Copyright infringement not intended

Picture Courtesy: economictimes

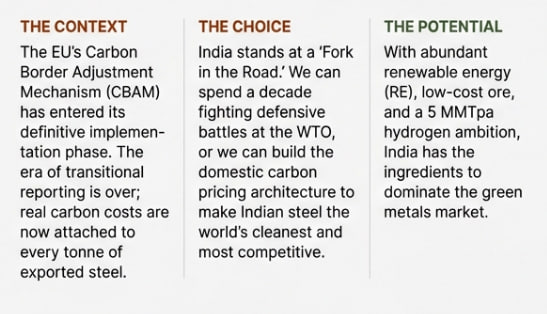

The EU's Carbon Border Adjustment Mechanism (CBAM) concludes its reporting-only phase in 2025 and enters its definitive phase on January 1, 2026, requiring Indian exporters to purchase carbon certificates for energy-intensive goods

|

Read all about: CARBON BORDER ADJUSTMENT MECHANISM (CBAM) l NATIONAL DESIGNATED AUTHORITY FOR CARBON MARKETS |

CBAM is a climate measure designed to prevent 'carbon leakage'.

It is a central element of the EU’s ‘Fit for 55’ package, which aims to reduce greenhouse gas (GHG) emissions by at least 55% by 2030 compared to 1990 levels (Source: European Commission).

Objective: To ensure a level playing field between EU and non-EU producers by equalizing the price of carbon paid for goods.

How does it work?

Mechanism: Importers in the EU will have to buy 'CBAM certificates' to cover carbon emissions of the goods they import.

Credit for Domestic Carbon Price: If a non-EU producer has already paid a carbon price in their home country (e.g., through a carbon tax), the corresponding cost can be deducted from the CBAM liability.

Implementation Timeline: CBAM is rolled out in phases to allow industries and governments to adapt. The initial focus is on sectors with high emissions and a significant risk of carbon leakage.

|

Phase |

Timeline |

Key Features |

|

Transitional Phase |

October 1, 2023 - December 31, 2025 |

Importers are required to report the emissions in their goods without any financial payment or penalty. This is a data collection and learning period. |

|

Definitive Phase (Full Implementation) |

From January 1, 2026 |

Importers must declare emissions annually and surrender the number of CBAM certificates. Financial obligations will be fully enforced. |

The sectors currently covered under CBAM are:

The scope is expected to be expanded to include other sectors like organic chemicals and polymers by 2030 (Source: European Commission).

India, as a major trading partner of the EU, faces a mixed impact of immediate economic challenges and long-term strategic opportunities.

Challenges

Challenges

Economic Impact

Approximately 27% of India's exports of steel, iron, and aluminium, valued more than $8 billion, are directed to the EU (Source: Global Trade Research Initiative). These sectors will face increased costs, making Indian exports less competitive.

Green Protectionism

India has voiced concerns at the World Trade Organization (WTO) that CBAM could act as a non-tariff barrier, discriminating against developing countries.

Impact on MSMEs

Micro, Small, and Medium Enterprises (MSMEs), a crucial part of the industrial supply chain, lack the financial and technical capacity to adopt green technologies and comply with complex reporting requirements.

Equity Concerns (CBDR-RC)

CBAM is seen as a violation of the UNFCCC principle of 'Common But Differentiated Responsibilities and Respective Capabilities' (CBDR-RC), which acknowledges that developed nations have a greater historical responsibility for emissions.

Strategic Opportunities

Incentive for Decarbonization

CBAM acts as a powerful external driver for Indian industries to accelerate their transition to cleaner technologies, such as green steel (using green hydrogen) and low-carbon cement.

Competitive Advantage

Companies that invest in decarbonization can turn their low-carbon footprint into a unique selling proposition (USP), gaining a competitive edge in the EU and other climate-conscious markets.

Policy Catalyst

It pushes the Indian government to fast-track the implementation of domestic climate policies, such as a national carbon pricing mechanism or strengthening the existing Perform, Achieve, and Trade (PAT) scheme.

Boosting Green Exports

National Green Hydrogen Mission can be leveraged to produce and export green steel, green ammonia, and hydrogen itself, turning CBAM into a market opportunity.

