Copyright infringement not intended

Picture Courtesy: THE HINDU

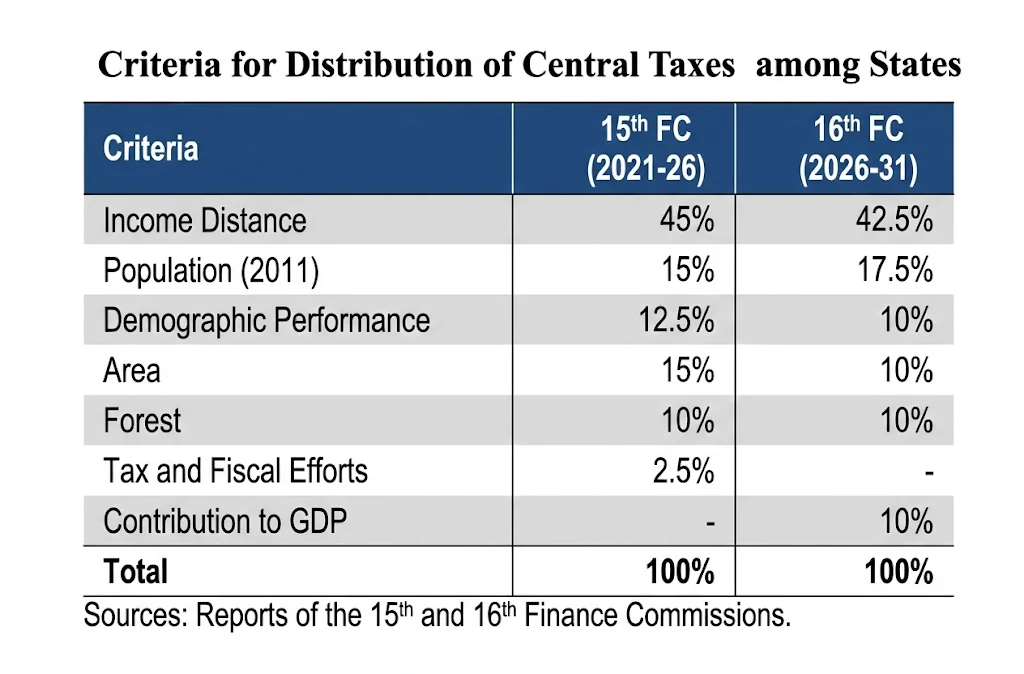

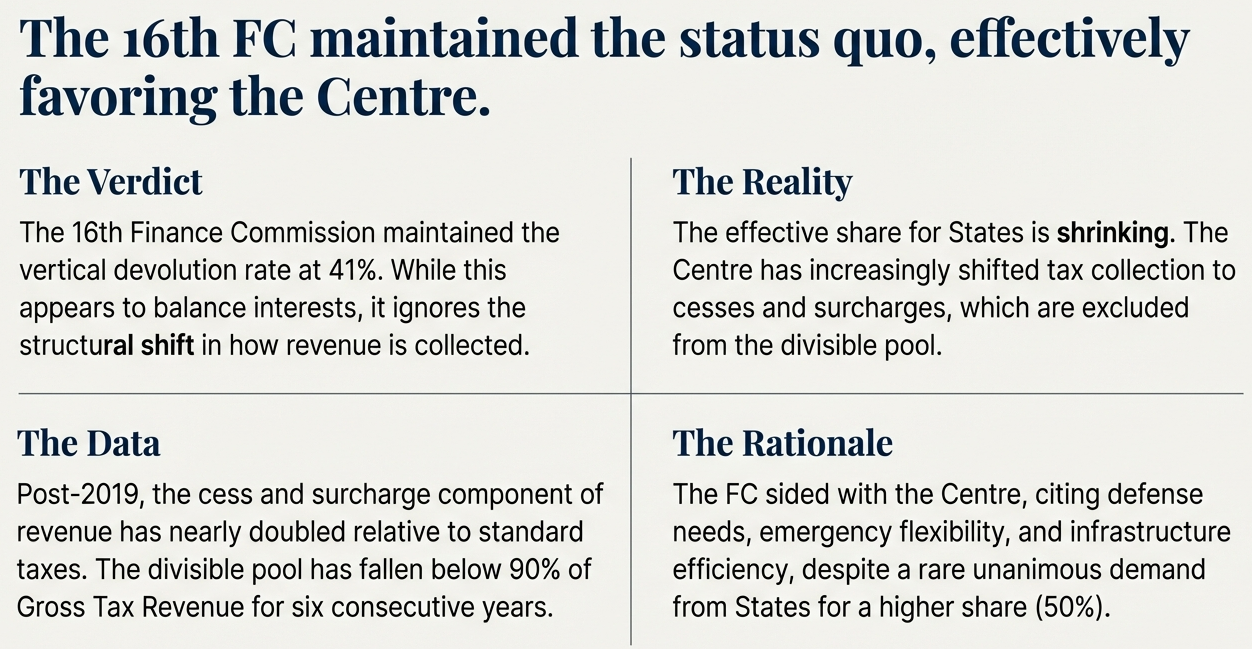

The 16th Finance Commission recommended keeping the vertical devolution of taxes to states at 41%, a move that caused controversy by rejecting states' unanimous demand for a 50% share.

|

Read all about: 16th Finance Commission Report Submitted To President l Cabinet Approves 16th Finance Commission's Terms |

It is a constitutionally mandated, quasi-judicial body established under Article 280 of the Constitution.

