Description

Copyright infringement not intended

In News

- The International Monetary Fund (IMF) has termed the Indian Governments’ Direct Benefit Transfer (DBT) scheme as the 'logistical marvel'.

- IMF's Deputy Director of the Fiscal Affairs Department, Paolo Mauro said that India's DBT scheme is quite impressive.

- He highlighted that the DBT programme helps people who are at low-income levels, specifically women and farmers.

- IMF's chief economist Pierre-Olivier Gourinchas mentioned that India has emerged as a bright light at a time when the world is facing a potential recession.

- He stated that India needs some key structural reforms to reach the ambitious target of a 10 trillion dollar economy.

Direct Benefit Transfer

- Direct Benefit Transfer (DBT) is the process of directly transferring the subsidy amount and making other transfers directly into the account of beneficiaries.

- In this context, the transfer can be defined as the payment that the government makes directly to the beneficiary without receiving any returns.

- Some examples of transfers are scholarships and subsidies.

- The Union Government introduced Direct Benefit Transfer (DBT) in 2013.

- The main aim was to improve the Government's delivery system and redesign the current procedure in welfare schemes by making the flow of funds and information faster, and more secure, and reducing the number of frauds.

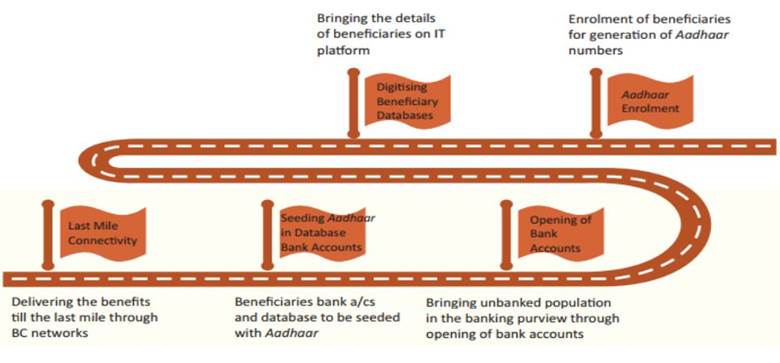

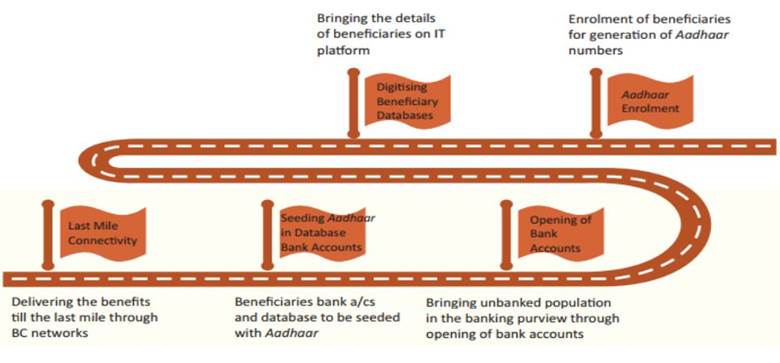

- DBT brings about accountability, transparency, effectiveness, and efficiency in the Government of India system. The DBT enablers are Jan Dhan, Aadhaar, and Mobile (JAM); RBI’s Business Correspondents (BC) Infrastructure; Payments Bank; Mobile Bank etc.

Pre-Requisites for DBT

Benefits of the DBT scheme

- The DBT scheme prevents corruption. The Government sends the funds straight to the beneficiaries’ accounts, which removes the possibility of fraud through a middleman.

- The beneficiaries can be recognized with the use of their Aadhaar number. Because Aadhaar is a universal ID, the Government can easily verify the beneficiaries using their Aadhaar details.

- DBT promotes accountability in subsidy distribution. As a result, it aids in the elimination of inconsistency and delay in payments.

- DBT aids in the distribution of subsidies to deserving applicants living below the poverty level. It helps the Government reach out to the intended beneficiaries with ease.

- The scheme eliminates pilferage in the distribution of money and reduces the misuse of public funds.

- DBT is a powerful transaction and settlement technology that works with multiple organizations.

- DBT has proven to be an effective technique for connecting with people to distribute relief funds.

Present Status of Union Government subsidy and to what extent is it under DBT?

- In the fiscal year 2021-22 Union Budget, the Centre provided around Rs 3.70 lakh crore (over 10% of the total budget size of Rs 35.83 lakh crore) for 38 types of subsidies, of which food, fertilizer and fuel are the important ones.

- All the subsidies are part of DBT. Also, not only subsidies but different types of scholarships/ stipends and cash assistance are covered under DBT.

- 312 schemes, including key subsidies being run by 54 Central Government Ministries and Departments, are part of DBT.

- Since 2014, more than 9 lakh Crore rupees have been transferred through Direct Benefit Transfer (DBT).

- The Public Distribution Scheme (PDS) saw the maximum gains with the deletion of 3.99 crore duplicate and fake/ non-existent ration cards (between 2013 and 2020) and that resulted in an estimated saving of over Rs 1 lakh crore.

- MGNREGS saw 10% savings on wages on account of the deletion of duplicate, fake/ non-existent, ineligible beneficiaries. That apart, 4.11 crore duplicate, fake/ non-existent, inactive LPG connections have been eliminated.

In the 2014-15 edition of the Economic Survey, the chapter titled, ‘Wiping every tear from every eye: The JAM Number Trinity Solution’, used the term leakage to describe subsidized goods that do not reach households. Leakages, it said, not only have the direct costs of wastage, but also the opportunity cost of how the government could otherwise have deployed those fiscal resources. Converting all subsidies into direct benefit transfers is therefore a laudable goal of government policy.

For More Information: https://www.iasgyan.in/daily-current-affairs/international-monetary-fund-imf

https://newsonair.gov.in/News?title=IMF-terms-India%26%2339%3bs-Direct-Benefit-Transfer-scheme%2c-as-a-%26%2339%3blogistical-marvel%26%2339%3b&id=449287

https://t.me/+hJqMV1O0se03Njk9