THE BIG PICTURE: END OF RETRO TAX

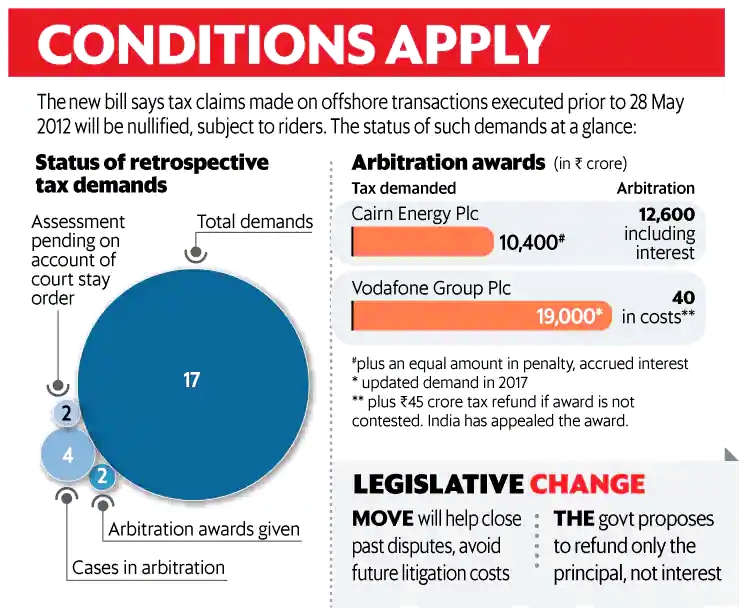

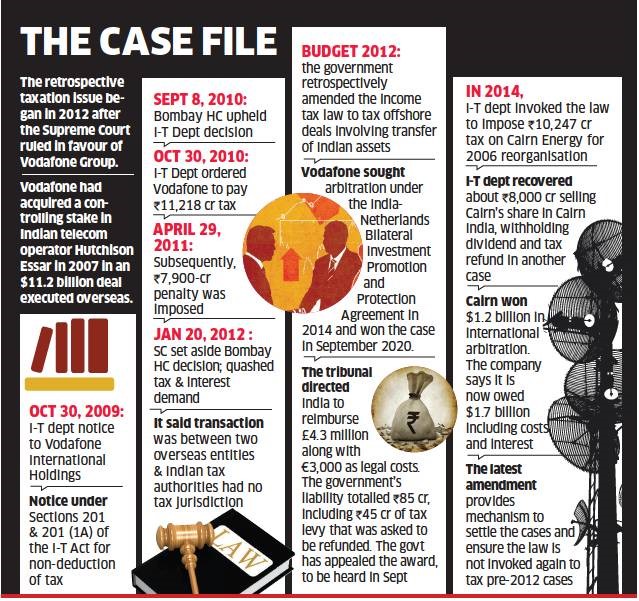

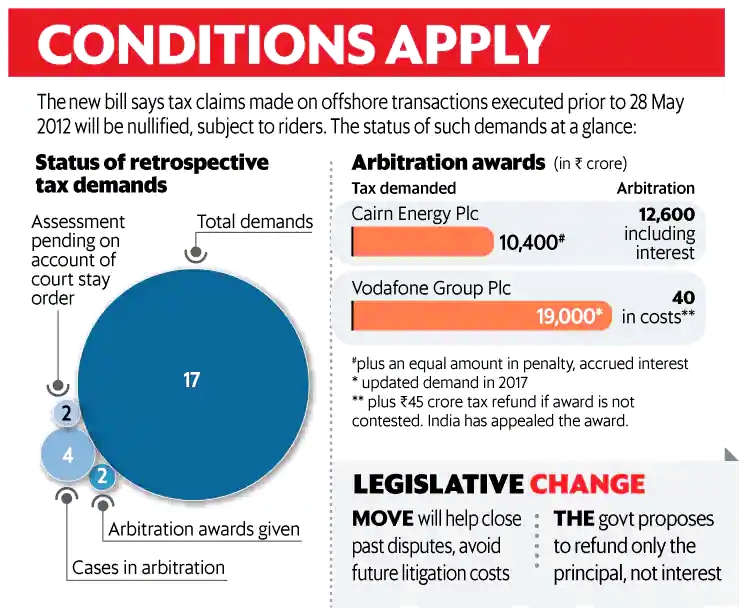

Context: The Taxation Laws (Amendment) Bill, 2021 was introduced in Lok Sabha. Centre also notifies new rules on process to be followed by affected taxpayers.

