Copyright infringement not intended

Picture Courtesy: THE HINDU

Context

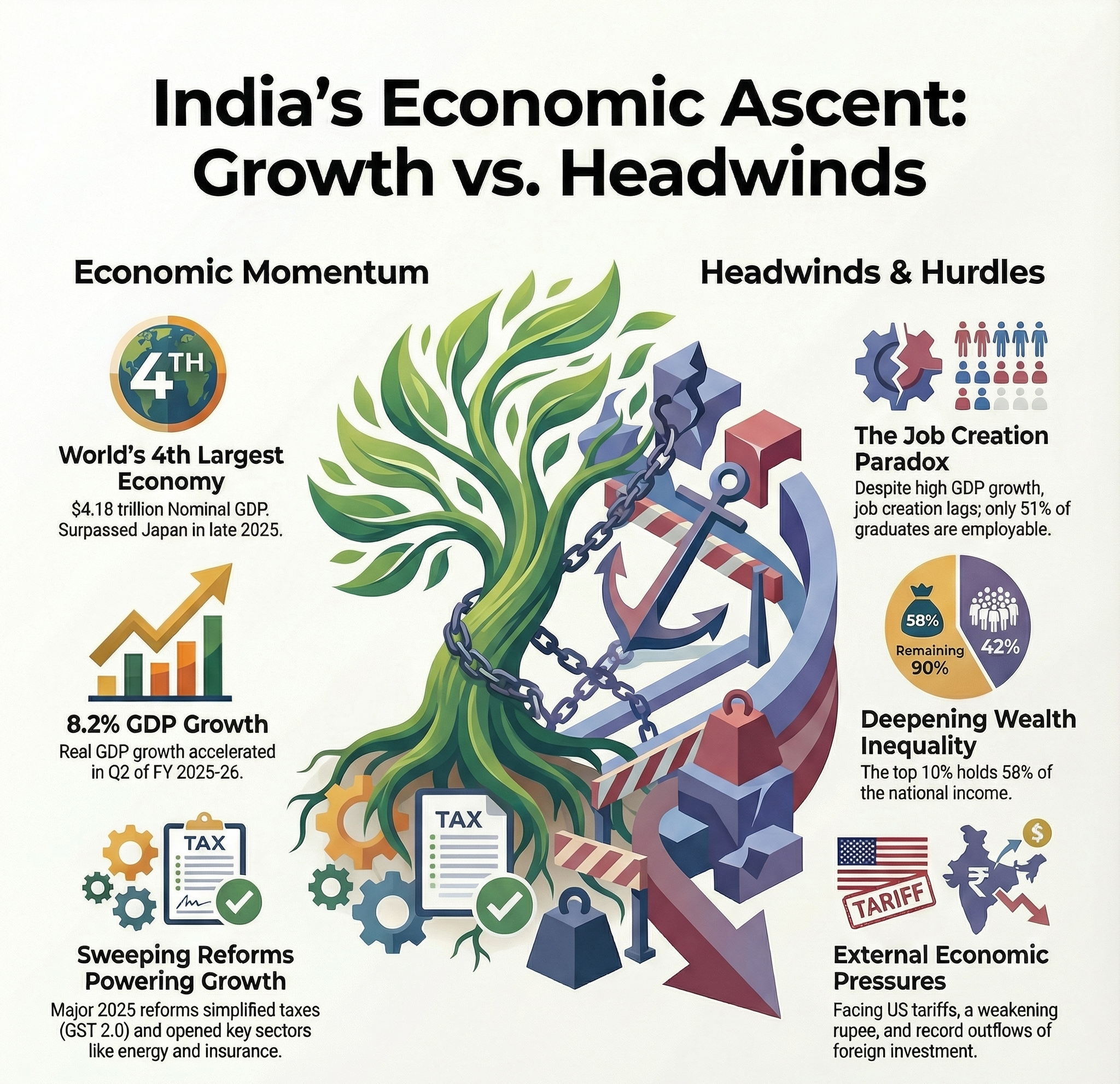

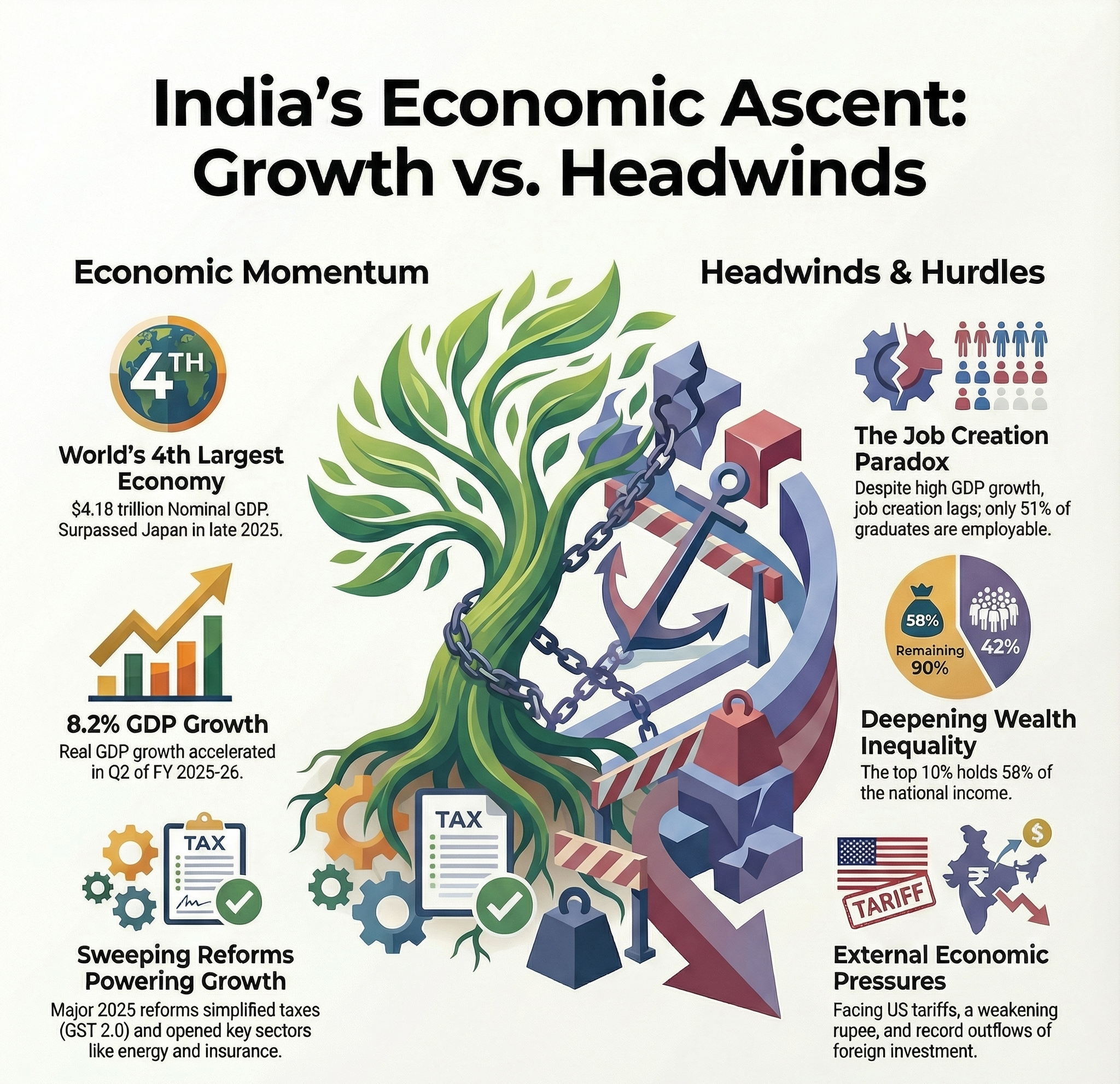

India continues to be the world's fastest-growing major economy, having surpassed Japan in late 2025 to become the world's fourth-largest economy with a nominal GDP of $4.18 trillion, and is expected to overtake Germany for the third position by 2030.

