Copyright infringement not intended

Picture Courtesy: THE HINDU

Context

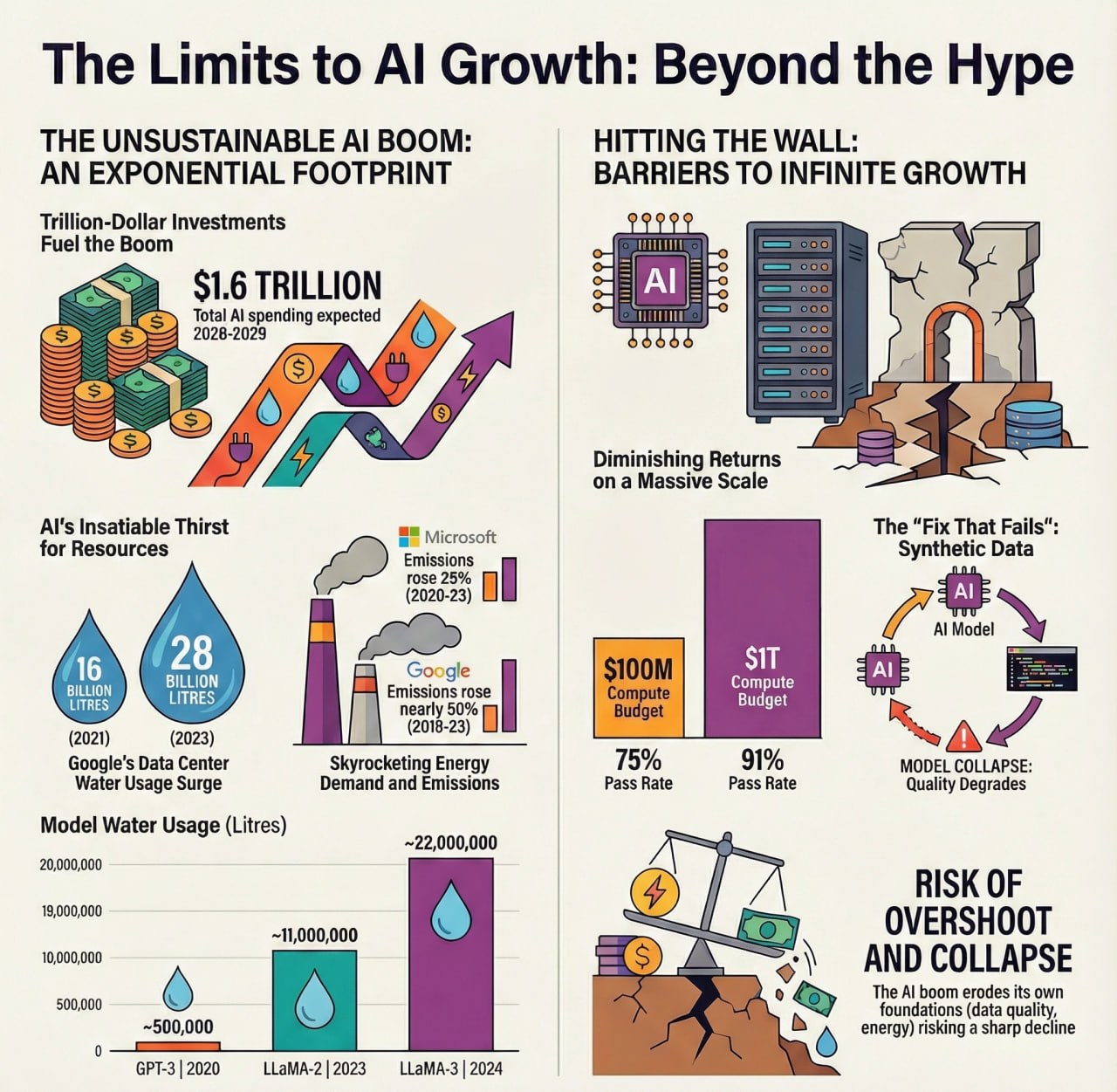

The global AI surge, driving high market valuations, raises sustainability concerns: is it a technological revolution or a speculative bubble, similar to the dot-com era?