Key features of the Bill include:

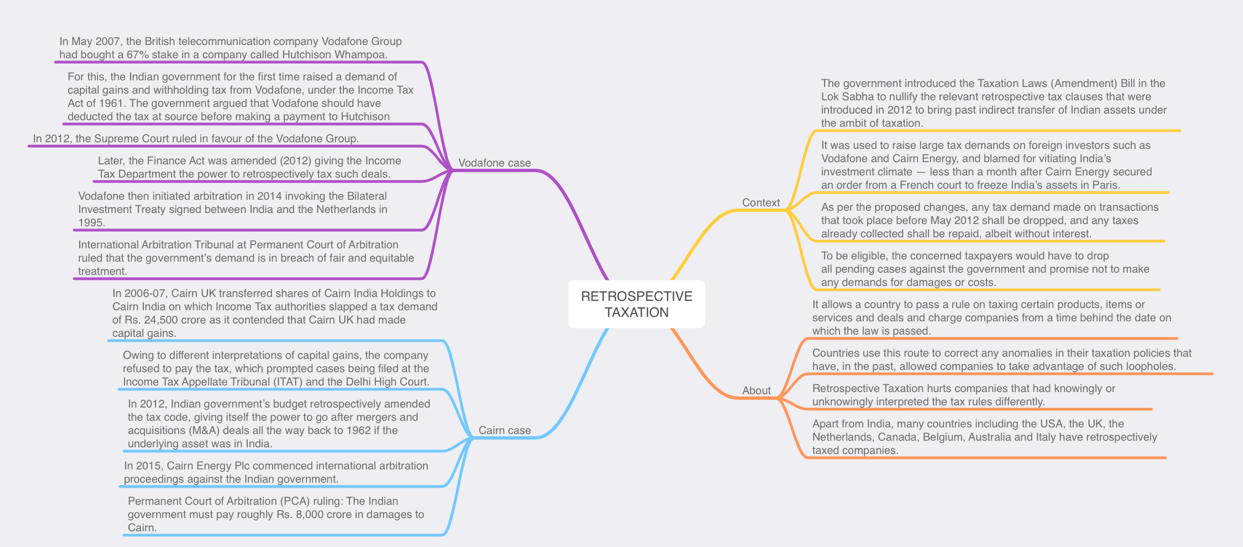

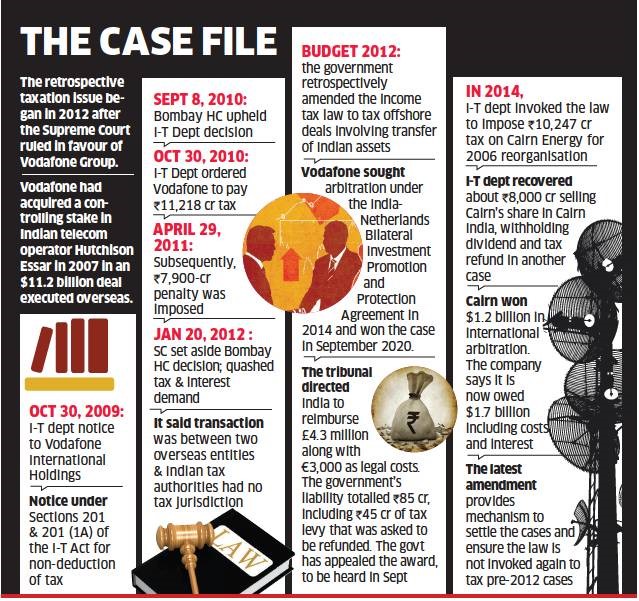

- Under the IT Act 1961, non-residents are required to pay tax on the income accruing through or arising from any business connection, property, asset, or source of income situated in India.

