES l REFORMING INDIA'S FOOD AND FERTILISER SUBSIDIES |

What is Subsidies?

A subsidy is financial assistance or support provided by a government or organization to individuals, businesses, or specific economic sectors.

Its primary purpose is to promote social welfare, encourage economic growth, and make essential goods and services more affordable for the public.

Core Mechanisms

Direct Subsidies: Actual transfer of funds directly to beneficiaries. Common examples include cash grants (e.g., PM-KISAN) and Direct Benefit Transfers (DBT) for LPG or student scholarships.

Indirect Subsidies: Provide support without a direct cash transfer by reducing costs or tax burdens. Examples include tax breaks, reduced utility rates, or interest subventions on loans (e.g., Kisan Credit Card).

Major Subsidies Categories in India

Food Subsidies: Aimed at providing essential food grains at lower-than-market prices through the Public Distribution System (PDS) to ensure food security for vulnerable populations.

Agricultural Subsidies: Targeted at farmers to reduce input costs. This includes support for fertilizers (e.g., urea), irrigation, and electricity.

Fertilizer Subsidies: Designed to make crop nutrients affordable, by covering the gap between the cost of production and a fixed Maximum Retail Price (MRP).

Petroleum Subsidies: Focused on making cooking gas (LPG) and kerosene accessible to households (e.g., PM Ujjwala Yojana).

Industrial & Export Subsidies: Offered to specific sectors like MSMEs or exporters to increase competitiveness and stimulate production (e.g., PLI Schemes).

Economic Objectives

Affordability: Makes essential commodities like food, education, and healthcare accessible to low-income groups.

Production Incentives: Encourages businesses to increase output in sectors that are critical for national development but might otherwise be unprofitable.

Inflation Control: Helps stabilize the prices of vital goods, particularly during global price surges (e.g., fuel).

Market Correction: Used to address "market failures" by supporting activities that provide broad benefits to society (positive externalities).

Agricultural support is split into direct and indirect subsidies, with indirect subsidies traditionally making up the larger share of the total support.

Direct Agricultural Subsidies

These involve actual cash transfers or direct financial assistance to farmers' bank accounts.

PM-KISAN (Pradhan Mantri Kisan Samman Nidhi): Provides an annual income support of ₹6,000 in three equal installments to eligible landholding farmer families.

PM-KUSUM: Offers central financial assistance (up to 30–50%) for the installation of solar agricultural pumps to reduce reliance on diesel and traditional power.

Farm Loan Waivers: Periodically implemented by central or state governments to provide immediate relief from agricultural debt during times of distress.

Indirect Agricultural Subsidies

These subsidies are not paid directly to farmers but instead lower the prices of essential inputs or provide price guarantees for produce.

Fertilizer Subsidy: Government covers the difference between the high cost of production/import and the lower price paid by farmers. As of early 2026, this is the second-largest subsidy component, following the food subsidy.

The combined food and fertilizer subsidy for FY 2025–26 is estimated at approximately ₹3.71 lakh crore.

Price Support (Minimum Support Price - MSP): The government guarantees a floor price for 23 crops, purchasing produce through agencies like the Food Corporation of India (FCI) to prevent market price crashes.

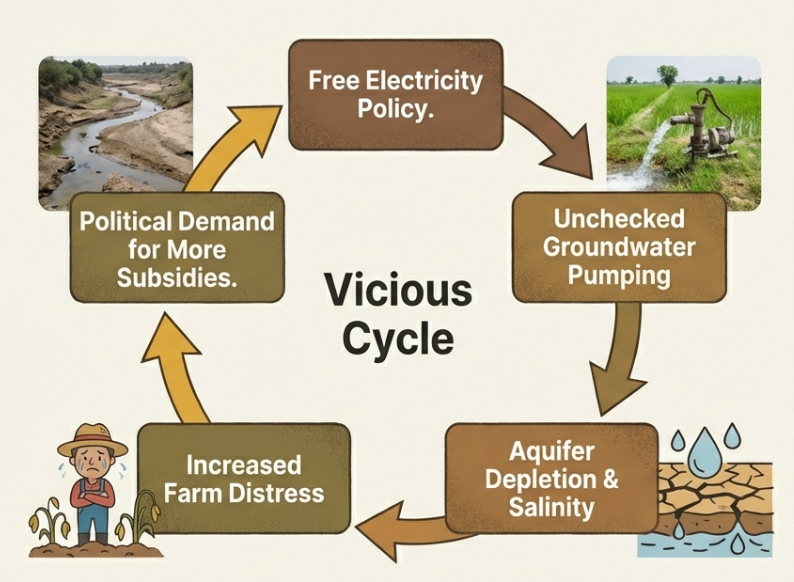

Power and Electricity Subsidy: States provide free or heavily subsidized electricity to farmers for irrigation pumps, which often leads to groundwater depletion in regions like Punjab.

