Description

GS PAPER III: Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

What is the issue?

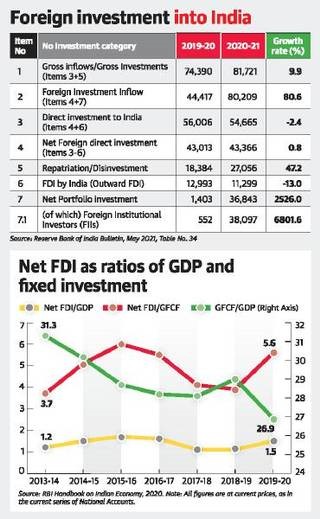

- Total foreign direct investment (FDI) inflow in 2020-21 is $81.7 billion, up 10% over the previous year, reported a recent Ministry of Commerce and Industry.

- Measures taken by the Government on the fronts of Foreign Direct Investment (FDI) policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country.

What accounts for gross inflow?

- The gross inflow consists of

(i) “direct investment to India” and

(ii) “repatriation/disinvestment”.

The disaggregation shows that “direct investment to India” has declined by 2.4%.

- Hence, an increase of 47% in “repatriation/disinvestment” entirely accounts for the rise in the gross inflows. In other words, there is a wide gap between gross FDI inflow and direct investment to India.

What explains the surge in FDI inflows?

- FDI inflow increasingly consists of private equity funds, which are usually disinvested after 3-5 years to book profits (per its business model).

- In principle, private equity funds do not make long-term greenfield investment.

What then accounts for the impressive headline number of 10% rise in gross inflow?

- It is almost entirely on account of “Net Portfolio Investment”, shooting up from $1.4 billion in 2019-20 to $36.8 billion in the next year.

- Further, within the net portfolio investment, foreign institutional investment (FIIs) has boomed by an astounding 6,800% to $38 billion in 2020-21, from a mere half a billion dollars in the previous year.

- It is entirely on account of net foreign portfolio investment.

What is portfolio investment, and how is it included in FDI inflow?

- FDI inflow, is supposed to bring in additional capital to augment potential output (taking managerial control/stake).

- In contrast, foreign portfolio investment, is short-term investment in domestic capital (equity and debt) markets to realise better financial returns (that is, higher dividend/interest rate plus capital gains).

If the deluge of FII inflow did little to augment the economy’s potential output, what then did it do?

- It added a lot of froth to the stock prices.

- When GDP has contracted by 7.3% in 2020-21 on account of the pandemic and the economic lockdown, the BSE Sensex nearly doubled from about 26,000 points on March 23, 2020 to over 50,000 on March 31, 2021.

- BSE’s price-earnings (P-E) multiple — defined as share price relative to earnings per share — is among the world’s highest, close behind S&P 500 in the U.S.

Modest contribution

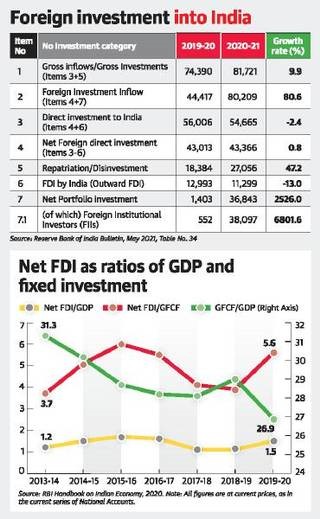

- Thus the surge in total FDI inflow during the pandemic year is entirely explained by booming short-term FIIs in the capital market – and not adding to fixed investment and employment creation.

- For years now, the government has showcased the rise in gross FDI inflows as a badge of the success of its economic policies to counter the widespread criticisms of output and investment slowdown and rising unemployment rates (especially during the last year).

- Thus, FDI inflow’s contribution to domestic output and investment remains modest.

The rapid influx is evidence of the success of the economic policies during the pandemic, the government claims. Is it so?

- Probably not. Unprecedented short-term foreign portfolio investments are entirely responsible for the surge.

- And within the portfolio investment, FIIs shot up to $38 billion in 2020-21, from half a billion-dollar the previous year.

- The flood of FIIs has boosted stock prices and financial returns. These inflows did little to augment fixed investment and output growth.

https://www.thehindu.com/opinion/op-ed/what-explains-the-surge-in-fdi-inflows/article34702117.ece?homepage=true