- The amendments made by the 2012 Act clarified that if a company is registered or incorporated outside India, its shares will be deemed to be or have always been situated in India if they derive their value substantially from the assets located in India.

- As a result, the persons who sold such shares of foreign companies before the enactment of the Act (i.e., May 28, 2012) also became liable to pay tax on the income earned from such sale.

- The Bill proposes to nullify this tax liability imposed on such persons provided they fulfil certain conditions. These conditions are:

- if the person has filed an appeal or petition in this regard, it must be withdrawn or the person must submit an undertaking to withdraw it,

- if the person has initiated or given notice for any arbitration, conciliation, or mediation proceedings in this regard, the notices or claims under such proceedings must be withdrawn or the person must submit an undertaking to withdraw them,

- the person must submit an undertaking to waive the right to seek or pursue any remedy or claim in this regard, which may otherwise be available under any law in force or any bilateral agreement, and

- other conditions, as may be prescribed.

- The Bill provides that if a concerned person fulfils the above conditions, all assessment or reassessment orders issued in relation to such tax liability will be deemed to have never been issued.

- Further, if a person becomes eligible for refund after fulfilling these conditions, the amount will be refunded to him, without any interest.

New rules on process to be followed by affected taxpayers:

- The Income-Tax (31st Amendment) Rules, 2021, introduce a new portion pertaining to ‘indirect transfer prior to 28th May, 2012 of assets situated in India’, and lay out the conditions and formats for undertakings to be submitted by all ‘interested parties’ to the tax department in order to settle their tax disputes.

- The affected taxpayers, along with all the interested parties (such as their shareholders, for instance), will have to give up all claims in any ongoing legal proceedings, including arbitration, mediation efforts and attachment proceedings, with an explicit undertaking that such initiatives will not be reopened under any circumstances.

- Firms such as Cairn and Vodafone disputing retrospective tax demands in India will not only have to withdraw all legal proceedings and waive all rights to claim costs or attach Indian assets but also indemnify the government on costs and liabilities from any action pursued by other interested parties in future.

- I-T Rules also require the taxpayer and all the interested parties to issue a public notice or press release explicitly stating that ongoing claims against these tax demands ‘no longer subsist’ and they have signed an indemnity undertaking.

- The affected taxpayers will have to furnish these undertakings within 45 days, following which the Income Tax Department is expected to process the dispute settlement in another 60 days and initiate tax refunds where necessary.

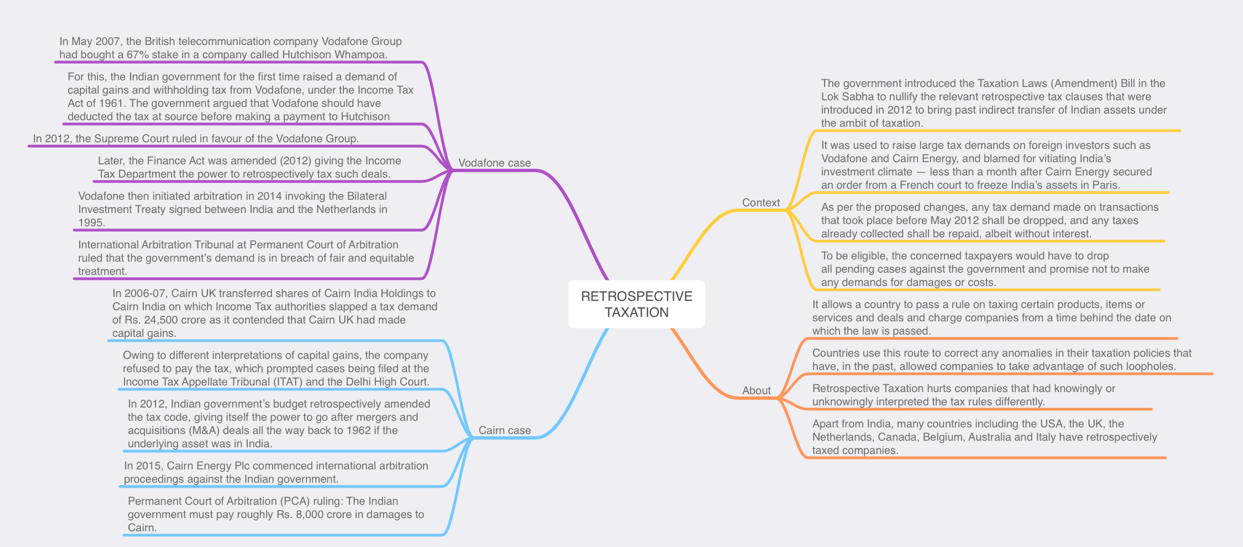

Retrospective Taxation:

- It allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Countries use this route to correct any anomalies in their taxation policies that have, in the past, allowed companies to take advantage of such loopholes.

