Copyright infringement not intended

Picture Courtesy: THE HINDU

Context

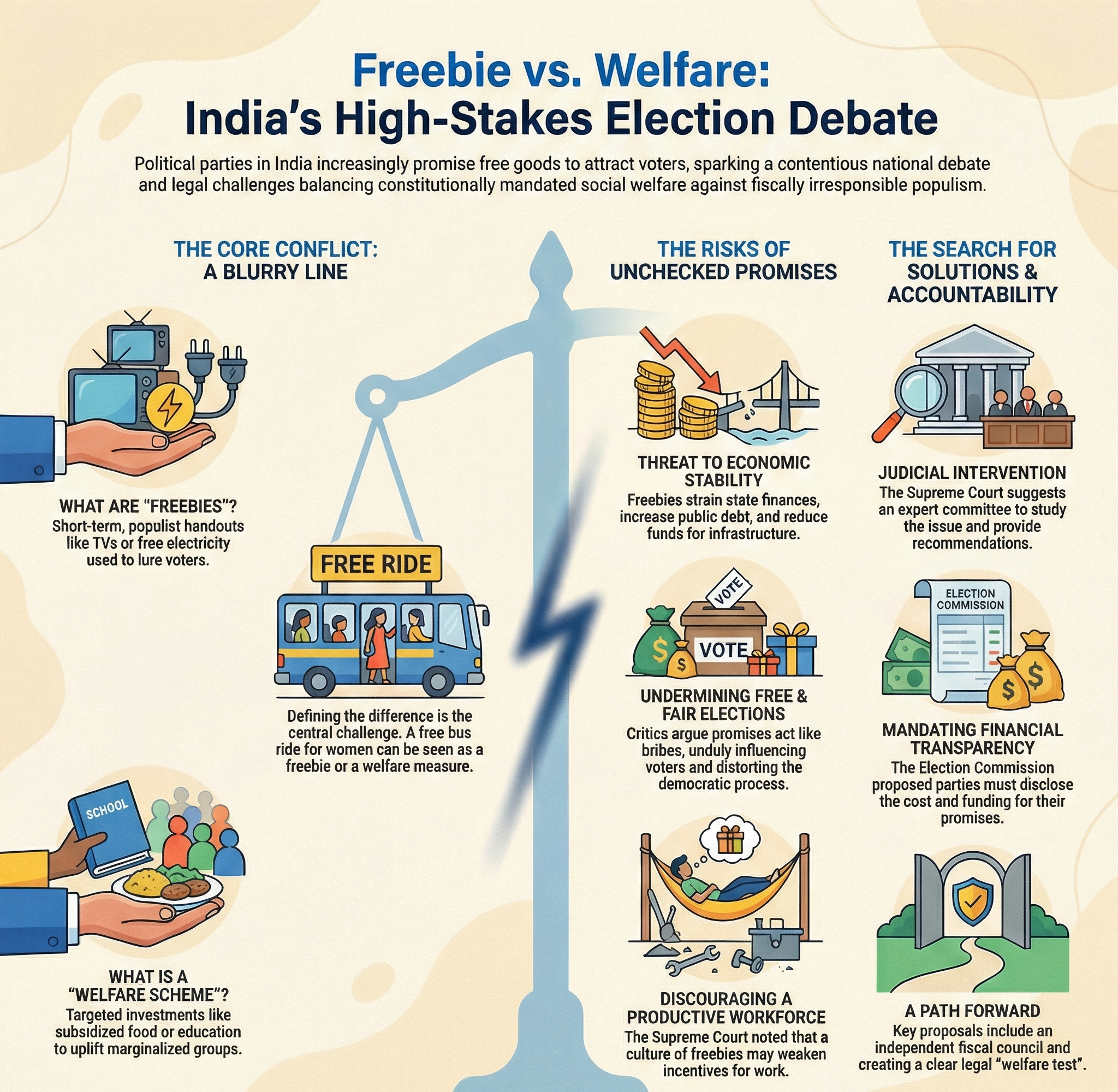

The Supreme Court clarified the "freebies" debate, distinguishing between legitimate public welfare and damaging, voter-driven distributions that threaten state finances and fair elections.

|

Read all about: BALANCING EMPOWERMENT WITH ECONOMICS l FREEBIES AND WELFARE SCHEMES |

What is the difference between Welfare and Freebies?

