Copyright infringement not intended

Source: The Hindu

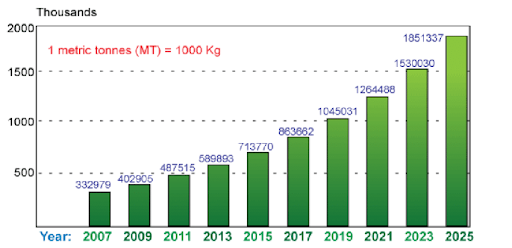

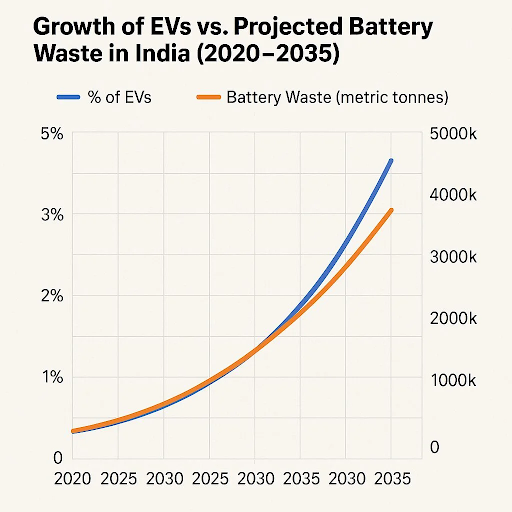

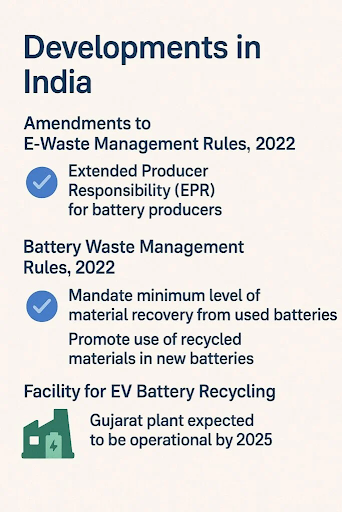

India's aim of decarbonization and Net Zero by 2070 depends on rapid electrification, primarily through EV and BESS uptake. Due to exponential battery garbage growth, electrification is threatening the environment.

E-waste refers to any abandoned electrical or electronic equipment. This covers both working and broken things that are discarded or donated to a charity reseller. If an item does not sell in a store, it is frequently discarded. E-waste is especially hazardous because of the poisonous compounds that naturally leach from the metals therein when buried.

Copyright infringement not intended

Source: ResearchGate

Copyright infringement not intended

Source: Amulya Charan

Copyright infringement not intended

Source: Amulya Charan

|

Practice Question Q. Discuss the key issues in battery waste management in India. Suggest measures to ensure sustainable recycling to promote the circular economy. |

© 2026 iasgyan. All right reserved