Key Economic Indicators

Growth and Output

- GDP Growth Rate: Real GDP grew by 8.2% in Q2 of FY 2025-26, an increase from 7.8% in Q1.

- Nominal GDP: Estimated at $4.5 trillion for 2026.

- GDP per Capita: Approximately $3,051 (Nominal) and $12,964 (PPP) for 2026 estimates.

- Sectoral Contribution: Services lead the economy at 54.7%, followed by Industry at 27.6% and Agriculture at 17.7%.

Inflation and Monetary Policy

- Inflation Rate (CPI): Softened to 0.71% in November 2025.

- Interest Rate (Repo Rate): Set at 5.25% by the Reserve Bank of India (RBI) as of December 2025.

- Cash Reserve Ratio (CRR): Standing at 3%.

Labor Market

- Unemployment Rate: Reduced to 4.7% in November 2025, the lowest level since April 2025.

- Labour Force Participation Rate (LFPR): Rose to a seven-month high of 55.8% in November 2025.

- Worker Population Ratio (WPR): Improved to 53.2% as of November 2025.

Fiscal Indicators

- Government Debt to GDP: Approximately 80% - 81%.

- Foreign Exchange Reserves: Stood at $693.32 billion as of December 2025.

Development and Social Indicators

- Human Development Index (HDI): India is ranked 130th with an index of 0.685.

- Extreme Poverty: According to the World Bank report, extreme poverty fall from 16.2% in 2011-12 to 2.3% in 2022-23.

Major Reforms in 2025

GST 2.0 Reforms

Government simplified the GST tax structure from a four-slab system to two-slab regime of 5% and 18%. Luxury and demerit items are now taxed at a single 40% rate, replacing the previous complex GST-plus-cess system.

New Income Tax Act, 2025

The Union Budget 2025-26 introduced relief, exempting annual incomes up to ₹12 lakh from tax under the new regime. The new Act simplifies tax law and strengthens faceless, digital administration.

Nuclear Energy (SHANTI Bill)

The Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India (SHANTI) Bill dismantled state monopolies, allowing private and foreign participation in building and operating nuclear plants for the first time.

Insurance Liberalization

The government opened the insurance sector fully by allowing 100% Foreign Direct Investment (FDI) to deepen market penetration and reduce costs.

Labour Code Implementation

The four new Labour Codes were enacted, consolidating 29 central labour laws. This reform aims to streamline compliance for businesses while providing social security to all workers, including those in the gig economy.

Rural Employment Reforms

The Viksit Bharat – Guarantee for Rozgar and Ajeevika Mission (Gramin) Act, 2025, replaced the MGNREGA. It extends the employment guarantee to 125 days and focuses on creating durable community assets.

Challenges Facing the Economy

External Vulnerabilities and Trade

- Trump-era Tariffs: "Trump tariffs" of up to 50% pose threat to export momentum, particularly in labor-intensive sectors like textiles, gems, and jewelry.

- Currency Pressures: The Indian rupee has faced depreciation, breaching the 91 mark against the US dollar by early 2026, which risks importing inflation through higher commodity costs.

- FII (Foreign Institutional Investor) Outflows: In 2025, FIIs recorded the worst year for foreign investment in Indian equities, with net outflows surpassing ₹1.5 lakh crore by late December, driven by high valuations, US Fed rate hikes, and global uncertainty.

Labor Market and Social Challenges

- Youth Unemployment: Only 51.25% of graduates are considered employable (Source: Economic Survey).

- The low employment rate stems from a skills gap in communication, problem-solving, critical thinking, and technological proficiency—qualities sought by employers.

- Sluggish Job Creation: Despite an 8% GDP growth rate, job creation has not kept pace with the millions of young Indians entering the workforce annually.

- Income Inequality: Wealth remains concentrated, with the top 10% of earners accounting for 58% of national income, and bottom 50% receive only 15%, hindering social cohesion and inclusive growth. (Source: World Inequality Report)

Structural and Administrative Hurdles

- Private Investment Lull: While public capital expenditure is high, private sector investment remains cautious due to global uncertainties and domestic growth concerns.

