Knitting The Future in India's Textile & Garment Industry

Disclaimer: Copyright infringement not intended.

Context

- Union Minister for Textiles, Commerce and Industry Piyush Goyal has said that the Indian textile industry will regain its lost glory in the future and Tamil Nadu will be at the forefront of the sector.

Details:

- Food, clothing and shelter are our basic needs without which life cannot be imagined. And these three are also the backbone of the country's development.

- The textile industry in India has played a vital role in the country's economy with a rich history spanning centuries.

- Keeping in mind the potential of the textile sector to generate employment and export revenue, the government is taking several measures to promote the sector.

- After agriculture, the textile and clothing industry provides the maximum employment in the country.

- The textile and garment sector is going to play a big role in the goal of making the country a 5 trillion-dollar economy soon.

- Schemes like the PLI Scheme, PM Mitra Textile Parks, 100% FDI, Technology Upgradation Scheme, FTA, and MSME loan rebate, are changing the picture of this industry.

- Today, through our special offer, let us know how efforts are being made to realize the immense potential of this sector. And how the Indian textile and garment sector is becoming the pillar of the country's self-reliance.

INTRODUCTION:

- India's textile sector is one of the oldest industries in the Indian economy, dating back several centuries. The industry is extremely varied, with hand-spun and hand-woven textiles sectors at one end of the spectrum, with the capital-intensive sophisticated mills sector at the other end.

- The fundamental strength of the textile industry in India is its strong production base of a wide range of fiber/yarns from natural fibers like cotton, jute, silk and wool, to synthetic/man-made fibers like polyester, viscose, nylon and acrylic.

- The decentralized power looms/ hosiery and knitting sector form the largest component of the textiles sector. The close linkage of the textiles industry to agriculture (for raw materials such as cotton) and the ancient culture and traditions of the country in terms of textiles makes it unique in comparison to other industries in the country.

- India's textiles industry can produce a wide variety of products suitable for different market segments, both within India and across the world.

- To attract private equity and employ more people, the government introduced various schemes such as the Scheme for Integrated Textile Parks (SITP), Technology Upgradation Fund Scheme (TUFS) and Mega Integrated Textile Region and Apparel (MITRA) Park scheme.

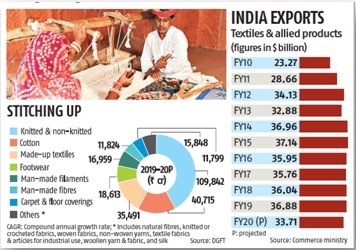

MARKET SIZE:

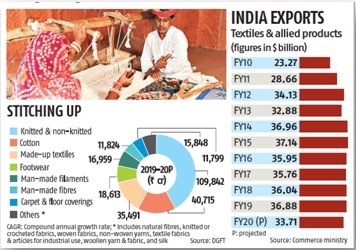

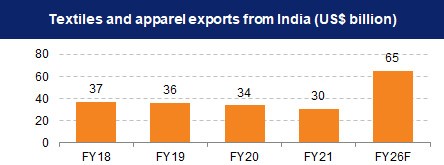

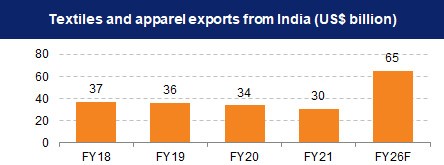

- The Indian textile and apparel industry is expected to grow at 10% CAGR from 2019-20 to reach US$ 190 billion by 2025-26. India has a 4% share of the global trade in textiles and apparel.

- India is the world’s largest producer of cotton. Estimated production stood at 362.18 lakh bales during cotton season 2021-22. Domestic consumption for the 2021-22 cotton season is estimated to be 338 lakh bales.

- Cotton production in India is projected to reach 2 million tonnes (~43 million bales of 170 kg each) by 2030, driven by increasing demand from consumers.