|

Read all about: Skilling for AI Readiness (SOAR) Program l Artificial Intelligence In Governance l Artificial Intelligence (AI) in Military Operations l AI transforming teaching and learning |

An "AI bubble" is a feared financial scenario where AI company valuations become wildly inflated, far surpassing their actual worth, fueled by speculation and hype rather than real revenue or proven models.

Potential Indicators of an AI Bubble

Stretched Valuations: AI leaders like Nvidia and Arm are trading at price above the market average, indicating that much of their future growth is already "priced in".

Speculative Investing: A high volume of speculative investments, including the use of debt to finance large capital expenditures, suggests a focus on short-term gains rather than long-term fundamentals.

Lack of Clear ROI: Revenue potential from many AI applications remains largely projected into the future, creating a gap between massive spending and proven returns.

Market Concentration: A large percentage of recent U.S. stock market gains are limited to a handful of AI companies, increasing concentration risk.

AI Boom vs Dot-Com Bubble

AI Boom vs Dot-Com Bubble

The current AI boom and the late 1990s dot-com bubble share similarities, like transformative technology promises and huge investment, but also key differences.

|

Feature |

Dot-Com Bubble (Late 1990s) |

Current AI Boom (2020s) |

|

Business Models & Profitability |

Dominated by startups with little to no revenue or profits. The focus was on "growth over profits" and gaining market share. |

Led by established, highly profitable tech giants (e.g., Microsoft, Google, NVIDIA) with proven business models and substantial cash flows. |

|

Valuation Metrics |

Traditional valuation metrics were often ignored. Companies went public based on hype rather than financial performance. |

Valuations are high, but often backed by strong earnings growth and revenue. However, many AI startups still lack clear revenue models. |

|

Nature of Investment |

Speculative investment in websites and digital concepts with minimal physical assets. |

Massive real investment in tangible, capital-intensive assets like data centers, semiconductor manufacturing, and physical AI infrastructure. |

|

Investor Base |

Fueled by abundant venture capital and widespread retail investor speculation in Initial Public Offerings (IPOs). |

Dominated by large institutional investors, corporate venture arms, and tech giants, although retail participation is also present. |

AI investment remains heavily dominated by a small set of firms. If these players underperform or cut back spending:

Way Forward

Way Forward

AI is a genuine technological shift with long-term potential for productivity and growth. However, excessive hype and inflated valuations risk a speculative correction, which is more likely to eliminate unsustainable firms than derail AI's development.

The real challenge lies in aligning innovation with credible business models, prudent regulation, skilled human capital, and inclusive deployment.

AI’s lasting impact will be determined not by market exuberance, but by its capacity to generate durable, broad-based, and productivity-enhancing growth.

Source: THE HINDU

|

PRACTICE QUESTION Q. The current global AI boom exhibits characteristics of both a technological revolution and a speculative bubble. Critically analyze. 250 words |

The IndiaAI Mission is a comprehensive national program approved with a budget outlay of ₹10,371 crore over five years. Its primary goal is to establish a robust and inclusive AI ecosystem in India by focusing on seven key pillars: compute capacity, innovation centers, datasets, application development, future skills, startup financing, and safe AI.

AI Kosha is India's national dataset platform designed to act as a centralized repository. It provides high-quality, non-personal datasets from both government and private sectors, enabling the training of AI models on diverse Indian languages and cultural contexts.

Launched in late 2025, YUVA AI for ALL is a free national program designed to provide basic AI literacy to the youth. It covers AI fundamentals, safe and responsible usage, and showcases real-world Indian use cases to prepare the next generation for an AI-driven workforce.

© 2026 iasgyan. All right reserved