Copyright infringement not intended

Picture Courtesy: THE HINDU

Context

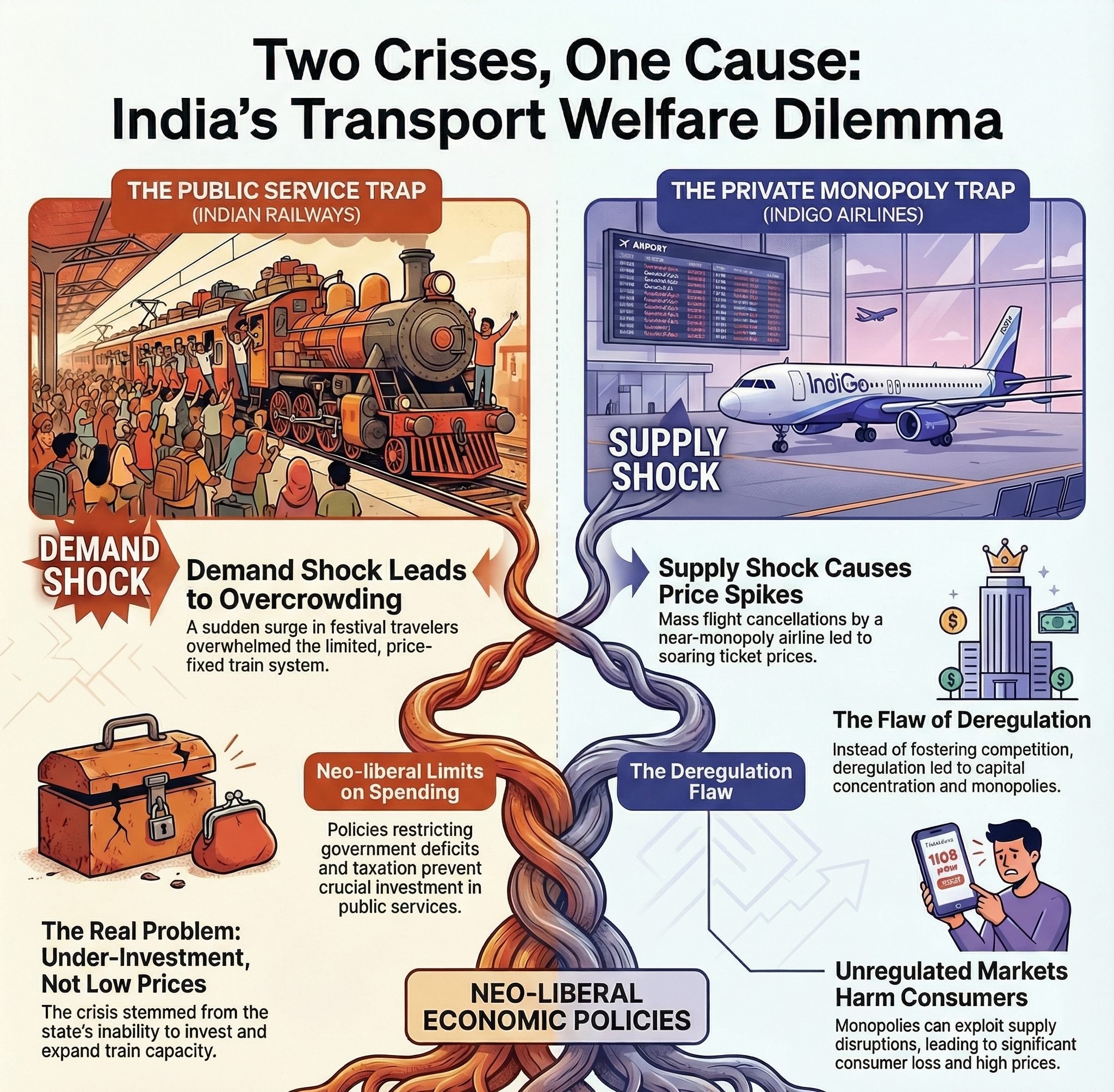

Recent transport crises show that cheap fares without adequate capacity create hidden costs for citizens and the economy, while deregulation without competition leads to exploitation and volatility.

Recent crises across railway, aviation, and maritime sectors, though triggered by different events, are not isolated incidents.

They are symptoms of deep-rooted structural problems, including systemic under-investment, flawed market design that encourage monopolies, weak regulatory oversight, and a lack of integrated risk management.

These failures expose vulnerabilities in Indian transport architecture, impacting everyone from migrant workers to international exporters.

Indian Railways: The Festive Rush Crisis

Trigger: A predictable, massive surge in demand during the annual festival, with millions of migrant workers travelling to their home states.

Cause: Policy of maintaining politically popular low fares without a corresponding increase in investment to expand capacity.

Impact: Extreme overcrowding led to inhumane and unsafe travel conditions. This crisis highlights how the state transfers hidden costs—such as loss of time, dignity, and physical safety—onto its most vulnerable citizens.

Civil Aviation: The Perils of Market Concentration

Trigger: Implementation of revised, safety-oriented Flight Duty Time Limitations (FDTL) rules by the Directorate General of Civil Aviation (DGCA), aimed at reducing pilot fatigue.

