The word tax comes from a Latin word “taxo”. A tax is a compulsory fee or financial charge levied by a government on an individual or an organisation to raise revenue for public works. The collected amount is then used to fund different public expenditure programmes. Failure in payment of taxes or resisting to contribute towards it invites punishment under the pre-defined law.

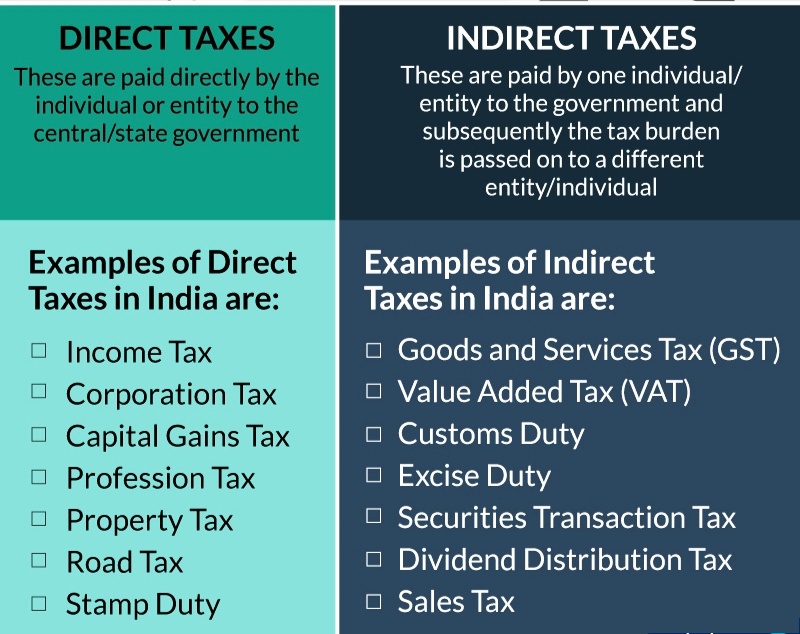

An entity has to pay taxes in various forms. Depending on the manner in which they are paid to the taxation authorities, these taxes are classified into direct and indirect taxes. Let us discuss about both taxes in detail:

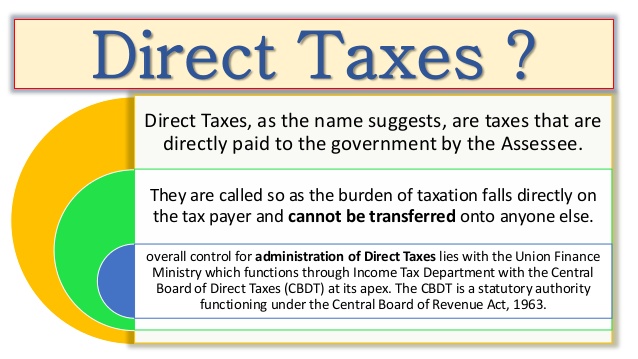

Taxes that are paid directly by individuals and organizations to the government of India come under Direct Tax.

Acts that preside over Direct Taxes

Indirect taxes are collected a bit differently from direct taxes and these are consumption-based taxes that are applied to goods or services when they are bought and sold.

The government receives indirect tax payments from the seller of the good/service.

The seller, in turn, passes the tax on to the end user i.e. buyer of the good/service.

Thus, the name indirect tax as the end user of the good/service does not pay the tax directly to the government.

Goods and Services Tax (GST) is an indirect tax (or consumption tax) levied in India on the supply of goods and services. It is levied at every step in the production process.

The tax is divided into five slabs -- 0 per cent, 5 per cent, 12 per cent, 18 per cent, and 28 per cent.

Although GST is collected by the central government, taxes on petroleum products, alcoholic drinks, electricity are separately collected by the state government.

