Disclaimer: Copyright infringement not intended.

Introduction

In a nutshell,

Micro ATMs - Delving deeper

How is it more convenient?

Disadvantages:

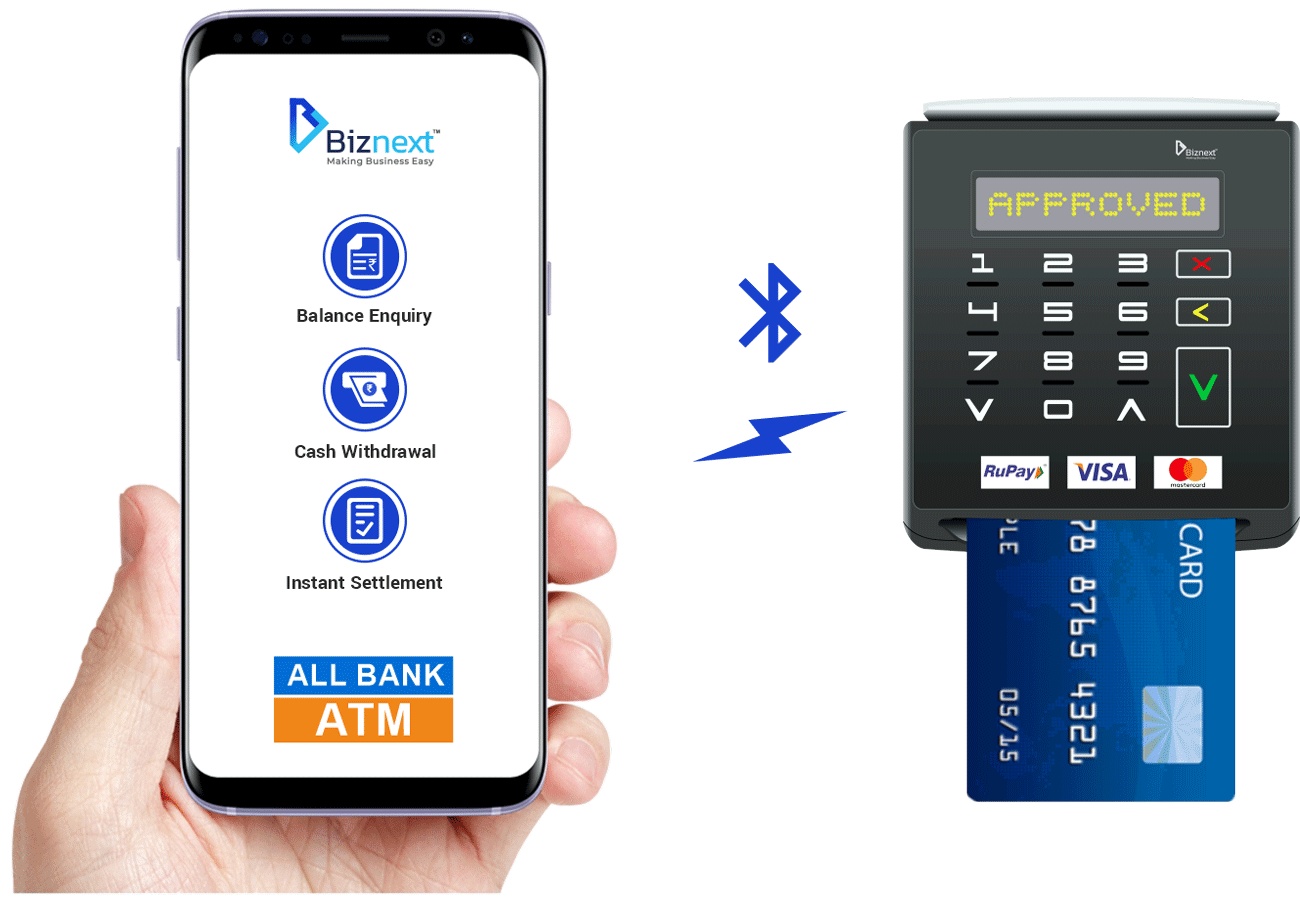

How does Micro ATM work?

Micro ATMs in India

The trend

How are Micro-ATMs filling the gaps created by traditional ATMs models?

How are Micro-ATMs increasing cash-flow in unbanked rural and semi-urban areas?

Can we expect more facilities in future from Micro ATMs?

What has led to the sharp growth in setup of Micro ATMs over traditional ATMs?

Closing Thoughts

https://www.iasgyan.in/course/personalized-mentorship-programme

© 2026 iasgyan. All right reserved