Irrigation Subsidy: Subsidies for micro-irrigation systems (drip and sprinkler) under the PM Krishi Sinchayee Yojana (PMKSY), providing up to 45–55% support.

Credit and Insurance Subsidies:

Challenges with the Current Subsidy Regime

Challenges with the Current Subsidy Regime

Massive Fiscal Burden

Fertiliser subsidy, estimated at 3.3% of the 2025-26 Union budget, is concerning because it diverts (or "crowds out") public investment from other agricultural areas, such as Research and Development (R&D), infrastructure (including rural roads and cold chains), and market development. (Source: PIB)

Skewed Benefits and Inequity

Subsidies are disproportionately captured by larger farmers and are concentrated in specific regions and crops. For example, MSP benefits are largely cornered by farmers in states like Punjab, Haryana, and Western Uttar Pradesh for wheat and paddy, neglecting other regions and crops.

Environmental Degradation

Groundwater Depletion: Free or subsidized power has led to the unsustainable over-extraction of groundwater. States like Punjab and Haryana face extreme water stress, with over 80% of their blocks being over-exploited (Source: Central Ground Water Board).

Deteriorating Soil Health: Heavy subsidy on urea has skewed the NPK (Nitrogen-Phosphorus-Potassium) nutrient application ratio. The ideal ratio is 4:2:1, but in many areas, it has become highly distorted, leading to declining soil fertility and productivity.

Lack of Crop Diversification: Assured procurement of wheat and rice under MSP discourages farmers from cultivating other crops like pulses, oilseeds, and millets, which are often more climate-resilient and nutritious.

Market Distortions

MSP, when set higher than the market-clearing price, discourages private sector participation in agricultural trade and processing. This hinders the development of a competitive and efficient agricultural value chain.

Challenges at the World Trade Organization (WTO)

Developed nations criticize India's domestic support for agriculture, claiming it violates the WTO's Agreement on Agriculture (AoA) limits. To protect its food procurement programs from WTO challenges, India frequently utilizes the 'Peace Clause'.

Create Fiscal Space for Investment

Replacing price and input subsidies with more efficient support mechanisms will free up funds for agricultural capital expenditure, such as irrigation, warehousing, and agri-logistics.

Promote Sustainable Agriculture

Reforming fertilizer and power subsidies encourages efficient resource use, supporting climate-smart practices like micro-irrigation and organic farming.

Enhance Farmer Incomes

Doubling farmers' income, per the Ashok Dalwai Committee, demands shifting from a production-centric to an income-centric policy. Direct income support is better than distortionary subsidies for this goal.