India's Strategic Response

To navigate the CBAM landscape, India needs a comprehensive strategy involving policy reforms, technological investments, and diplomatic engagement.

Policy and Investment Roadmap

|

Area of Action |

Specific Measures |

|

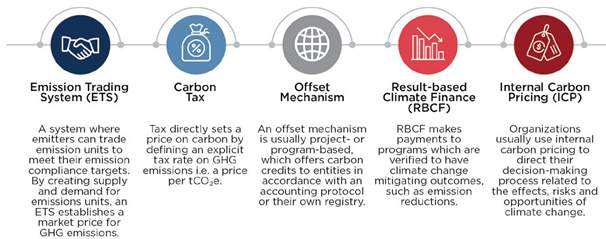

Domestic Carbon Pricing |

Design and implement a domestic Emissions Trading Scheme (ETS) or a carbon tax, to retain the carbon revenue domestically instead of it being paid to the EU. |

|

Technology & Infrastructure |

Increase public and private investment in Carbon Capture, Utilization, and Storage (CCUS), green hydrogen production, and renewable energy infrastructure to decarbonize hard-to-abate sectors. |

|

Support for MSMEs |

Provide targeted financial incentives, subsidies, and technology transfer support to help MSMEs adopt cleaner production methods and meet CBAM's reporting standards. |

|

Data and Reporting |

Establish internationally accepted systems for Monitoring, Reporting, and Verification (MRV) of carbon emissions at the company and plant level. |

Diplomatic Engagement

Multilateral Forums (WTO, G20)

India advocates for a just and equitable climate and trade regime, arguing for special considerations for developing nations and pushing for CBAM revenues to be channeled into climate finance.

Bilateral Cooperation

Engage with the EU for technical assistance, technology transfer, and capacity building to facilitate a smoother green transition for Indian industries.

South-South Collaboration

Build alliances with other developing countries (e.g., Brazil, South Africa) to form a collective voice on the issue of carbon border taxes.

FTA Negotiations

The ongoing India-EU Free Trade Agreement (FTA) negotiations are a key platform for India to seek flexibility, such as the recognition of its domestic decarbonization efforts.

Accelerate Domestic Carbon Pricing

Fully operationalize the CCTS with a robust and transparent framework to offset CBAM liabilities by demonstrating that a domestic carbon price has been paid.

Encourage Industrial Decarbonization

Implement a national strategy to support heavy industries. This should include Production Linked Incentive (PLI) schemes for green steel and green hydrogen, support for R&D, and facilitating access to low-cost finance.

Strategic Diplomatic Negotiations

Engage with the EU through bilateral channels and at the WTO to negotiate for recognition of India's domestic climate actions and special considerations for its developmental needs.

Capacity Building for MSMEs

Establish dedicated support systems for MSMEs, including financial aid for compliance, technical assistance for emissions monitoring, and simplified reporting processes to ensure they remain integrated into global value chains.

The EU's CBAM is a trade challenge for India, necessitating faster domestic climate policies, industrial innovation, and enhanced green manufacturing. By enacting reforms and strategic diplomacy, India can transform this challenge into an opportunity for a more sustainable, competitive, and globally integrated economy.

Source: INDIANEXPRESS

|

PRACTICE QUESTION Q. The EU's Carbon Border Adjustment Mechanism (CBAM) is presented as a climate measure, but it poses significant challenges to developing economies like India. Critically analyze. 150 Words |

CBAM is a policy tool by the European Union that imposes a price on the carbon emitted during the production of certain carbon-intensive goods imported into the EU. Exporters to the EU will have to buy and surrender 'CBAM certificates' corresponding to the carbon emissions included in their products.

The sectors most affected initially are iron and steel, aluminium, cement, fertilisers, electricity, and hydrogen. India's iron, steel, and aluminium exports, valued at over $8 billion to the EU in 2022, are particularly vulnerable.

The CCTS is India's upcoming domestic carbon market. It is a strategic response to CBAM because if a carbon price is paid domestically in India under the CCTS, that amount can be deducted from the CBAM tax in the EU. This ensures the revenue stays within India to fund its own green transition, rather than being paid as a tax to the EU.

© 2026 iasgyan. All right reserved