Description

Disclaimer: Copyright infringement not intended.

Context

- India’s palm oil imports could drop by almost a fifth as cheaper soyoil takes more market share, following Indonesia’s curbs on palm oil exports.

- India allowed duty-free imports of two million tonnes each of soyoil and sunflower oil for the current and next fiscal years ending March 31, as part of efforts to local edible-oil prices under control.

Palm Oil

- Palm oil is an edible vegetable oil derived from the mesocarp (reddish pulp) of the fruit of the oil palms.

- Along with coconut oil, palm oil is one of the few highly saturated vegetable fatsand is semisolid at room temperature.

- It is resistant to oxidation and so can give products a longer shelf-life; it’s stable at high temperatures

- Hence, the oil is used in food manufacturing, in beauty products, and as biofuel.

- Its use in the commercial food industry in other parts of the world is widespread because of its lower cost.

Production

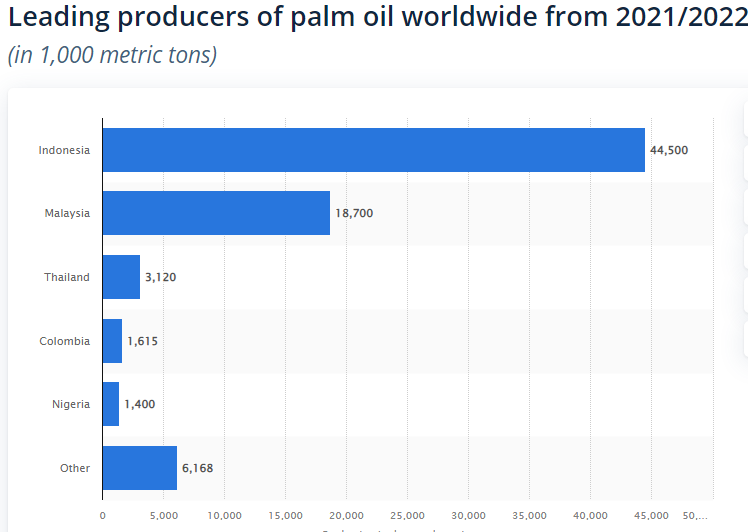

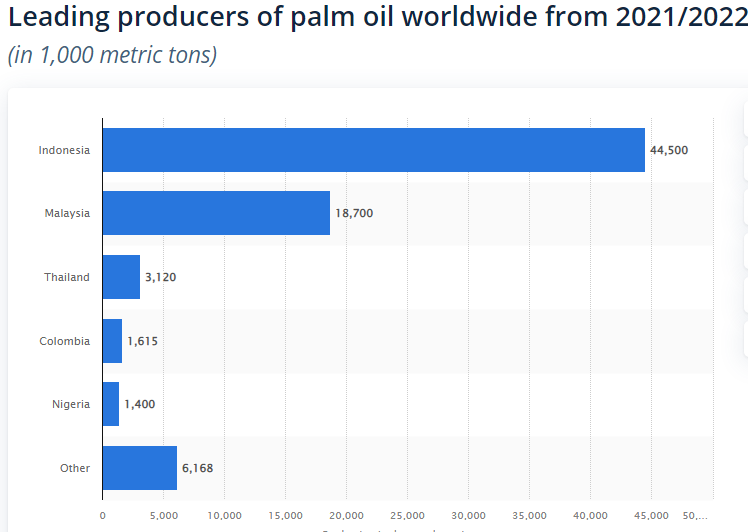

- Indonesia is the largest producer of palm oil, followed by Malaysia - both countries account for 84% of the worlds palm production. The largest producers of palm oil are Thailand, Colombia and Nigeria.

- Globally, palm oil supplies 35% of the world’s vegetable oil demand on just 10% of the land.

Consumption

- The largest consumer of palm oil are India (9.4 million tonnes) and Indonesia (6 million tonnes)– countries in which palm oil is traditionally used for cooking.

- The largest importer of palm oil is India(19 per cent), followed by the European Union (15 per cent, 7.3 million tonnes) and China (14 per cent) (Index Muni, 2020).

