Copyright infringement not intended

Source: Political Science Solution

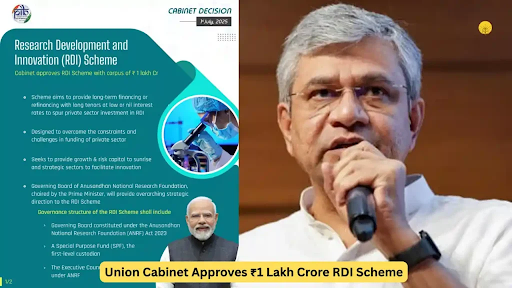

The Union Cabinet, chaired by India's Prime Minister, recently authorized the Research Development and Innovation (RDI) Scheme with a capital of Rs. 1 lakh crore.

Targeting Private Sector Participation:

Creation of Special Purpose Fund:

Role of ANRF:

Low-Interest Loans:

Single-Window Clearance Mechanism:

Academic-Industrial Integration:

To bridge India’s low R&D investment (4.93%), the private sector must take proactive steps:

|

Practice Question Q. Analyse in the context of the recently launched ₹1-lakh crore Research Development and Innovation (RDI) scheme. |

© 2026 iasgyan. All right reserved