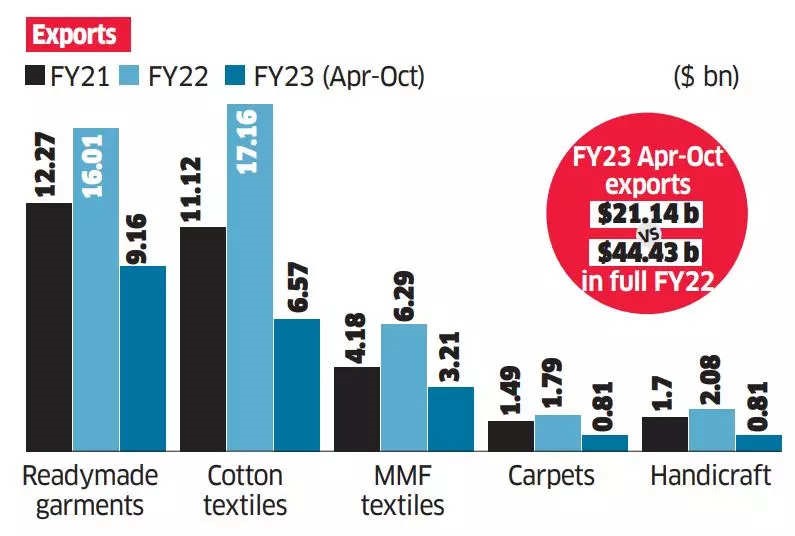

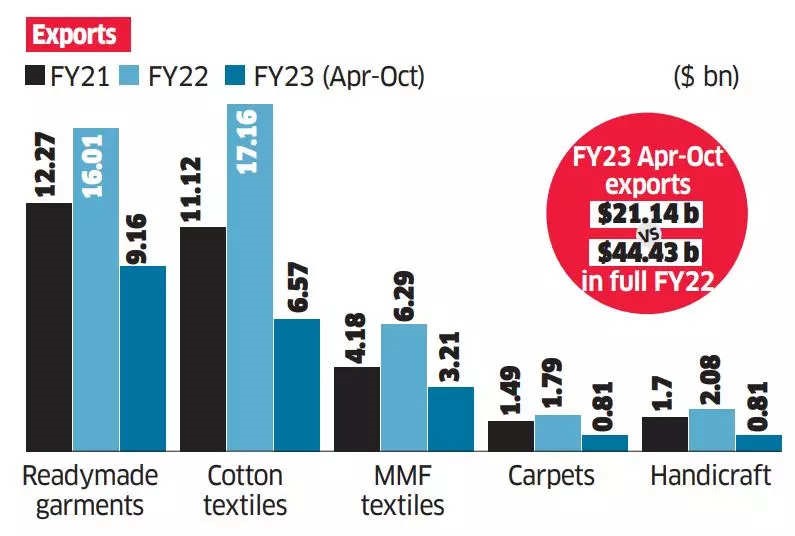

- In FY23, exports of readymade garments (RMG) including accessories stood at US$ 16.2 billion. It is expected to surpass US$ 30 billion by 2027, with an estimated 4.6-4.9% share globally.

- Production of fiber in India reached 2.40 MT in FY21 (till January 2021), while for yarn, the production stood at 4,762 million kgs during the same period.

- Natural fibers are regarded as the backbone of the Indian textile industry, which is expected to grow from US$138 billion to US$195 billion by 2025.

- India’s textile and apparel exports (including handicrafts) stood at US$ 44.4 billion in FY22, a 41% increase YoY. During November in FY23, the total exports of textiles stood at US$ 23.1 billion.

- India’s textile and apparel exports to the US, its single largest market, stood at 27% of the total export value in FY22. Exports of readymade garments including cotton accessories stood at US$ 6.19 billion in FY22.

- India’s textiles industry has around 4.5 crore employed workers including 35.22 lakh handloom workers across the country.

INVESTMENT AND KEY DEVELOPMENT:

- In April 2022, Indo Count Industries bagged the home textile business of GHCL for US$ 74.14 million.

- In March 2022, Reliance Retail Ventures Limited (RRVL) acquired a controlling share of Purple Panda Fashions for US$ 115.8 million

- Sutlej Textiles plans to set up a green field project for 89,184 spindles comprising cotton mélange yarn and PC grey yarn along with a dye house in Jammu & Kashmir with an estimated cost of US$ 111.41 million (Rs. 914 crore).

- Vardhman has established Vardhman ReNova, a cotton recycling facility with a six TPD production capacity. By establishing two new facilities in Madhya Pradesh, the company has also increased its capacity to produce yarn.

- With top-notch technology, the expansion includes over 100,000 spindles in total. This will result in a 75 TPD increase in yarn production capacity.

- The textile ministry has selected 61 companies, including Arvind Limited to enjoy benefits under its US$ 1.3 billion (Rs. 10,683 crores) production-linked incentive (PLI) scheme for the labor-intensive textiles and garment sector.

- The companies have pledged to invest US$ 2.32 billion (Rs 19,077) crore over five years under the scheme, which will lead to an incremental turnover of US$ 22.55 billion (Rs 1.85 trillion) and direct employment generation for 240,000 people.

- Arvind Limited, the largest textile-to-technology conglomerate in India, and PurFi Global LLC, a sustainable technology firm that specializes in rejuvenating textile waste into virgin-grade products, have formed a joint venture to reduce the quantity of textile waste dumped in landfills.

- In November 2022, local weavers in Tuensang in Nagaland were provided 45 days of skill upgrading training, which would equal 315 hours under the SAMARTH programme.

- In 2022-23, the Sardar Vallabhbhai Patel International School of Textiles and Management (SVPISTM) is planning to offer B.Sc. and MBA courses in technical textiles.

.jpg)

Challenges Faced by the Indian Textile and Apparel Industry:

Global Competition:

- Indian textile and apparel manufacturers face intense competition from other countries, particularly low-cost manufacturing hubs like China, Bangladesh, and Vietnam. These countries often have lower labor and production costs.