In January 2026, the Supreme Court established a clearer legal and economic distinction between "freebies" and "welfare," emphasizing that mass distribution of state funds to individuals is different from investing in public welfare.

|

Feature |

Electoral 'Freebies' |

Public Welfare Investments |

|

Primary Goal |

Immediate electoral gain; populist appeal. |

Long-term human and economic development. |

|

Nature of Goods |

Often non-merit goods, promoting private consumption without significant positive externalities. |

Primarily merit goods (e.g., education, health) and public goods (e.g., infrastructure) with strong positive externalities. |

|

Economic Impact |

Can distort markets, create a dependency culture, and lead to resource misallocation. They are consumption-oriented. |

Enhances productivity, creates assets, forms human capital, and boosts sustainable economic growth. It is investment-oriented. |

|

Fiscal Impact |

Strains public finances, increases public debt, and crowds out essential capital expenditure. |

May require significant initial outlay but generates future tax revenue and reduces long-term social costs. |

|

Beneficiary Outcome |

Creates passive recipients and can disincentivize work. |

Empowers citizens, making them self-reliant and productive members of the economy. |

|

Examples |

Distribution of non-essential consumer goods (laptops, grinders), universal loan waivers, and untargeted electricity subsidies. |

Investments in public schools and hospitals, rural roads (PMGSY), skill development programs, and targeted health insurance (Ayushman Bharat). |

Fiscal Stress

Many states have a high debt-to-GSDP ratio, partly driven by populist spending. For example, Punjab's debt-to-GSDP ratio was projected to be over 47% for 2023-24, one of the highest in the country. (Source: RBI)

Market Distortion

Free electricity for farmers leads to over-extraction of groundwater and inefficient agricultural practices, creating long-term ecological and economic problems.

Crowding Out Capital Expenditure

When a major portion of the budget is allocated to populist schemes, spending on infrastructure like roads, ports, and power plants is reduced, hindering long-term growth.

Inflationary Pressure

Widespread cash handouts increase demand without increase in supply, leading to inflation.

Erosion of Credit Culture

Unconditional loan waivers can harm the financial discipline of borrowers and the health of the banking sector.

Human Capital Formation

Schemes like the Mid-Day Meal Scheme (now PM-POSHAN) have improved school attendance and nutrition, creating a healthier and better-educated future workforce.

Poverty Alleviation

The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) provides a social safety net and creates durable rural assets. In FY 2024-25, it generated over 2.9 billion person-days of work. (Source: MGNREGA Portal)

Enhanced Productivity

Investments in infrastructure, such as the Pradhan Mantri Gram Sadak Yojana (PMGSY), have improved rural connectivity, boosting agricultural income and access to markets.

Improved Health Outcomes

The Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PM-JAY) provides health coverage to over 55 crore beneficiaries, reducing out-of-pocket expenditure and improving access to healthcare (Source: National Health Authority).

The Indian Constitution and various institutions provide a framework for balancing welfare with fiscal responsibility, although its enforcement remains a challenge.

Directive Principles of State Policy (DPSP)

Articles 38, 39, and 41 of the Constitution direct the state to secure a social order for the promotion of the welfare of the people. While these are not legally enforceable, they form the moral and political foundation for welfare policies.

Supreme Court's Stance

The Supreme Court has repeatedly expressed concern over irrational freebies, noting that they can lead to economic disaster. It has suggested the formation of an expert body to examine the issue and provide recommendations.

Election Commission of India (ECI)

The ECI's Model Code of Conduct requires political parties to provide a rationale for their poll promises and explain how they will be financed, but its powers to enforce this are limited.

Finance Commission

The Finance Commission recommends the distribution of tax revenues between the Centre and states, and the 16th Finance Commission is being urged to consider states' fiscal discipline in its recommendations.