The recent ban by Indonesia

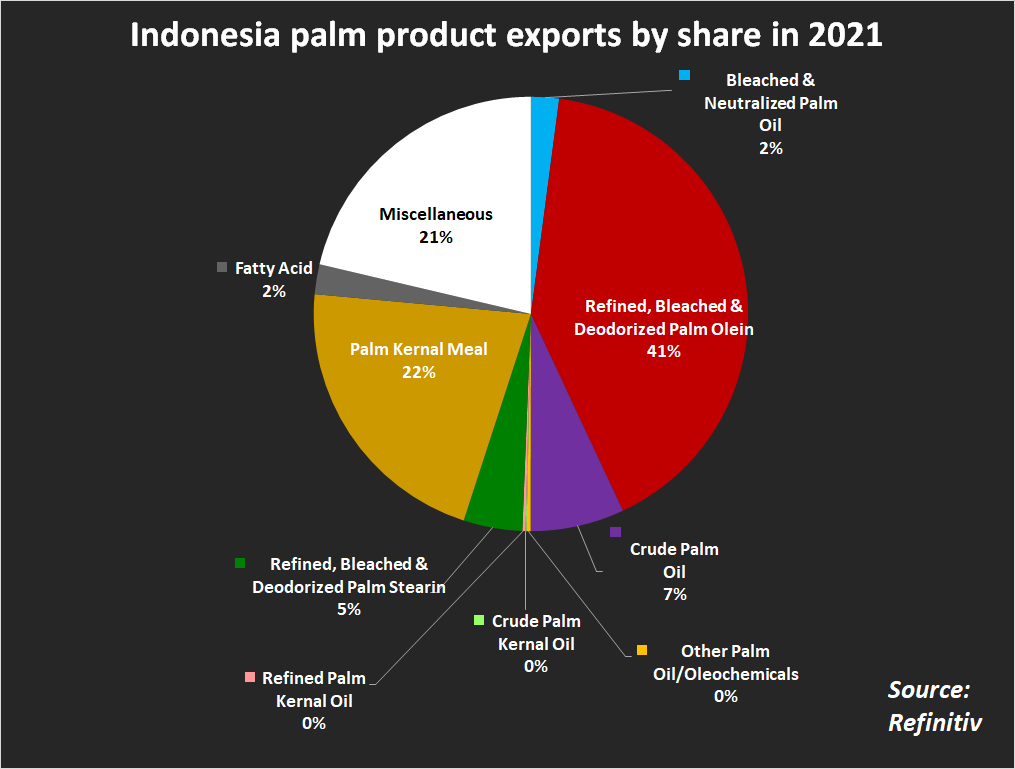

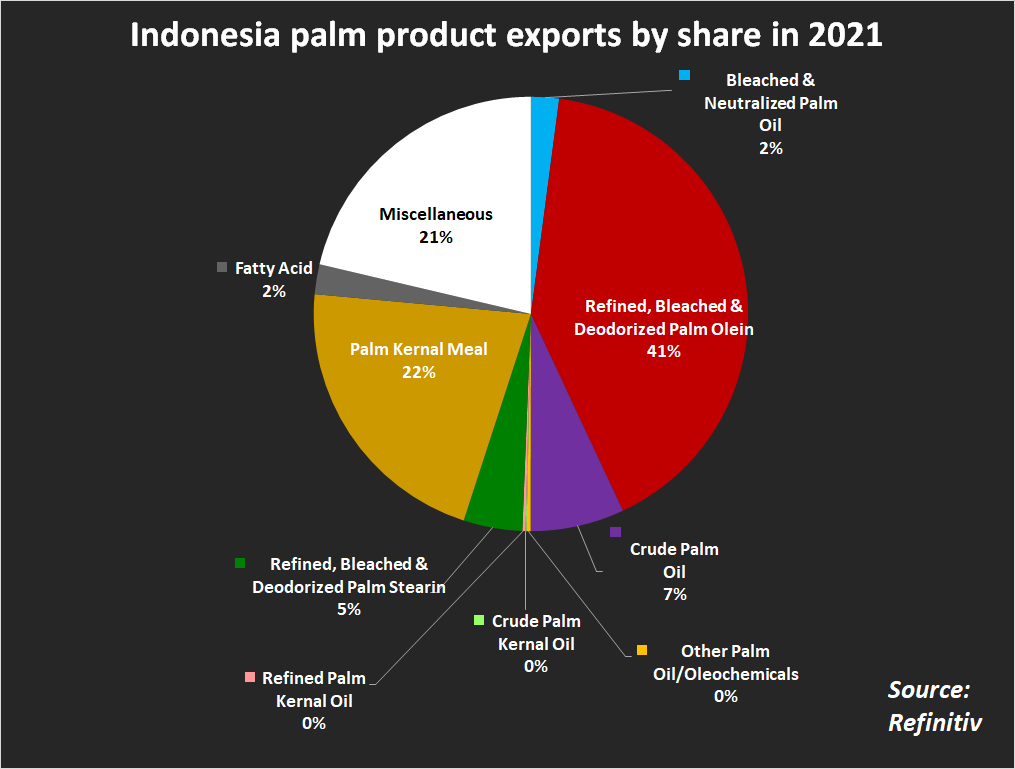

- Indonesia has confirmed that the ban will only apply to exports of refined, bleached and deodorized (RBD) palm olein, and would not affect flows of crude palm oil or other forms of derivative products.