- Agricultural Inefficiency: The sector employs nearly half of the workforce but remains the most inefficient, vulnerable to price fluctuations and climate-induced supply shocks.

- Compliance Burden: Despite reforms, bureaucratic red tape and the "Sovereignty and Liability Trap" in sectors like space and nuclear energy continue to hamper private participation.

Emerging Risks

- Climate Change: Air pollution and extreme weather events are impacting productivity; pollution-related health issues cause an estimated 1.7 million deaths annually and a sharp fall in effective working hours. (Source: Lancet)

- AI Disruption: The Indian IT sector, a pillar of the economy, faces an "uncertain future" as AI threatens the traditional labor-arbitrage model.

- Household Debt: Rising household debt, reaching 41.3% of GDP in March 2025, poses a risk to long-term consumption stability if interest rates remain elevated. (Source: RBI)

Way Forward

Way Forward

To transition from a developing to a developed economy by 2047, a multi-faceted and sustained policy approach is essential.

Strengthening the "Four Engines" of Growth

The 2025-26 budget identified four critical sectors to drive national development:

- Agriculture: Boosting productivity through the 'Prime Minister Dhan-Dhaanya Krishi Yojana' across 100 low-productivity districts and launching a six-year Mission for Aatmanirbharta in Pulses.

- MSMEs: Raising investment and turnover limits for classification by up to 2.5 times and providing expanded credit guarantee covers.

- Investment: Capital expenditure with a focus on modernizing infrastructure through the Gati Shakti platform and a second Asset Monetization Plan (2025-30).

- Exports: Diversifying markets to counter US tariffs. Utilize the Export Promotion Mission and the digital BharatTradeNet to integrate MSMEs into global value chains.

Deepening Human Capital and Skilling

- Industry 4.0 Focus: Introduce new courses in AI, 5G, Green Hydrogen, and Drone Technology in school and Universities.

- Apprenticeship-Led Jobs: Scaling the National Apprenticeship Promotion Scheme (NAPS) with direct stipend transfers to make "earning while learning" the primary school-to-work pathway.

- Social Security for New Economy: Registering gig workers on the e-Shram portal and extending Ayushman Bharat healthcare benefits to them.

Transition to Green and High-Tech Economy

- Energy Resilience: Implementing Nuclear Energy Mission for small modular reactors and promoting domestic manufacturing of EV batteries and solar PV cells.

- Tech-Driven Governance: Implementing the Jan Vishwas Bill 2.0 to decriminalize legal provisions and launching an Investment Friendliness Index for states to promote competitive federalism.

Trade Realism and Diplomacy

- Strategic FTAs: Prioritize effective implementation of new trade agreements with the UK, Oman, and New Zealand to secure new market access.

- Multipolar Leadership: Utilizing India's 2026 BRICS Chairmanship to promote local currency trade and Global South priorities, while upholding "Strategic Autonomy" in US and Russia relations.

Conclusion

The Indian economy in 2026 demonstrates robust growth and resilience, with ongoing reforms providing a strong foundation for sustained and inclusive growth towards the 'Viksit Bharat' 2047 vision.

Source: THEHINDU

|

PRACTICE QUESTION

Q. "India’s Digital Public Infrastructure (DPI) has become a global benchmark. Discuss its role in driving the 'quiet revolution' in financial inclusion and formalization." (150 words)

|

Frequently Asked Questions (FAQs)

The four labour codes, which came into effect in November 2025, consolidate 29 central labour laws. Key provisions include mandating appointment letters for all workers, extending social security to gig and platform workers, and simplifying compliance for businesses through a single registration, license, and return mechanism.

India has taken several steps, including the reduction of over 47,000 compliances and the decriminalisation of thousands of minor procedural provisions. Additionally, the growth of digital platforms like ONDC and GeM, along with a focus on improving India's rank in the Global Innovation Index, contribute to a better business environment.

The SHANTI (Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India) Bill is a proposed legislation introduced in Budget 2025. Its primary objective is to create a regulated framework that allows for private sector participation in the nuclear energy sector, aiming to help India achieve its goal of 100 GW of nuclear capacity by 2047.

Way Forward

Way Forward