Summary of the Budget 2021-22

PART-A

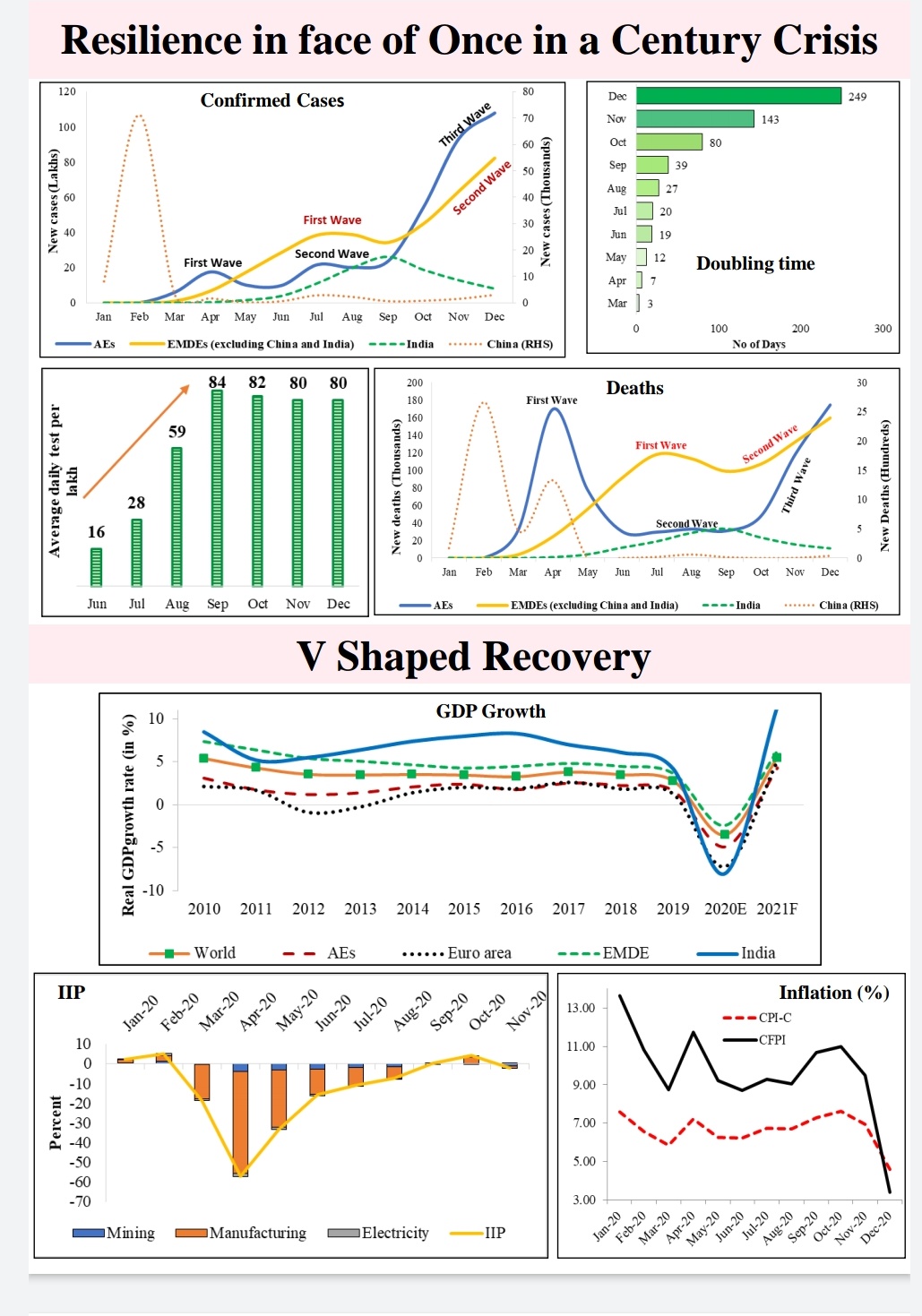

The Union Minister for Finance & Corporate Affairs presented the Union Budget 2021-22 which is the first budget of this new decade and also a digital one in the backdrop of unprecedented COVID-19 crisis.

The Budget proposals for 2021-22 rest on 6 pillars.