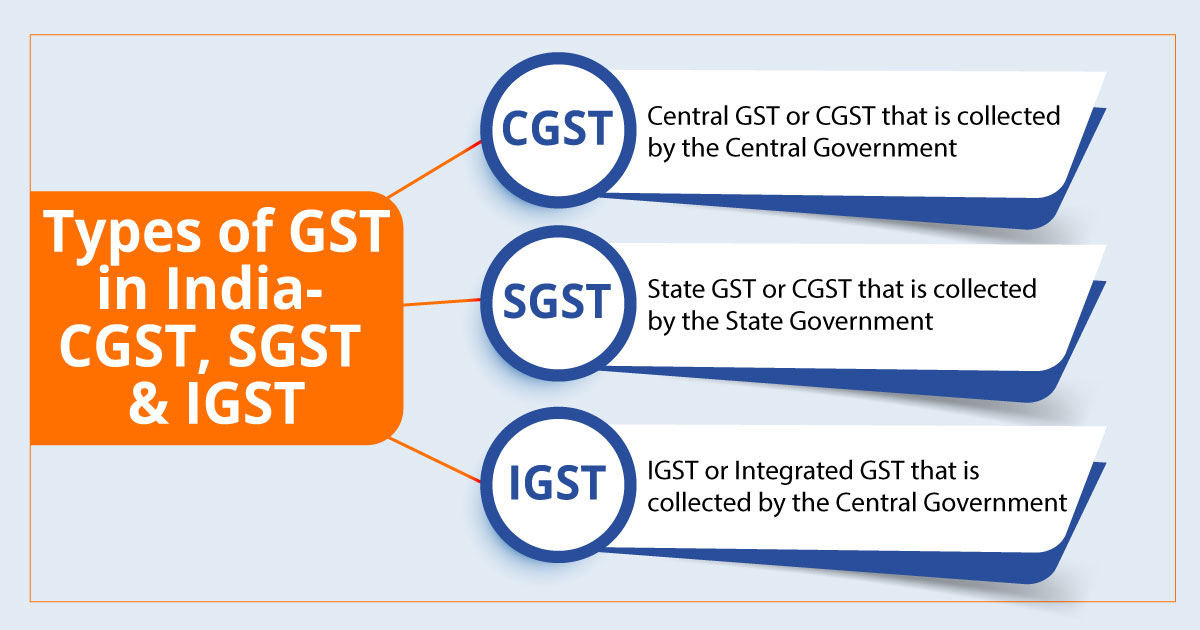

Based on the kind of transaction, there are four types of GST, viz. Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Integrated Goods and Services Tax (IGST), and Union Territory Goods and Services Tax (UTGST).

Central Goods and Services Tax

CGST is charged on the intra state supply of products and services. The Central Government levies CGST and it is governed by the Central Goods and Services Tax Act. CGST has effectively replaced all the previous Central taxes such as Central Excise Duty, Customs Duty, Service Tax, SAD, CST, etc. It is charged to taxpayers along with SGST. The rate at which CGST is charged is usually the same as the SGST rate, and the revenue collected under CGST is remitted to the Central Government.

State Goods and Services Tax

SGST, like CGST, is charged on the sale of products or services within a state. The State Government is responsible for the levy of SGST. This tax replaces all the previous taxes such as Entry Tax, Value Added Tax, Entertainment Tax, State Sales Tax, cesses, and surcharges. The revenue collected under SGST is remitted to the State Government.

Integrated Goods and Services Tax

IGST is charged on inter-state transactions of products and services. It is also levied on imports. The Central Government collects IGST and distributes it among states. IGST is levied when goods or services are transferred from one state to another. The tax was implemented so that states would only have to deal with the Union Government rather than dealing with each state.

Union Territory Goods and Services Tax

UTGST is levied on the supply of products and services in any of the Union Territories in the country, viz. Andaman and Nicobar Islands, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep, and Chandigarh. UTGST is levied along with CGST.

This is the most common type of tax that an individual citizen pays to the government. The concept is pretty simple – a portion of your income is paid to the government every year and this money is used by the government to fund its growth and development activities across the country.

Income Tax Assessee

Any individual who is liable to file taxes as a result of having an income is an income tax assessee. However, not all individuals who have an income are actually required to pay taxes. Common reasons for not having to pay taxes include annual income below a threshold level determined by the government from time to time or income from exempted sources such as agriculture. Additionally, an income tax assessee may be responsible for filing tax returns for himself/herself or on behalf of another person depending on specific situations.

Income Tax Slabs

Indian Income tax levies tax on individual taxpayers on the basis of a slab system. Slab system means different tax rates are prescribed for different ranges of income. It means the tax rates keep increasing with an increase in the income of the taxpayer. This type of taxation enables progressive and fair tax systems in the country. Such income tax slabs tend to undergo a change during every budget. These slab rates are different for different categories of taxpayers. Income tax has classified three categories of “individual “taxpayers such as:

Income tax slabs for resident individuals below 60 years of age for FY 2019-20, 2020-21

Income tax slabs for resident individual between 60 and 80 years of age (Senior Citizen) for FY 2019-20, 2020-21

Income tax slabs for resident individual above 80 years of age (Super Senior Citizen) FY 2019-20, 2020-21

A new surcharge rates have been introduced for the super rich.

