THE BIG PICTURE BASED ON GLOBAL CORPORATE TAX AND INDIA

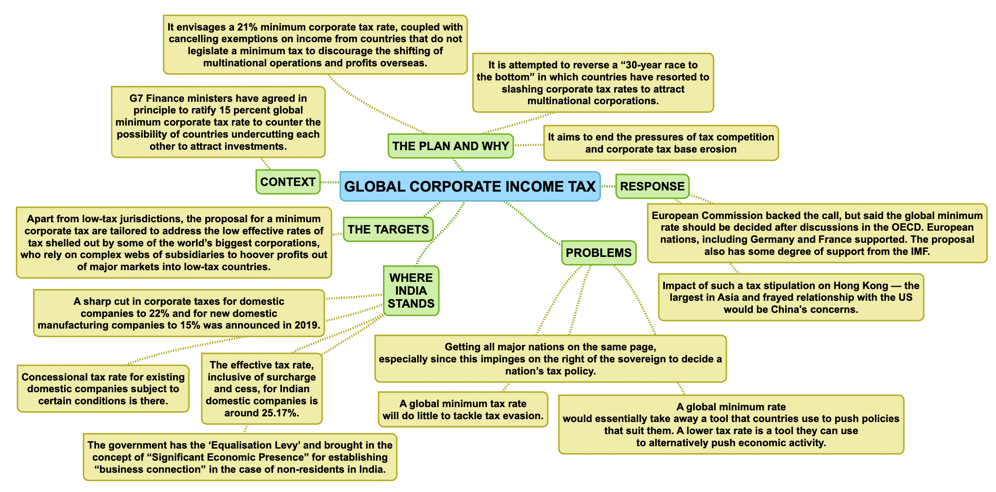

CONTEXT:

HOW WOULD THE NEW TAX WORK?

ISSUES:

WHERE DOES INDIA STAND?

WAY FORWARD:

SUMMARY:

SOURCES:

https://indianexpress.com/article/explained/explained-bidens-radical-tax-proposal-7266899/

© 2025 iasgyan. All right reserved