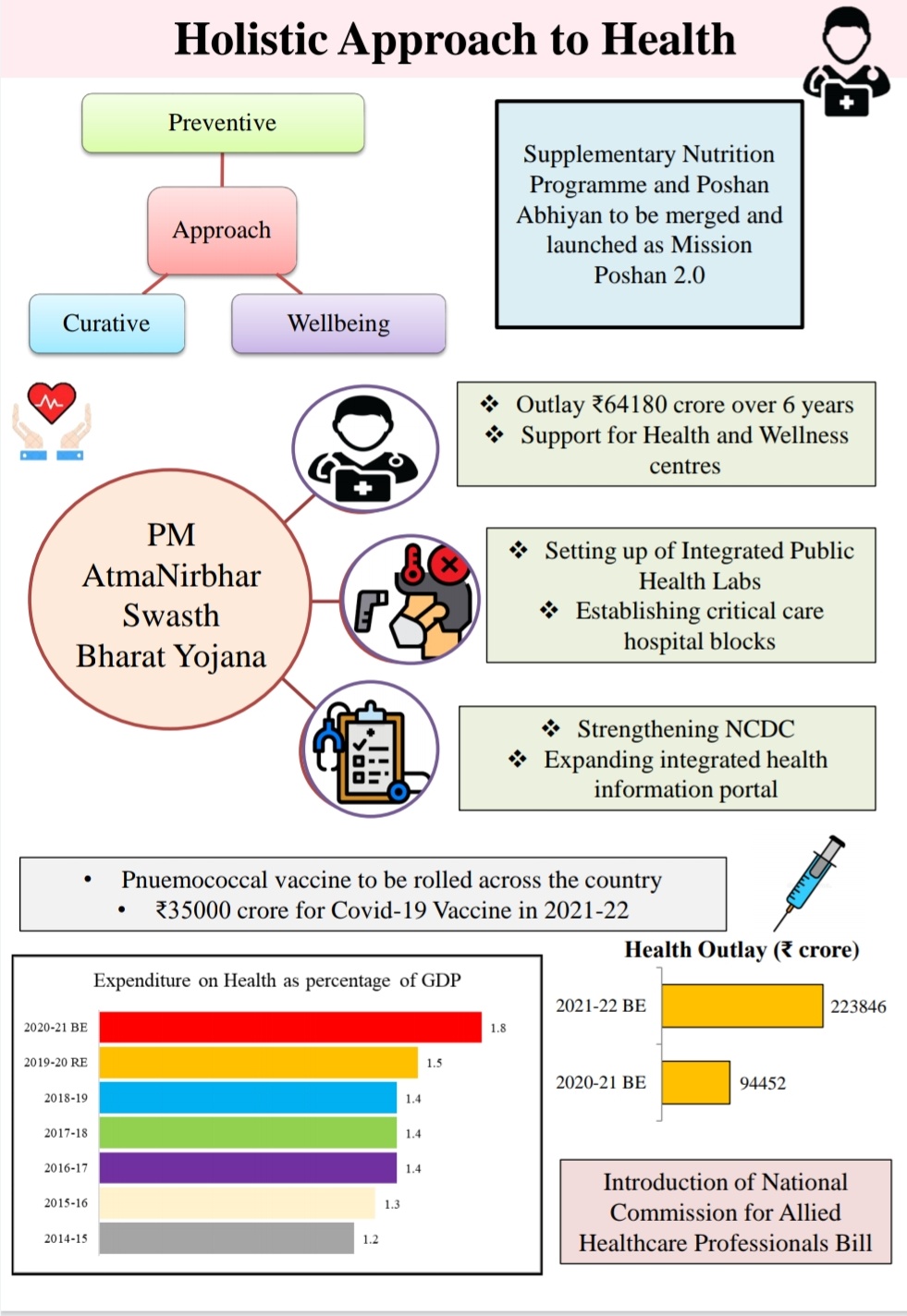

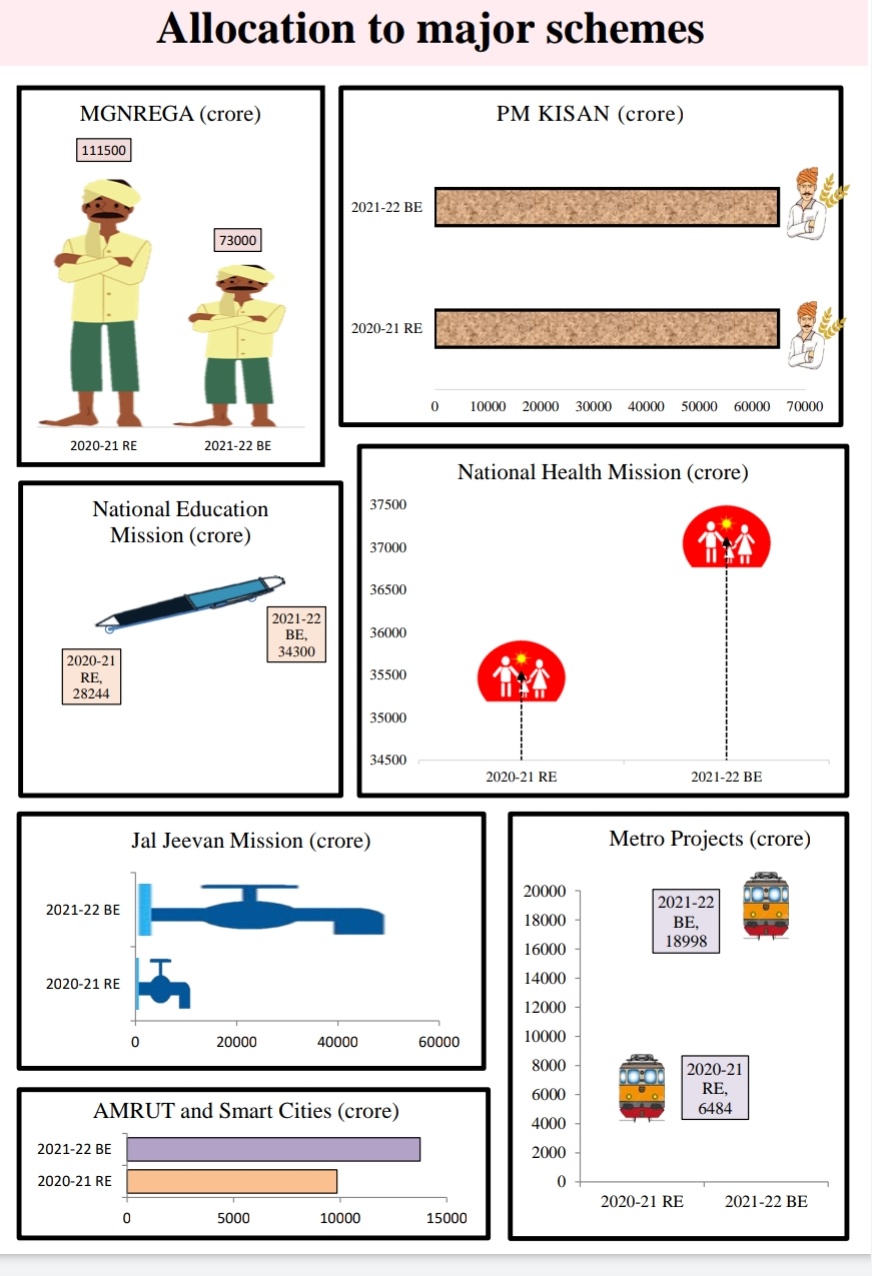

Health and Wellbeing