Its primary purpose is to define and regulate the financial relations between the Central Government and the individual State Governments.

It is constituted by the President every five years (or earlier if necessary) to recommend the distribution of tax revenues and ensure equitable resource allocation across the country.

Composition of the Commission

The Commission consists of a Chairman and four other members appointed by the President.

Core Functions and Roles

The Commission serves as the "balancing wheel of fiscal federalism" by performing several duties:

What is the Core Controversy Regarding the 16th FC Recommendations?

What is the Core Controversy Regarding the 16th FC Recommendations?

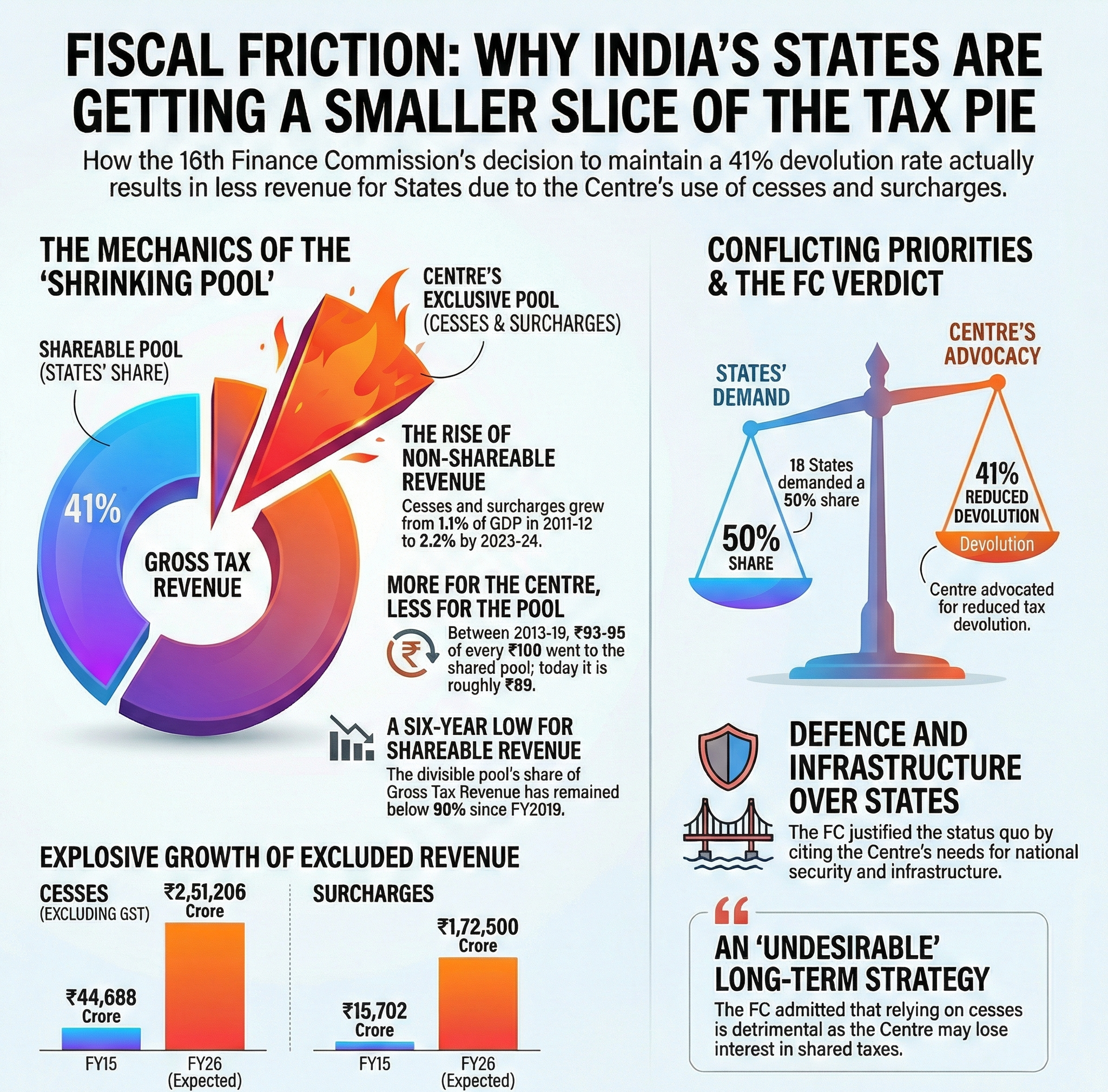

The central issue is the shrinking "Divisible Pool" of taxes shared between the Centre and the States. Although the States' 41% share remains constant, the total tax revenue it applies to is decreasing because of the Centre's method of tax collection.