Way Forward

Way Forward

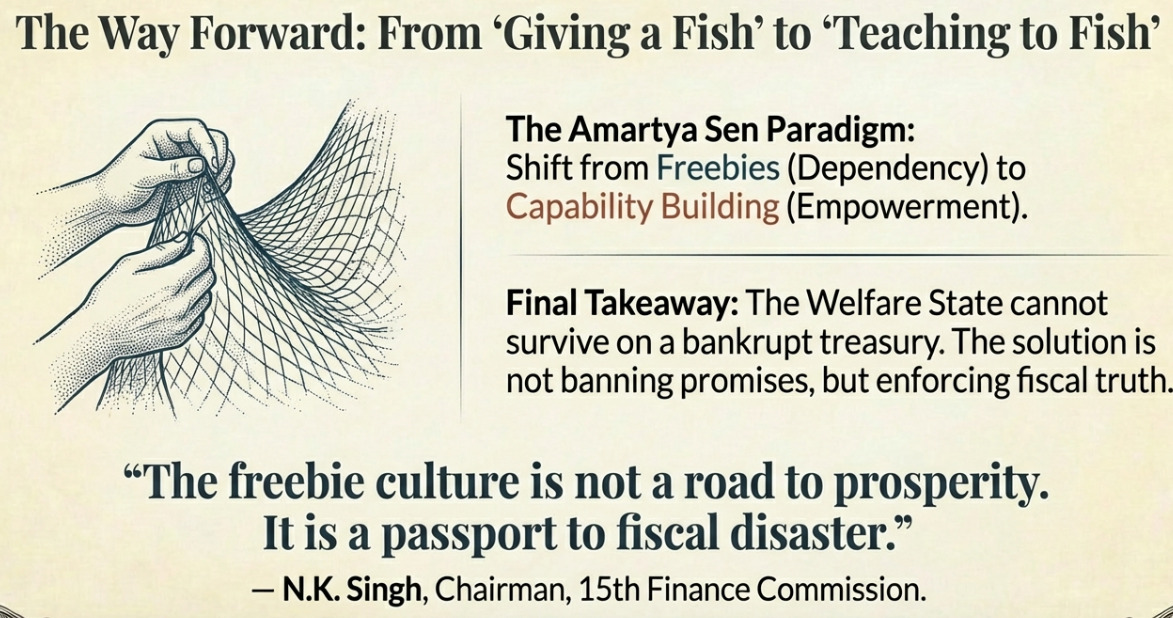

Balancing the needs of the vulnerable with fiscal sustainability requires a multi-pronged approach focused on empowerment and accountability.

Clear Distinction and Criteria

Policymakers must adopt a framework to differentiate between welfare and freebies based on criteria like asset creation, productivity enhancement, and long-term empowerment.

Strengthening the FRBM Act

The Fiscal Responsibility and Budget Management (FRBM) Act needs to be strengthened at both the central and state levels with clear, enforceable penalties for non-compliance.

Independent Fiscal Councils

Establishing an independent fiscal council to review the budget promises of governments and political parties can bring transparency and hold them accountable for their financial implications.

Focus on Outcome-Based Budgeting

Shifting focus from mere allocation of funds to measuring the tangible outcomes of schemes can ensure that money is spent effectively.

Promoting Financial Literacy

An informed electorate that understands the long-term economic consequences of populist promises is the strongest check against unsustainable freebie culture.

Targeted Delivery through DBT

Leveraging technology like the Jan Dhan-Aadhaar-Mobile (JAM) trinity for Direct Benefit Transfers (DBT) can ensure that welfare reaches the intended beneficiaries efficiently, plugging leakages.

Learn from Global Best Practice

Brazil's Bolsa Família program is a globally acclaimed Conditional Cash Transfer (CCT) scheme that links financial aid for poor families to mandatory school attendance and vaccinations, effectively reducing poverty and inequality by investing in health and education.

Conclusion

Conclusion

The focus must be on long-term empowerment, fiscal sustainability, and strengthening human capabilities, moving from a culture of dependency to one of dignity and self-reliance.

Source: THE HINDU

|

PRACTICE QUESTION Q. "The distinction between 'irrational freebies' and 'welfare schemes' is crucial for maintaining fiscal discipline and democratic integrity." 150 words |

Welfare schemes and "freebies" differ fundamentally in public spending. A welfare scheme is a sustained, long-term investment in human capital (e.g., public health, education, MGNREGA), aimed at socio-economic progress. A 'freebie' is a short-term, populist distribution of non-merit goods (e.g., electronics, loan waivers), intended to secure immediate votes and lacking a sustainable financial plan.

Offering freebies burdens state finances, escalating debt and redirecting resources from crucial long-term capital investments in areas such as infrastructure, health, and education, a practice the 15th Finance Commission's Chairman, N. K. Singh, warned could lead to a "fiscal disaster."

Subsidies are classified as 'merit' or 'non-merit.' Merit subsidies, such as PDS and MGNREGA, are vital for poverty reduction and human development. Non-merit subsidies, or "distortive freebies," provide only fleeting benefits, fail to improve productive capacity, and harm the economy.

© 2026 iasgyan. All right reserved