- However, it will widen the ban if there is a shortage of refined palm oil.

- RBD palm olein accounts for around 40% of Indonesia's total exports of palm oil products.

Why has Indonesia banned the export of palm oil?

- Indonesia, much like most of the world, is grappling with inflation and a shortage of palm oil, as high exports of the commodity, has further fuelled inflation in that country.

- Of late, there have been multiple protests in the country on rising food prices.

- The country is also facing an acute shortage of edible oil including palm oil.

- Rise in palm oil prices has been a cause of worry for the Indonesian government.

- To stem the rising prices of palm oil, the government banned its exports and removed retail price caps on the commodity, which had led to the shortage of the commodity.

- So, it has made a series of interventions over the past few months, including capping local prices, providing higher subsidies, hiking export duty, and controlling exports through surveillance and documentation, etc.

Why are palm oil prices rising?

- Palm oil prices, have jumped 50 percent in the last 12 months and nearly tripled over two years. The rise in prices is the result of multiple factors.

- The key price drivers, are :

- Weather conditions in top oil-producing nations,

- Demand-supply balance of competing oils like soya bean, rapeseed, sunflower, etc.,

- Demand environment and mix of edible oils in consuming countries, and

- Demand for palm-based bio-diesel, especially in Indonesia and Malaysia.

- A labour unrest in Malaysia also led to a shortage of the product last year.

- With the Russia-Ukraine war, prices of the commodity climbed again.

India’s Palm Oil requirements

- As per ICRA, palm oil accounts for about 40 percent of total edible oil consumption in India and 60 percent of imports.

- Almost India’s entire palm oil requirement is met by Indonesia and Malaysia.

- Indonesia though, was the largest exporter of palm oil to India historically, imports of the commodity from Malaysia increased in recent years.

- Currently, India imports less than 50 percent of its palm oil needs from Indonesia, which though lesser than Malaysia, is still substantial.

- India imported about 500,000 tons of crude palm oil from Indonesia in the five months ended March 2022.

- RBD palm olein purchases totaled 475,000 tons, according to data compiled by the Solvent Extractors’ Association of India.

|

India is the second-largest consumer of vegetable oils globally, accounting for more than 10 percent of global demand. Palm oil is of importance, given it accounts for about 40 percent (normalized) share in India’s overall edible oil consumption basket. Nearly two-thirds of India’s edible oil demand is met by imports.

|

Plausible implications of recent export bans on India

- Indonesia’s palm oil export ban has huge implications for the Indian consumers, as it would lead to a further jump in prices of several daily-use items.

- Palm oil is a key commodity for several products, such as soaps, shower gels, hand washes, shampoos, oral care products, and processed food products, such as noodles, biscuits, and frozen desserts.

- The commodity is cheaper compared to other edible oils, and hence, is used by the hotels, restaurants and caterers (HoReCa) industry

- Palm oil is a key ingredient in the food processing industry. Rising prices of palm oil will impact costs and margins of several consumer companies.

- The impact would be seen most in categories, such as biscuits, noodles, cakes, potato chips, frozen desserts.

- The restaurant industry is already grappling with a 10-12 percent increase in operational costs due to inflation. And now with prices of palm oil set to surge again, the industry might pass on the costs to the consumers.

How will this impact FMCG companies and QSRs?

- The margins of FMCG companies and QSRs have been under stress for several quarters now, as they battle inflation across key commodities. A tepid demand scenario makes it challenging to pass on the cost to consumers. A further price rise in palm oil, fuelled by the ban, can increase their troubles.

- Fast-moving consumer goods (FMCG), majors such as Britannia, Hindustan Unilever, Nestle India and ITC would be amongst the key companies affected directly as a result of the ban and higher prices.

- Quick service restaurant (QSRs) like Westlife Development and Burger King will also suffer, given the use of edible oil to cook/ fries.

Palm Oil: India specific

- In India, oil palm is being cultivated in 13 states. Potential states are Andhra Pradesh, Gujarat, Karnataka, Tamil Nadu and Bihar.