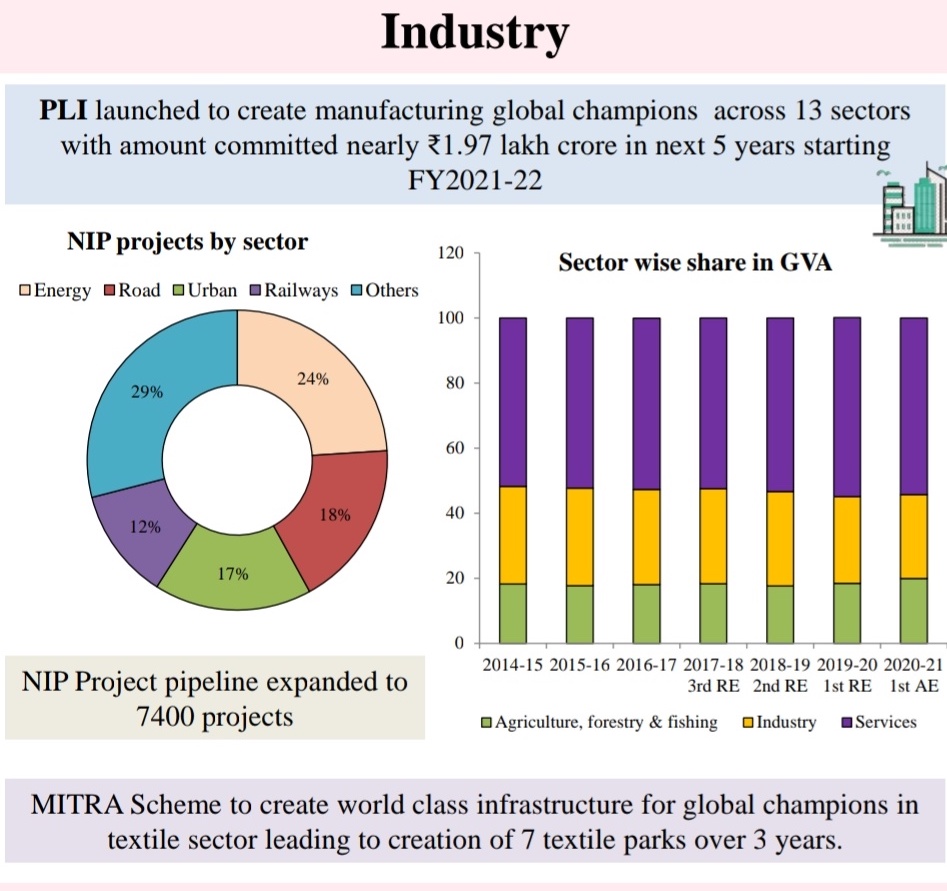

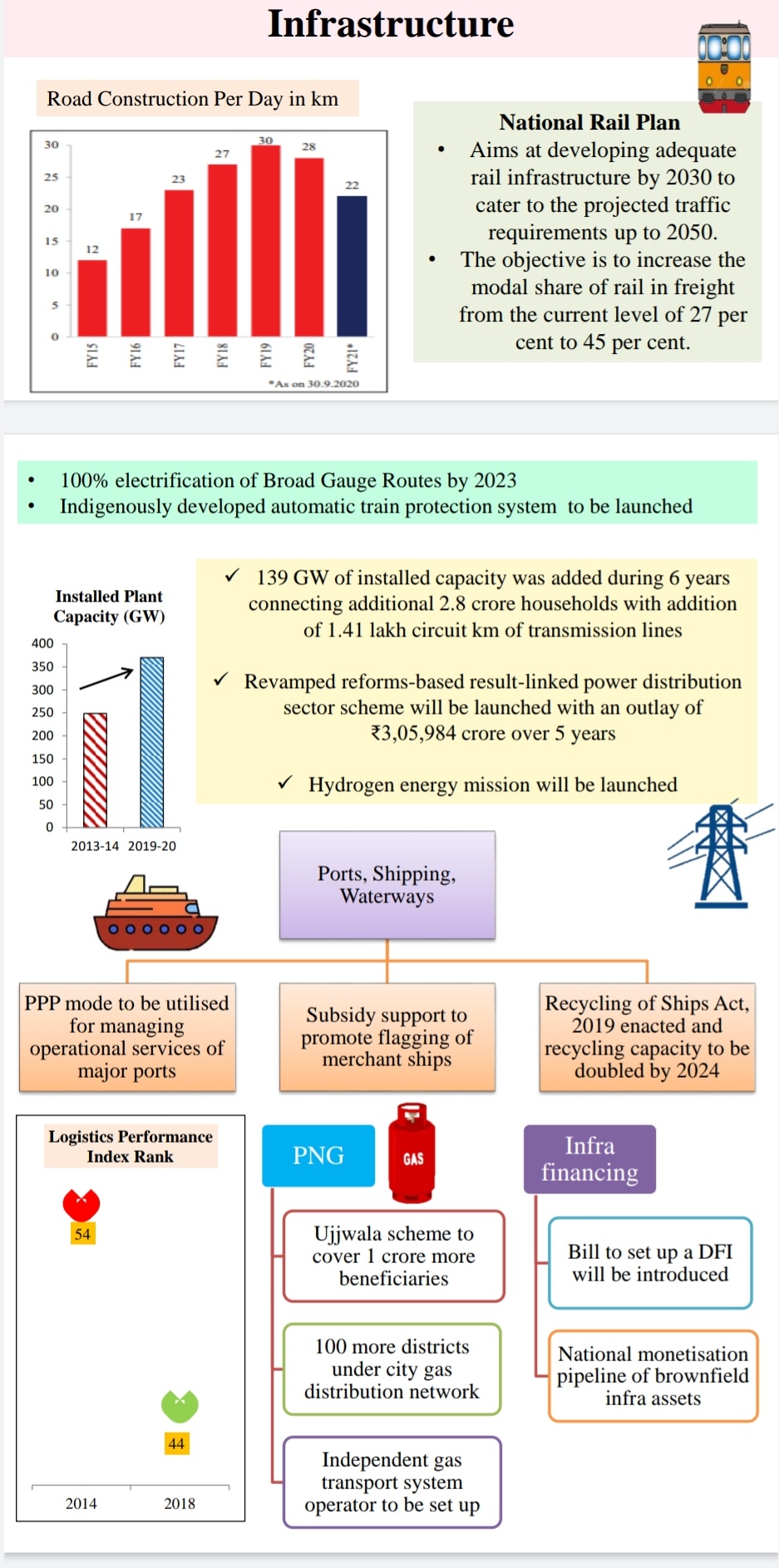