Surcharges to be levied for FY 2019-20 and FY 2020-21:

Collected by Central Board of Excise and Customs (CBEC) under the Department of Revenue, the Ministry of Finance, Government of India, Custom Duty is levied on goods imported in India as well as exported from India.

The Constitutional provisions have given to Union the right to legislate and collect duties on imports and exports.

Central Excise duty is an indirect tax levied on those goods which are manufactured in India and are meant for home consumption. The taxable event is 'manufacture' and the liability of central excise duty arises as soon as the goods are manufactured. It is a tax on manufacturing, which is paid by a manufacturer, who passes its incidence on to the customers.

The term "excisable goods" means the goods which are specified in the First Schedule and the Second Schedule to the Central Excise Tariff Act, 1985 , as being subject to a duty of excise and includes salt.

In India, Excise Duty is applied to these goods namely,

The income tax a company pays from its revenue earned by it is called a corporate tax -- Company whether Indian or foreign is liable to taxation, under the Income Tax Act,1961--Companies in India, whether public or private are governed by the Companies Act, 1956. The registrar of companies and the company law board administers the provisions of the Act.

The government divides it between two sub-categories:

Domestic company [Section 2(22A)]

An Indian company (i.e. a company formed and registered under the Companies Act,1956) or any other company which, in respect of its income liable to tax, under the Income Tax Act, would have to pay the tax.

A domestic company may be a public company or a private company.

Foreign company [Section 2(23A)]

A company whose control and management are situated wholly outside India, and which has not made the prescribed arrangements for declaration and payment of dividends within India.

There are four types of corporate taxes. They are:

Minimum Alternate Tax:

MAT or Minimum Alternate Tax is a provision in Direct tax laws to limit tax exemptions availed by companies, so that they mandatorily pay a minimum amount of tax to the government. Minimum Alternative Tax (MAT) is fundamentally a means for the IT Department to get the companies to make payment of a minimum tax. Nevertheless, the companies that are involved in power sectors and infrastructure are exempted from making payment of MAT.

Once the MAT is paid by the company, it can cart the payment forward and adjust against the regular tax payable for the period of the succeeding five-year duration liable to be subjected to specific conditions.

|

All companies whether private or public irrespective of whether Indian or foreign are liable to pay MAT, if the income tax payable (including cess and surcharge) as per the provisions of Income Tax Act is less than 15% of the book profit plus cess and surcharge.

Fringe Benefit Tax:

Abbreviated as FBT, was a tax that was applied to nearly all the fringe benefits an employee receives from its employer. This tax covers several aspects such as:

The FBT was initiated under the stewardship of the Government of India from April 1, 2005. Nevertheless, Pranab Mukherjee, the-then Finance Minister abandoned it in 2009 while the Union Budget Session 2009.

Dividend Distribution Tax:

This tax was brought in after the end of Union Budget 2007. It is fundamentally a tax that is levied on the companies that depend on the dividend paid by them to their investors. The Dividend Distribution Tax is chargeable on the net or gross income of an investor received from the investments made by them. Presently, the DDT rate is 15 percent.

Banking Cash Transaction Tax:

This tax is yet another type of tax, which the Government of India has scrapped. This type of taxation was into effect from 2005 to 2009 until Mr. Pranab Mukherjee, the-then Finance Minister, wiped out the tax. Under this tax, every bank transaction, credit or debit, would be levied tax at a rate of 0.1 percent

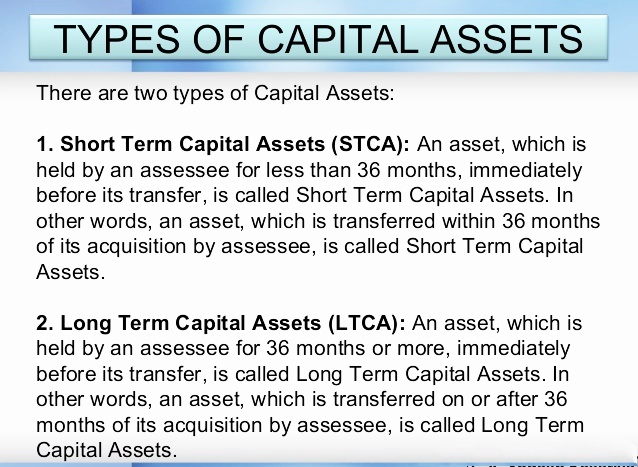

Capital gain can be defined as any profit that is received through the sale of a capital asset. The profit that is received falls under the income category. Therefore, a tax needs to be paid on the income that is received. The tax that is paid is called capital gains tax and it can either be long term or short term. The tax that is levied on long term and short term gains starts from 10% and 15%, respectively.