Cause: Poor workforce planning by the largest airline, IndiGo, despite months of notice. The operational failure caused a systemic shock in a highly concentrated duopoly market. IndiGo holds a dominant domestic share of 61.7%, and its combined share with the Air India group exceeds 90%.

Impact: Mass flight cancellations. Due to weak competition and regulatory oversight in a deregulated environment, airlines used algorithm-driven dynamic pricing, leading to exorbitant fare surges and a clear failure of consumer protection.

Maritime Shipping: Geopolitical Shocks and External Vulnerability

Maritime Shipping: Geopolitical Shocks and External Vulnerability

Trigger: Geopolitical instability and attacks on commercial vessels in the Red Sea, forcing global shipping lines to divert from the vital Suez Canal route.

Cause: India is heavily dependent on the Suez Canal for trade with Europe and the US, and relies critically on foreign-flagged ships. Over 90% of India's trade volume uses foreign vessels, limiting its control over freight costs and logistics.

Impact: Rerouting via the Cape of Good Hope added 10-15 days to transit, making overall freight costly. This hurt exports' competitiveness and revealed a major strategic vulnerability.

Core Structural Problems in Transport Sector

Core Structural Problems in Transport Sector

Hidden Costs of "Cheap" Public Services

Subsidies without adequate investment harm the poor. Low ticket prices stop railways from generating the resources needed for capacity expansion. This policy imposes non-monetary burdens:

True public welfare requires a service that is reliable, safe, and dignified, not just nominally cheap.

Market Failure in Deregulated Sectors

Deregulation and market forces only improve consumer welfare with strong competition and robust regulation—conditions absent in India.

Governance and Regulatory Gaps

Recent crises show a failure of anticipatory governance; authorities react to problems instead of proactively building resilient systems.

|

Stakeholder |

Impact |

Implication |

|

Migrant Workers |

Endured unsafe, undignified travel; many were forced to pay exorbitant prices. |

The most vulnerable are the worst hit by failures in public service planning. |

|

Middle-Class Travellers |

Faced sudden, exorbitant fare hikes and last-minute cancellations. |

Deregulation without consumer protection shifts corporate failure risks onto consumers. |

|

Exporters & MSMEs |

Suffered higher freight costs, shipment delays, and loss of orders, eroding global competitiveness. |

Logistics bottlenecks are a direct threat to India’s export ambitions and economic growth. |

|

Overall Economy |

Experienced inflationary pressures from higher logistics costs and supply chain disruptions. |

A non-resilient transport sector acts as a direct brake on sustainable economic growth. |

Integrated Planning and Governance

Strengthen the PM GatiShakti National Master Plan to break down ministerial silos.

Fully operationalize the Unified Logistics Interface Platform (ULIP) for real-time tracking of passenger and freight flows to enable data-driven responses to bottlenecks.

Aligning Prices with Investment

Railways: Move from across-the-board subsidies to targeted financial support for vulnerable groups via Direct Benefit Transfer (DBT). This approach, hinted at in the Bibek Debroy Committee Report (2015), would allow fares to be linked to service quality, generating resources for capacity expansion.

Aviation: Implement smart regulation, including caps on surge pricing during emergencies, and enforce mandatory, time-bound compensation for cancellations caused by airline mismanagement.

Strengthening Competition

The Competition Commission of India (CCI) must proactively monitor and address market concentration in aviation.

Encourage new players through policies for a competitive, resilient market, preventing one dominant airline's failure from crippling the system.

Investing in Strategic Self-Reliance

Build redundancy by investing in alternate trade routes like the International North-South Transport Corridor (INSTC) and the India-Middle East-Europe Economic Corridor (IMEC).

Promote the expansion of an Indian-flagged shipping fleet and invest in domestic container manufacturing, as mentioned in the Maritime India Vision 2030, to reduce external dependency.

The recent transport crises are a wake-up call, reflecting state capacity, market fairness, and the true meaning of inclusive growth, requiring bold, systemic reforms in planning, pricing, and regulation to achieve sustainable and equitable development.

Source: THE HINDU

|

PRACTICE QUESTION Q. Deregulation without robust, pre-emptive regulatory oversight can be detrimental to consumer welfare. Critically analyze. 150 words |

The Fiscal Responsibility and Budget Management (FRBM) Act imposes strict targets to control the government's fiscal deficit and debt-to-GDP ratio. While aimed at ensuring macroeconomic stability, these rigid constraints can limit the government's ability to borrow and fund essential long-term capital expenditure in sectors like railways.

Market concentration refers to a situation where a small number of firms control a large share of the market. In Indian aviation, IndiGo and the Air India group control over 91% of the market. When IndiGo (with a 66% share) cancelled flights, other airlines lacked the capacity to absorb the stranded passengers, leading to a massive, sector-wide surge in airfares and harming consumers.

The Competition Commission of India (CCI) is a statutory body responsible for enforcing the Competition Act, 2002. Its primary role is to prevent anti-competitive practices, such as the abuse of dominant market positions and cartels, to ensure fair competition and protect consumer interests.

© 2026 iasgyan. All right reserved