Improve Targeting and Equity

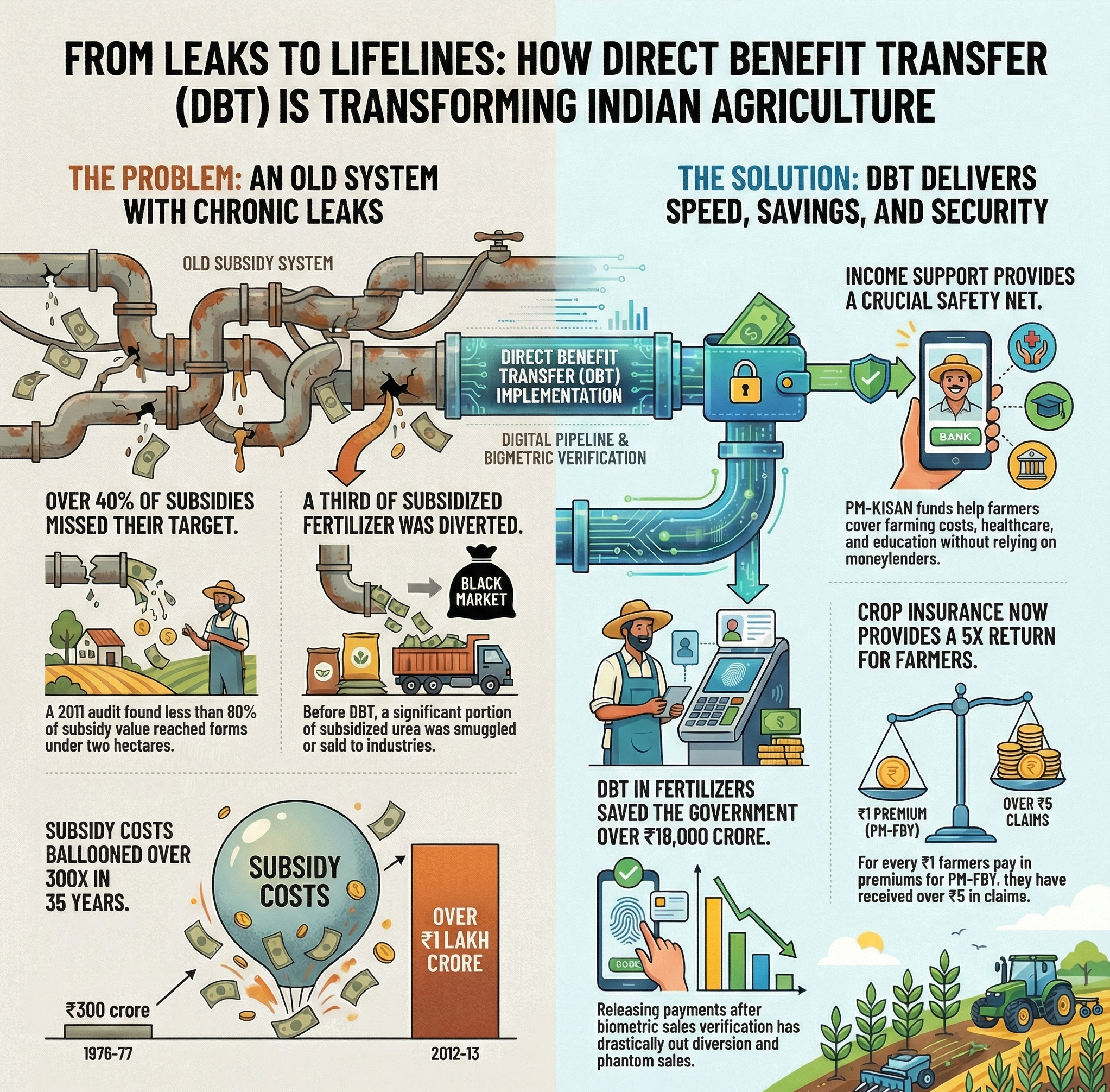

Leveraging the Jan Dhan-Aadhaar-Mobile (JAM) trinity allows for the precise targeting of benefits through Direct Benefit Transfer (DBT), plugging leakages and ensuring support reaches small and marginal farmers.

Transition from Price to Income Support

Gradually reduce input and price subsidies while expanding direct income support schemes like PM-KISAN. This provides farmers with flexibility and minimizes market distortions.

Implement Expert Committee Recommendations

Shanta Kumar Committee: Shifting food and fertilizer subsidies to cash-based Direct Benefit Transfer (DBT) is suggested to improve targeting and reduce leakages. Increased procurement decentralization was also recommended.

Ashok Dalwai Committee: Shift policy from agricultural output to boosting farmers' income through diversification into high-value crops, agro-processing, and allied sectors (animal husbandry, fisheries).

Boost Investment in Agri-Infrastructure & R&D

Use the fiscal savings from subsidy rationalisation to increase public investment in agricultural research, extension services, cold storage, and market linkages to reduce post-harvest losses and improve farmer price realisation.

Incentivize Climate-Smart Agriculture

Link financial support to the adoption of sustainable practices such as micro-irrigation, conservation agriculture, and integrated farming systems to build resilience against climate change.

Learn from Global Best Practices

China's Agricultural Support Shift: China has moved away from price support towards a system of "decoupled payments" and subsidies linked to environmental protection and improving farmland quality, aiming for both productivity and sustainability.

Brazil’s Bolsa Família: Conditional Cash Transfer (CCT) program provides financial aid to poor families on conditions like school attendance and vaccinations. It serves as a benchmark for effective targeting and poverty reduction through direct transfers.

Reforming agricultural subsidies in India requires a strategic shift from inefficient indirect support to targeted direct income assistance, combined with increased investment in infrastructure and R&D, to boost farmer welfare, environmental protection, and food security.

Source: INDIAN EXPRESS

|

PRACTICE QUESTION Q. "The current structure of agricultural subsidies in India is environmentally unsustainable and economically inefficient." Critically analyze. (250 Words) |

Agricultural subsidies in India are broadly categorized into three types: 1) Input Subsidies (e.g., on fertilizers, electricity, irrigation), 2) Output Subsidies (primarily the Minimum Support Price - MSP mechanism), and 3) Direct Income Support (e.g., the PM-KISAN scheme).

Rationalisation is necessary due to several negative consequences of the current system. These include a massive fiscal burden on the government, market distortions favouring water-guzzling crops, severe environmental damage like groundwater depletion and soil degradation, and inequitable distribution where benefits are often captured by larger farmers.

Indirect subsidies are provided on inputs like fertilizers, power, and irrigation, or through price support like MSP, which distorts market prices and farmer choices. Direct subsidies, like cash transfers under PM-KISAN, provide money directly to farmers, empowering them with choice and causing minimal market distortion.

© 2026 iasgyan. All right reserved