- Andhra Pradesh (83.5 percent) along with Telangana accounts for about 97 percent of India's 278,000 tonnes of crude palm oil production.

India and Oilseeds

- Stats:India is one of the major oilseeds grower and importer of edible oils. India’s vegetable oil economy is the world's fourth largest after the USA, China & Brazil.

- Coverage:The oilseed accounts for 13% of the Gross Cropped Area, 3% of the Gross National Product and 10% value of all agricultural commodities.

- Trend in production:This sector has recorded annual growth rate of area, production and yield @ 2.44%, 5.47% and 2.96% respectively during the last decade (1999-2009).

- Oilseed crops:The diverse agro-ecological conditions in the country are favourable for growing 9 annual oilseed crops, which include 7 edible oilseeds (groundnut, rapeseed & mustard, soybean, sunflower, sesame, and niger) and two non-edible oilseeds (castor and linseed).

- Consumption:During the last few years, the domestic consumption of edible oils has increased substantially and has touched the level of 90 million tonnes in 2011-12 and is likely to increase further.

- Demand:With per capita consumption of vegetable oils at the rate of 16 kg/year/person for a projected population of 1276 million, the total vegetable oils demand is likely to touch 20.4 million tonnes by 2017.

Need for reforms in oilseeds and palm oil

- Maximize production:A substantial portion of our requirement of edible oil is met through import of palm oil from Indonesia and Malaysia. It is, therefore, necessary to exploit domestic resources to maximize production to ensure edible oil security for the country.

- Area expansion:Oil Palm is comparatively a new crop in India and is the highest vegetable oil yielding perennial crop. With quality planting materials, irrigation and proper management, there is potential of achieving 20-30 MT Fresh Fruit Bunches (FFBs) per ha after attaining the age of 5 years. Therefore, there is an urgent need to intensify efforts for area expansion under oil palm to enhance palm oil production in the country.

- Source diversification:Tree Borne Oilseeds (TBOs), like sal, mahua, simarouba, kokum, olive, karanja, jatropha, neem, jojoba, cheura, wild apricot, walnut, tung etc. are cultivated/grown in the country under different agro-climatic conditions in a scattered form in forest and non-forest areas as well as in waste land /deserts/hilly areas. These TBOs are also a good source of vegetable oil and therefore need to be supported for cultivation.

National Mission on Edible Oils-Oil Palm (NMEO-OP)

- Under this mission the government will focus on increasing the oil palm cultivation to 10 lakh hectares by 2025-26 and 16.7 lakh hectares by 2029-30.

- The Centre will provide some financial assistance to farmers to ensure that they get a good price for their produce. It will work out the formula price and the viability price of the produce.

- The weather condition in North East and Andaman and Nicobar Islands is conducive for oil palm cultivationand this is the reason why the special focus of the mission will be on these two areas.

Other Concerns associated with Palm Oil Production

- Deforestation:Palm oil has been and continues to be a major driver of deforestation of some of the world’s most biodiverse forests, destroying the habitat ofalready endangered species like the Orangutan, pygmy elephant and Sumatran rhino.

- GHGs:This forest loss coupled with conversion of carbon rich peat soils are throwing out millions of tonnes of greenhouse gases into the atmosphere and contributing to climate change.

- Labour exploitation:There remains some exploitation of workers and child labour.

Way Ahead

Enforcement of RSPO standards

- Palm oil need to be produced more sustainably.

- The Roundtable of Sustainable Palm Oil or RSPO was formed in 2004 in response to increasing concerns about the impacts palm oil was having on the environment and on society.

- The RSPO has a production standard that sets best practices producing and sourcing palm oil.

- Companies can be enforced to not just follow the basic RSPO standard but get independently verified against the new RSPO NEXT standard or the Palm Oil Innovation Group (POIG) Charter.

- RSPO NEXT and POIG include tougher criteria on issues.

Other steps

- Zero deforestation (including of secondary forest)

- No planting on peat

- Stricter targets to reduce greenhouse gas emissions

- Supporting smallholders with sustainability and business skills

- Companies can be enforced to be transparent in their use and sourcing of palm oil.

- No new planting in place of primary forest or areas of high conservation value since 2005.

- Free, prior and informed consent of local people to plant palm oil on their land.

- The obligation to measure and reduce climate change emissions.

- A prohibition on the use of fire to clear land.

- A requirement to keep soils healthy and to prevent erosion.

- Safe pesticide use.

- Decent working conditions and wages.

- Compliance with local, national and international laws.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=G639RQ5KR.1&imageview=0

1.png)