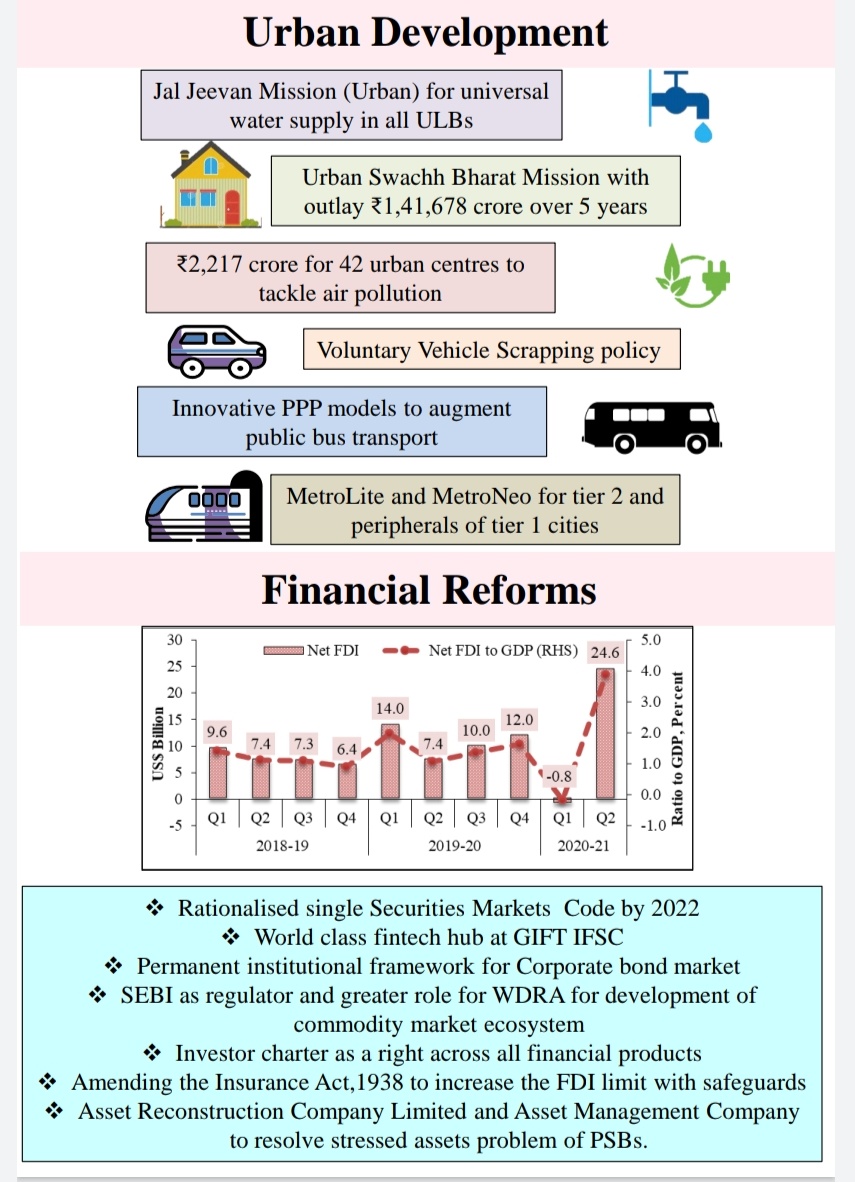

Physical and Financial Capital and Infrastructure