- Retrospective Taxation hurts companies that had knowingly or unknowingly interpreted the tax rules differently.

- Apart from India, many countries including the USA, the UK, the Netherlands, Canada, Belgium, Australia and Italy have retrospectively taxed companies.

- Capital Gain is the gain or profit comes under the category of ‘income’. Hence, the capital gain tax will be required to be paid for that amount in the year in which the transfer of the capital asset takes place. This is called the capital gains tax, which can be both short-term or long-term.

Negative Impacts of Retrospective Taxation:

- The Retrospective Tax removes the time limit provided under Section 149 of the Income Tax Act and makes taxes uncertain.

- Hurts Private investors/companies by introducing new demands which can spoil the business planning and expectations.

- Being a signatory to the Convention on the Recognition and Enforcement of Foreign Arbitral Awards, the companies can enforce foreign and non-domestic arbitral awards enforced against Indian assets in numerous jurisdictions around the world.

- It damages India’s reputation with reduced FDI inflows due to reduced confidence of potential investors, reduced effectiveness of special initiatives to attract investment like IFSC-GIFT city.

- Leads to a Vicious Cycle of low investment and low tax revenue along with low growth and reduced employment opportunities.

Significance of curbing retrospective taxation:

- The amendment while maintaining the “sovereign right to taxation”, also provides a reasonable opportunity to companies to resolve the issue.

- It will create a sense of credibility in the industry for partnering with the Government of India in resolving an issue.

- It is a welcome move for foreign investors, as it could provide them more clarity regarding all the prospective or already existing investments and it will directly result in attracting more foreign investments.

- Quick recovery of the economy is the need of the hour.

- It is in line with the government’s commitment to creating a non-adversarial tax environment.

- It is a good opportunity for the affected taxpayers to close all the past disputes and avoid future litigation costs

- The bill is also an opportunity for addressing some stressed sectors like the telecom and oil exploration sectors.

- The amendment also balances two different objectives.

- The policy of the government to have a predictable tax regime.

- India’s concern towards the adjudication of Indian tax law happening through foreign tribunals.

Way Forward:

- India needs to demonstrate greater clarity and consistency in policy across the board to fix its broken credibility.

- Establish a business friendly climate.

- India needs to craft meaningful and clear dispute resolution mechanisms in cross-border transactions to prevent the disputes from going to international courts, and save the cost and time expenditure.

- India is in need of a better Arbitration Mechanism especially when it today stands at a juncture of quick economic recovery and the COVID-19 pandemic.

https://youtu.be/Cudb6PTIOlM

https://indianexpress.com/article/india/retro-tax-withdrawal-bill-lok-sabha-cairn-vodafone-7440105/

https://www.indiatoday.in/magazine/up-front/story/20210823-retrospective-taxation-biting-the-bullet-1841521-2021-08-16

https://www.deccanherald.com/business/explained-what-is-retrospective-tax-and-why-the-centre-buried-it-1016814.html

https://prsindia.org/billtrack/the-taxation-laws-amendment-bill-2021

https://economictimes.indiatimes.com/news/economy/policy/retrospective-tax-explained-and-why-removing-it-lays-to-rest-indias-biggest-tax-blunder/videoshow/85587623.cms?from=mdr

https://cleartax.in/s/retrospective-tax

https://www.business-standard.com/article/economy-policy/govt-buries-retrospective-tax-introduces-bill-to-amend-income-tax-act-121080600051_1.html

https://indianexpress.com/article/india/retro-tax-withdrawal-bill-lok-sabha-cairn-vodafone-7440105/