Under the Income Tax Act, capital gains tax in India need not be paid in case the individual inherits the property and there is no sale. However, if the person who has inherited the property decides to sell it, tax will have to be paid on the income that has been generated from the sale. Some of the examples of capital assets are jewellery, machinery, leasehold rights, trademarks, patents, vehicles, house property, building, and land.

The below-mentioned assets are considered as long term assets if they are held for a duration of more than 12 months:

Although the taxes are collected by the central government, Electricity Tax may vary from state to state.

One of the important components of tax reforms initiated since liberalization is the introduction of Value Added Tax (VAT). The VAT is a multi-point destination-based system of taxation, with tax being levied on value addition at each stage of the transaction in the production/ distribution chain.

The VAT is basically a State subject, derived from Entry 54 of the State List, for which the States are sovereign in taking decisions. The State Governments, through Taxation Departments, are carrying out the responsibility of levying and collecting the VAT in the respective States. While the Central Government is playing the role of a facilitator for the successful implementation of VAT. The Ministry of Finance is the main agency for levying and implementing VAT, both at the Centre and the State level.

The Department of Revenue, under the Ministry of Finance, exercises control in respect of matters relating to all the direct and indirect taxes, through two statutory Boards, namely, the Central Board of Direct Taxes (CBDT) and the Central Board of Customs and Central Excise (CBEC).

The term 'value addition' implies the increase in the value of goods and services at each stage of production or transfer of goods and services. The VAT is a tax on the final consumption of goods or services and is ultimately borne by the consumer.

It is a multi-stage tax with the provision to allow 'Input tax credit (ITC)' on tax at an earlier stage, which can be appropriated against the VAT liability on the subsequent sale.

This input tax credit in relation to any period means setting off the amount of input tax by a registered dealer against the amount of his output tax. It is given for all manufacturers and traders for the purchase of inputs/supplies meant for sale, irrespective of when these will be utilised/ sold.

The VAT liability of the dealer/ manufacturer is calculated by deducting input tax credit from tax collected on sales during the payment period (say, a month).

It is the tax which is paid to the government for the sales of products and services. Sales tax is of different types depending upon the sale of product from manufacturer to wholesaler or retailer to the customer.

A cess is a form of tax levied by the government on tax with specific purposes till the time the government gets enough money for that purpose. Different from the usual taxes and duties like excise and personal income tax, a cess is imposed as an additional tax besides the existing tax (tax on tax). For example, the Swachh Bharat cess is levied by the government for cleanliness activities that it is undertaking across India.

A cess, generally paid by everyday public, is added to their basic tax liability paid as part of total tax paid.

A cess is different from taxes as it is imposed as an additional tax besides the existing tax (tax on tax). Another difference lies in the way the revenue recovered from cess is maintained. While revenue from taxes like income tax is kept in the Consolidated Fund of India (CFI) and the government can use it for any purposes it deems fit, the revenue coming from cess is first credited to the Consolidated Fund, and the government may then, after due appropriation from Parliament, utilise it for the specified purpose.

Another major difference between central taxes and cess is that the proceeds of a cess may or may not be shared with the state governments, while that of taxes have to be shared.

The government levies different cesses on services it provides to the public. Some of them are as follows:

Collected by the government to provide the mandatory free standard primary education to all citizens.

Proposed in 2018 by former finance minister Arun Jaitley to meet the health requirements of below-poverty-line families.

For maintenance of roads and infrastructure.

Introduced in 2010, it is a carbon tax on the production and import of coal, lignite and peat, operating on the “polluter pays” principle.

It was introduced in 2016 to provide additional support to farmers for agricultural activities.

Introduced in 2014 with the objective of delivering a clean India, it is levied at 0.5 per cent on all taxable services to fund Swachh Bharat initiatives.

© 2026 iasgyan. All right reserved