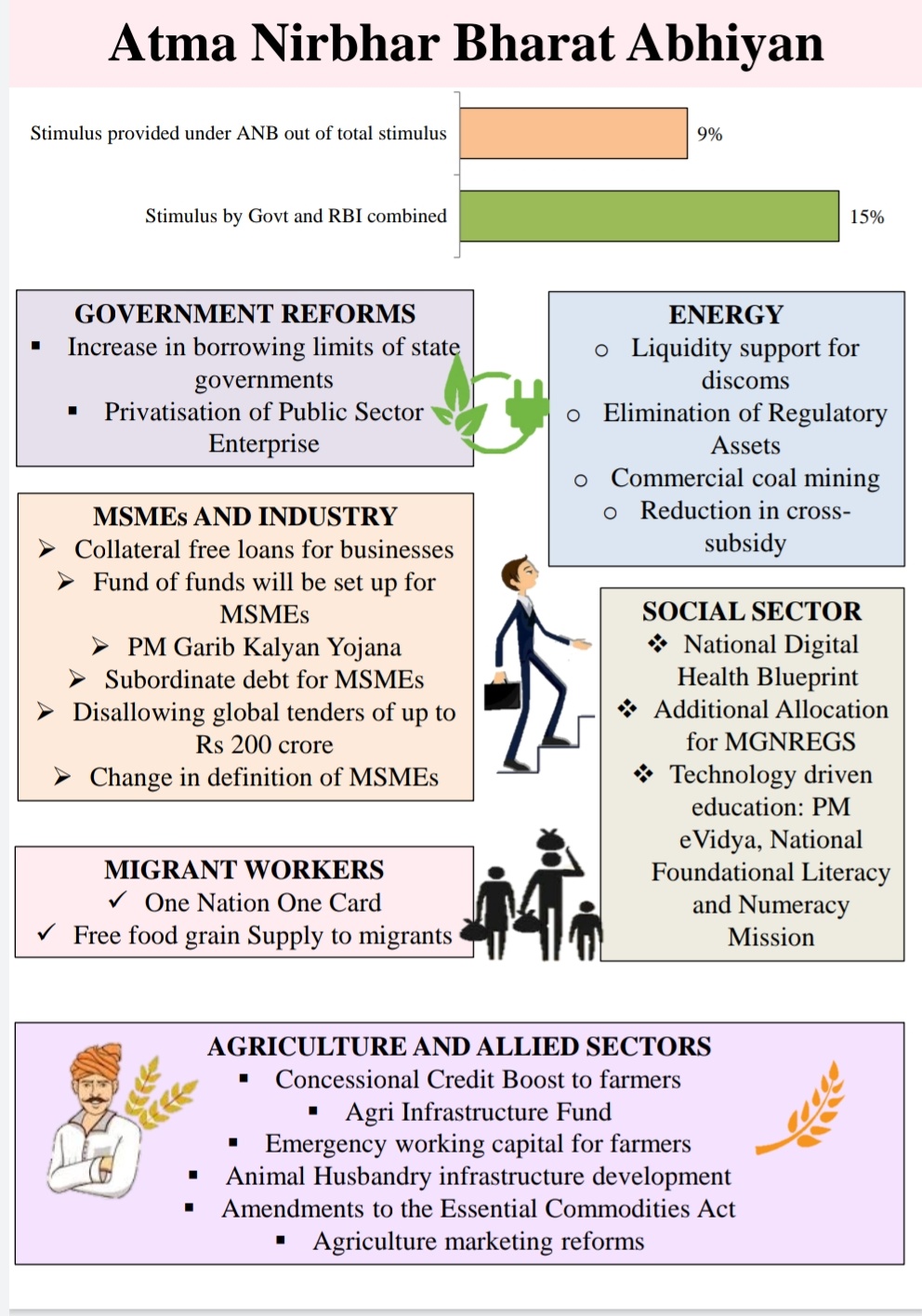

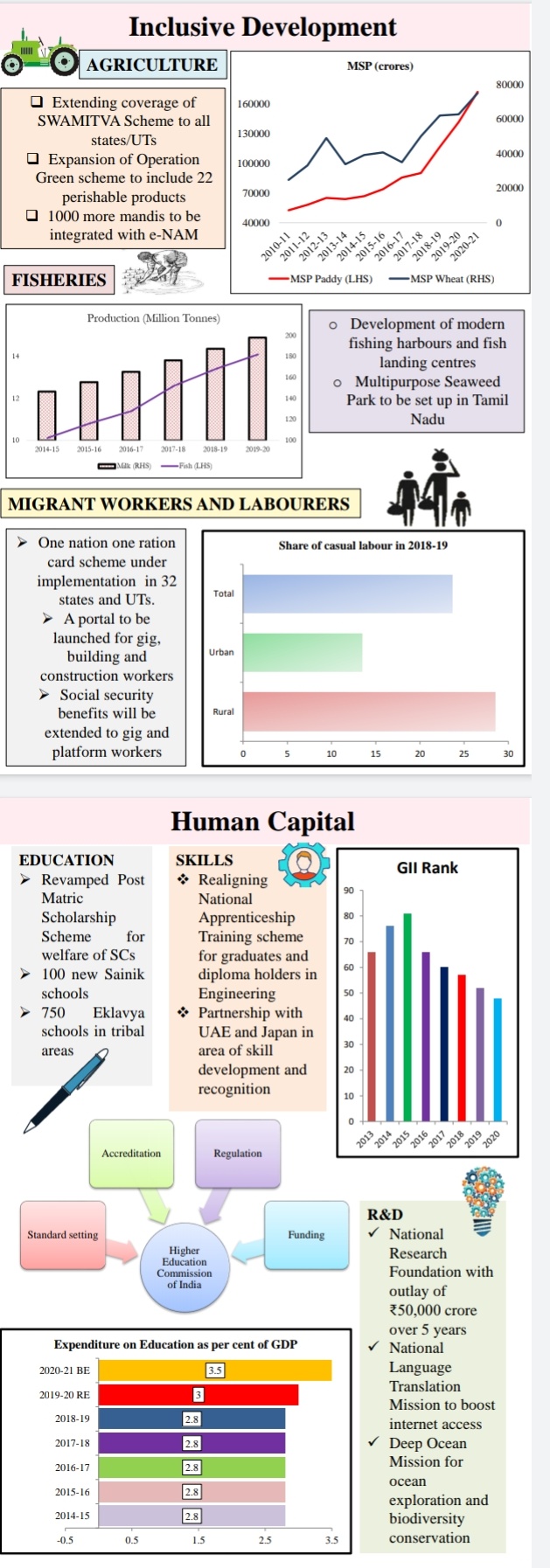

Inclusive Development for Aspirational India

Agriculture:

Fisheries:

Migrant Workers and Labourers:

Financial Inclusion:

Reinvigorating Human Capital

Innovation and R&D

Minimum Government, Maximum Governance

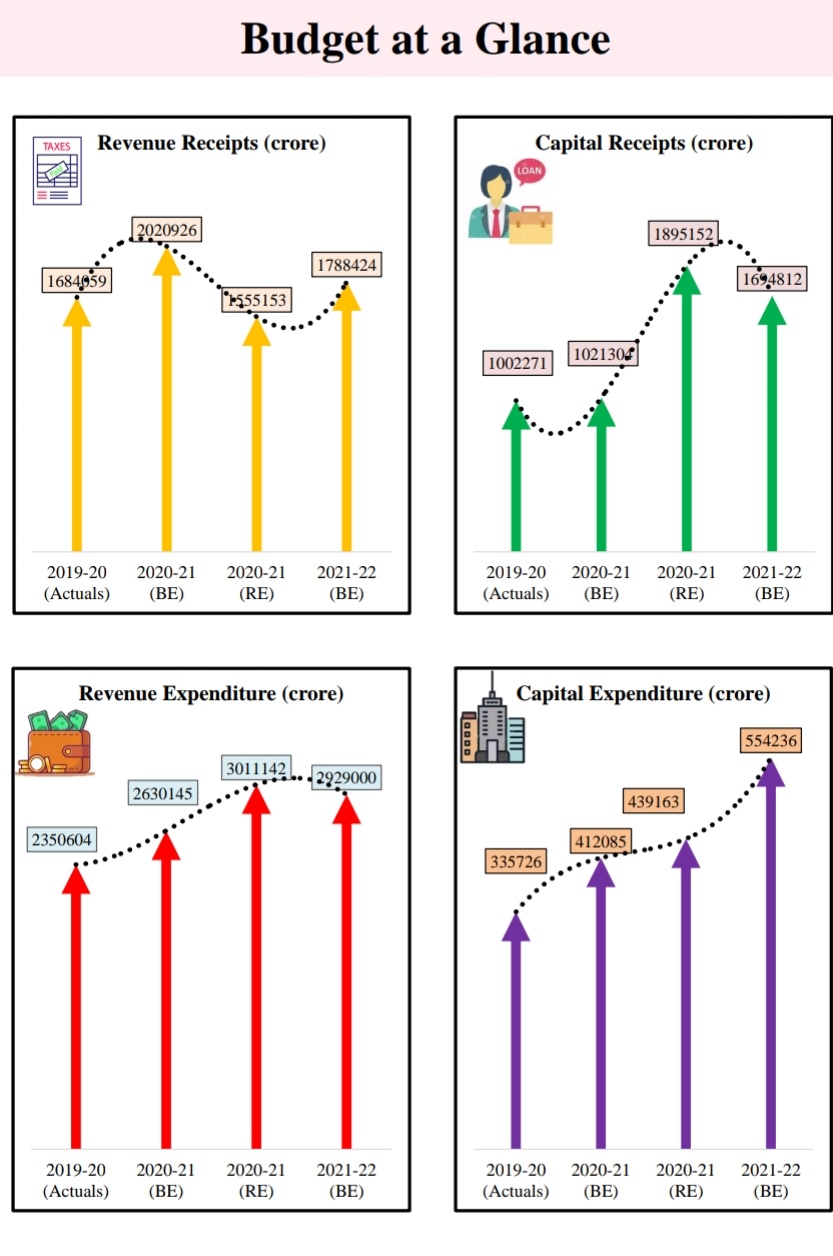

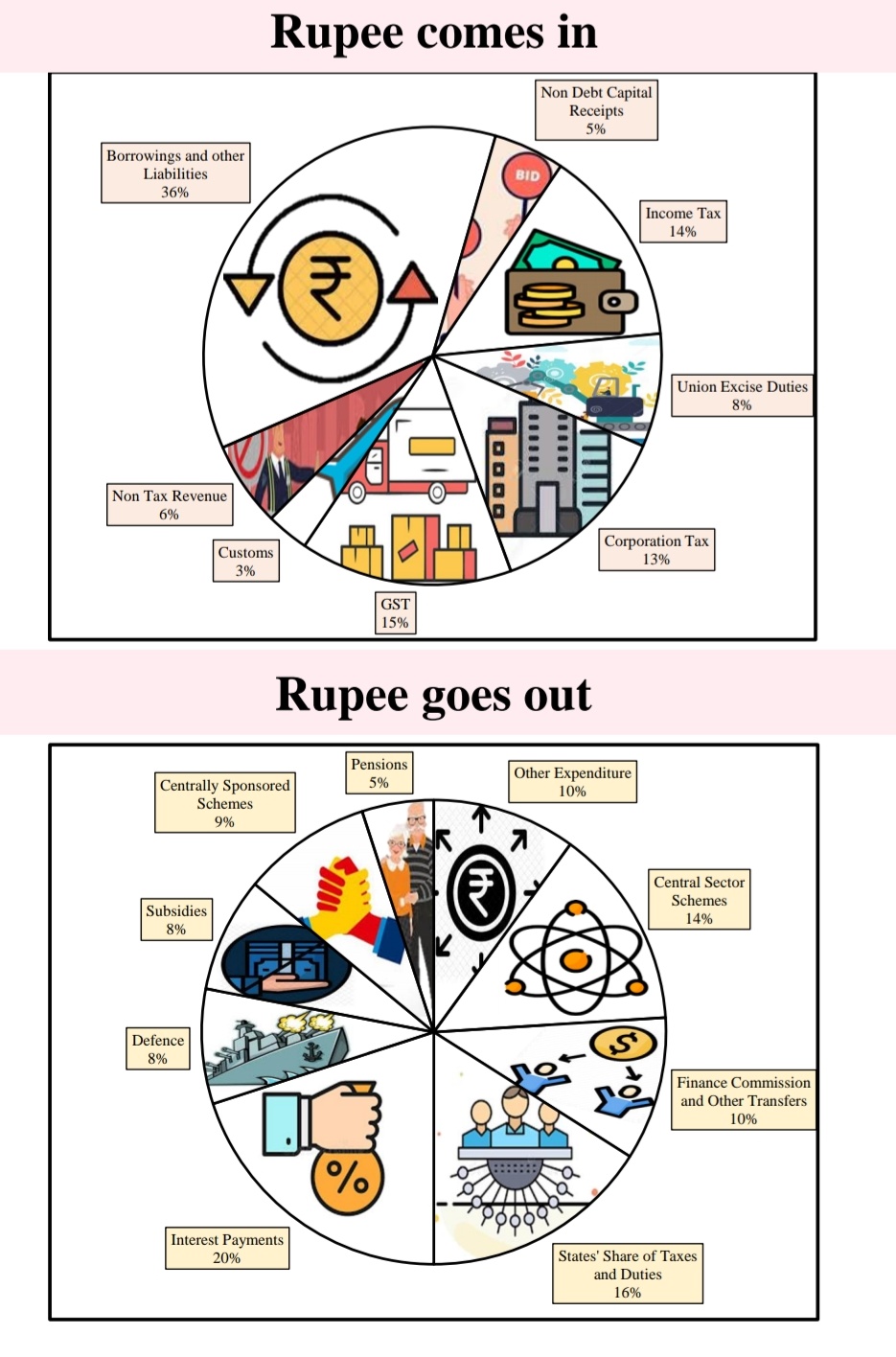