Labor Issues:

- Labor-intensive operations are common in the textile and apparel sector. Issues related to labor, such as high turnover, labor disputes, and skill shortages, can affect production efficiency and costs.

Technological Obsolescence:

- Many Indian textile mills and manufacturing units use outdated machinery and technology. The lack of modernization hampers productivity and quality, making it challenging to compete globally.

Supply Chain Fragmentation:

- The textile industry involves complex and fragmented supply chains, which can lead to inefficiencies, longer lead times, and difficulties in quality control and product traceability.

Environmental Concerns:

- The textile and apparel industry is known for its environmental impact, including water pollution, chemical usage, and high energy consumption. Meeting sustainability and environmental standards is becoming increasingly important but also costly.

Inconsistent Policy Framework:

- Frequent changes in government policies, particularly related to taxation and export incentives, can create uncertainty for businesses. A stable and predictable policy environment is crucial for long-term planning.

Infrastructure Challenges:

- Inadequate infrastructure, such as inadequate transportation networks, ports, and power supply, can disrupt production and supply chains, increasing costs and lead times.

Access to Finance:

- Small and medium-sized enterprises (SMEs) in the textile and apparel sector often struggle to access affordable financing, limiting their capacity for expansion and modernization.

Significance of the Indian Textile and Apparel Industry:

Employment Generation:

- The textile and apparel sector is one of the largest sources of employment in India, providing livelihoods to millions of people, especially in rural areas. It employs a diverse workforce, including skilled and unskilled labor.

Contribution to GDP:

- The industry contributes significantly to India's Gross Domestic Product (GDP). It encompasses various segments, such as textiles, clothing, and handloom, each making substantial contributions to the national economy.

Export Earnings:

- India is one of the world's largest exporters of textiles and apparel products. It exports a wide range of textiles, including cotton, yarn, fabrics, and garments to various countries. The export revenue earned from these products contributes to the country's foreign exchange reserves.

Diverse Product Range:

- The industry produces a diverse range of textile products, from traditional handloom fabrics to modern, high-value clothing items. This diversity allows India to cater to a wide spectrum of domestic and international consumer preferences.

Cultural Heritage:

- India has a vibrant textile heritage with a long history of traditional handwoven textiles, such as silk sarees, hand-block printed fabrics, and intricate embroidery. These traditions are not only culturally significant but also provide opportunities for skilled artisans.

Value Chain Integration:

- The industry encompasses the entire textile and apparel value chain, including cotton cultivation, spinning, weaving, dyeing, garment manufacturing, and retail. This integration allows for cost-effective production and value addition.

Global Competitiveness:

- Indian textile manufacturers are known for their competitiveness in terms of quality and pricing. The industry's ability to produce a wide range of textiles and garments at different price points makes it globally competitive.

Conclusion

- The future of the Indian textiles industry looks promising, buoyed by strong domestic consumption as well as export demand. India is working on various major initiatives to boost its technical textile industry.

- Owing to the pandemic, the demand for technical textiles in the form of PPE suits and equipment is on the rise. The government is supporting the sector through funding and machinery sponsoring.

- Top players in the sector are achieving sustainability in their products by manufacturing textiles that use natural recyclable materials.

- With consumerism and disposable income on the rise, the retail sector has experienced rapid growth in the past decade with the entry of several international players like Marks & Spencer, Guess and Next into the Indian market.

- The growth in textiles will be driven by growing household income, increasing population and increasing demand in sectors like housing, hospitality, healthcare, etc.

| The technical textiles market for automotive textiles is projected to increase to US$ 3.7 billion by 2027, from US$ 2.4 billion in 2020. Similarly, the industrial textiles market is likely to increase at an 8% CAGR from US$ 2 billion in 2020 to US$ 3.3 billion in 2027. The overall Indian textiles market is expected to be worth more than US$ 209 billion by 2029 |

CITATIONS:

https://www.ibef.org/industry/textiles

https://newsonair.gov.in/News?title=New-Mega-Textile-Park-at-Dhar-district-will-strengthen-Make-in-India-and-will-create-new-job-opportunities%3A-PM-Modi&id=461268

https://apparelresources.com/business-news/trade/indian-textile-industry-will-regain-lost-glory-future-says-textile-minister/

https://www.google.com/url?sa=i&url=https%3A%2F%2Fm.economictimes.com%2Findustry%2Fcons-products%2Fgarments-%2F-textiles%2Fbudget-2023-textile-industry-angles-for-changes-in-import-export-levies%2Farticleshow%2F97101248.cms&psig=AOvVaw3YkqcnT-jstFdeYy0-QrID&ust=1695907220851000&source=images&cd=vfe&opi=89978449&ved=0CBIQjhxqFwoTCIiJ9e3wyoEDFQAAAAAdAAAAABAJ