The Illusion of the 41% Share

Constitutional Mandate: Article 270 of the Constitution requires the Centre to share the "net proceeds of taxes" with the states.

The Loophole: Article 271 empowers the Centre to levy Cesses and Surcharges for specific purposes. However, revenue from these levies is not part of the divisible pool and is retained entirely by the Centre.

State Demands Ignored: Many states demanded a devolution rate of 50%, but the Finance Commission maintained it at 41%, aligning with the Centre's position.

Centre's Increasing Reliance on Non-Shareable Revenue

|

Metric |

Data & Trends |

|

Share of Cesses/Surcharges in Gross Tax Revenue |

|

|

Absolute Growth in Collection |

|

|

Share as a % of GDP |

The non-shareable part of central revenue doubled from 1.1% of GDP (2011-12) to 2.2% of GDP (2023-24). |

Justifications by the 16th Finance Commission

Constitutional Interpretation

The FC noted that the Constitution does not impose a cap on the Centre's power to levy Cesses and Surcharges, calling any potential limit "imprudent".

National Priorities

It cited the need for the Centre to have discretionary funds to address national security concerns and manage emergencies like pandemics or wars.

Centre's Efficiency

The Commission argued that the Centre has shown a "high degree of effectiveness" in executing large-scale infrastructure projects (e.g., National Highways), justifying its need for greater financial control.

Sufficiency of State Funds

The FC claimed that existing devolution mechanisms provide states with adequate resources to fulfill their constitutional duties, a view strongly contested by states.

What are the flaws in the Current Approach?

What are the flaws in the Current Approach?

The current fiscal trend undermines the spirit of Cooperative Federalism and poses several challenges to the financial autonomy and functioning of states.

Misuse of Cess Funds

The Comptroller and Auditor General (CAG) has repeatedly flagged that funds collected through Cesses are often not used for their stated purposes.

Undermining State Autonomy

States are responsible for critical sectors like health, agriculture, and law and order (State List). A shrinking divisible pool makes them more dependent on Centrally Sponsored Schemes (CSS), which come with rigid conditions and turn states into mere implementation agencies.

Penalizing Performing States

High-performing states like Tamil Nadu and Karnataka are negatively affected by the current fiscal devolution structure, receiving a lower share due to the equity-based horizontal formula and the shrinking overall divisible pool, despite their large contribution to national tax revenue.

Constitutional Amendment

Amend Article 270 to mandate that any Cess or Surcharge levied for more than a specific period (e.g., 3 years) must be included in the divisible pool. This aligns with a recommendation from the Justice Venkatachaliah Commission.

Rationalization of Cesses

The Centre should phase out most Cesses and Surcharges by subsuming them into the standard tax structure to rebuild trust with the states.

Strengthen Institutional Dialogue

Revitalize the Inter-State Council to serve as a permanent body for negotiating fiscal arrangements between the Centre and states, supplementing the work of the Finance Commission.

Learn from Global Practices in Fiscal Federalism

Australia: The Commonwealth Grants Commission ensures fiscal equalization by distributing the entire GST revenue among states, preventing the federal government from eroding the shareable pool with hidden levies.

Canada: The Fiscal Arrangements Act constitutionally guarantees equalization payments to provinces. The system does not allow arbitrary federal surcharges to exclude provinces from revenue growth.

"Cess-driven centralism" describes a growing reliance by the central government on cesses to fund initiatives. This trend centralizes fiscal power, undermining the financial autonomy of states, and risks transforming "Cooperative Federalism" into "Coercive Centralism."

Source: THE HINDU

|

PRACTICE QUESTION Q. "While the rate of devolution remains constant, the effective transfer of resources to States is eroding." Critically analyze. 150 words |

The Finance Commission (FC) is a constitutional body established by the President under Article 280 every five years (or earlier) to manage fiscal federalism. It recommends how to distribute tax revenues between the Union and States (vertical devolution) and among States (horizontal devolution), along with outlining principles for grants-in-aid.

Cesses and surcharges are additional levies imposed by the central government on top of existing taxes to raise revenue, with cesses dedicated to specific purposes (e.g., health, education) and surcharges added to the tax liability of high-income earners. Both are part of the Consolidated Fund of India and, unlike regular taxes, are not shared with state governments.

The 16th Finance Commission, chaired by Arvind Panagariya, submitted its report for the 2026–31 period in November 2025, and it was tabled in Parliament on February 1, 2026. The recommendations signal a shift toward compliance-driven fiscal federalism, prioritizing economic performance and fiscal discipline.

© 2026 iasgyan. All right reserved