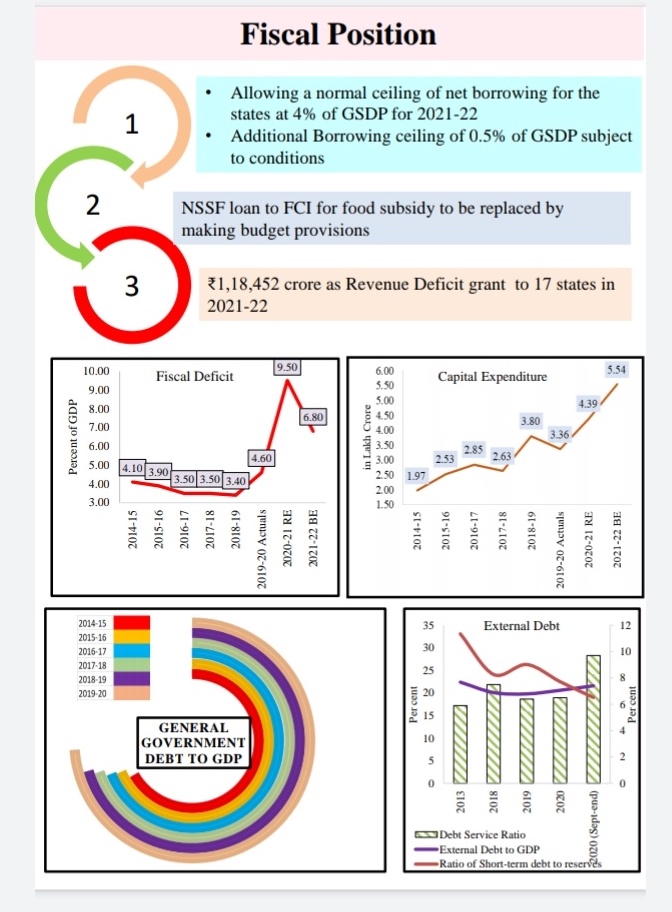

Fiscal position

PART-B

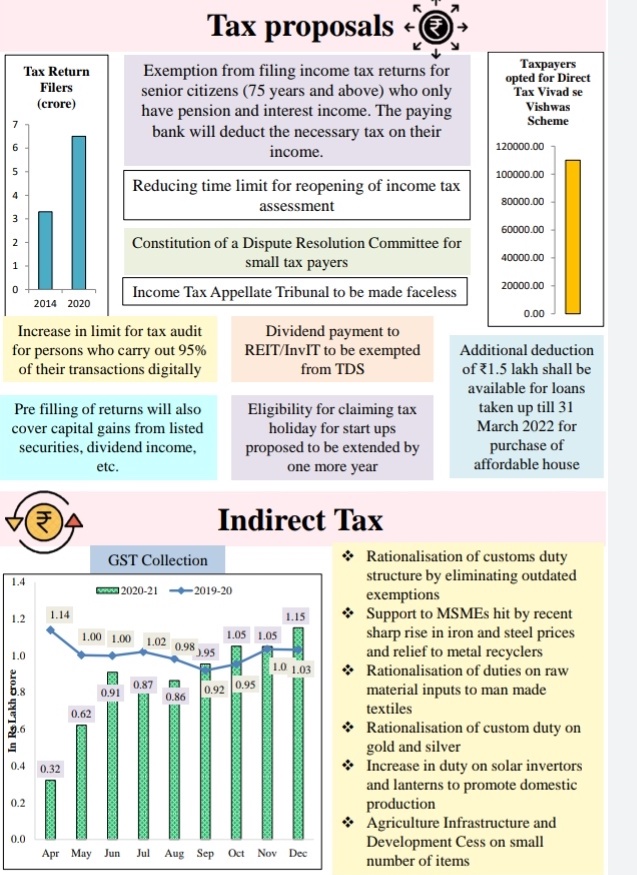

DIRECT TAX PROPOSALS

INDIRECT TAX PROPOSALS

© 2026 iasgyan. All right reserved