G-SAP was launched in April 2021 by the RBI.

Open market operations or OMOs are conducted by the Reserve Bank of India (RBI) by way of sale and purchase of G-Secs (government securities) to and from the market.

Objective: To adjust the rupee liquidity conditions in the market on a durable basis.

When the Reserve Bank feels that there is excess liquidity in the market, it resorts to sale of securities thereby sucking out the rupee liquidity.

Similarly, when the liquidity conditions are tight, RBI may buy securities from the market, thereby releasing liquidity into the market.

RBI carries out the OMO through commercial banks and does not directly deal with the public. Like bank fixed deposits, g-secs are not tax-free.

|

Recent structural change made: Retail investors can directly open their gilt accounts with RBI, and trade in government securities. Retail investors are allowed to place non-competitive bids in auctions of government bonds through their demat accounts. Stock exchanges act as aggregators and facilitators of retail bids. Reason behind bringing this change: The g-sec market is dominated by institutional investors such as banks, mutual funds, and insurance companies. These entities trade in lot sizes of Rs 5 crore or more. So, there is no liquidity in the secondary market for small investors who would want to trade in smaller lot sizes. In other words, there is no easy way for them to exit their investments. Thus, until now, direct g-secs trading was not popular among retail investors. |

OMO is one of the tools that RBI uses to smoothen the liquidity conditions through the year and minimize its impact on the interest rate and inflation rate levels.

|

More about OMOs Holding of OMO Securities The public debt office (PDO) of RBI, acts as the registry and central depository for G-Secs. They may be held by investors either as physical stock or in dematerialized (demat/electronic) form. It is mandatory for all the RBI regulated entities to hold and transact in G-Secs only in dematerialised (subsidiary general ledger or SGL) form. Note: To know about Government Securities (G-Secs): T-Bills and CMBs etc. Visit: https://www.iasgyan.in/blogs/government-securities-simplified How are the G-Secs issued? G-Secs are issued through auctions conducted by the RBI. Auctions are conducted on the electronic platform called the E-Kuber, the Core Banking Solution (CBS) platform of RBI. The RBI, in consultation with the Government of India, issues an indicative half-yearly auction calendar which contains information about the amount of borrowing, the range of the tenor of securities and the period during which auctions will be held. The Reserve Bank conducts auctions usually every Wednesday to issue T-bills (Treasury Bills) of 91-day, 182-day and 364-day tenors. Like T-bills, Cash Management Bills (CMBs) are also issued at a discount and redeemed at face value on maturity. The tenor, notified amount and date of issue of the CMBs depend upon the temporary cash requirement of the Government. The tenors of CMBs are generally less than 91 days. What is meant by repurchase (buyback) of G-Secs? Repurchase (buyback) of G-Secs is a process whereby the central government and state governments buy back their existing securities, by redeeming them prematurely, from the holders. The objectives of buyback can be

|

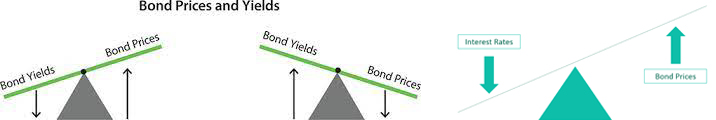

Note: Know about the relationship between Bond Price and Bond yield here before you read further:

https://www.iasgyan.in/blogs/bond-yield

Also, Note:

The RBI periodically purchases Government bonds from the market through Open Market Operations (OMOs). The G-SAP is in a way an OMO but there is an upfront commitment by the central bank to the markets that it will purchase bonds worth a specific amount. The idea is to give a comfort to the bond markets. In other words, G-SAP is an OMO with a ‘distinct character’.

Explanation:

The biggest drawback of OMOs is that investors do not know the timing of these purchases. The RBI, till now, was disclosing OMO purchases weekly, which created uncertainty in the bond market.

With G-SAP, the RBI fulfils the long-pending demand of the market participants of OMO purchase calendar. G-SAP holds a close relation to OMO, with an upfront commitment and clear communication about the OMO purchase calendar. Under this, the RBI will purchase bonds worth a specific amount, which will reduce the uncertainty and allow investors to bid better in the scheduled auction with a pre-decided calendar set by the RBI.

Mainly the government. It has a massive borrowing programme scheduled for FY22. The RBI’s endeavor is to keep the yield down to lower the borrowing cost of the Government. The Government has planned a Rs 12.05 lakh crore borrowing plan for fiscal year 2022.

During the financial year 2020-21, the government borrowed around Rs 12.8 lakh crore and plans to borrow another Rs 12.05 lakh crore in FY 2021-22. Due to this excessive borrowing, the bond market demands a higher return from government securities.

The average return (popularly known as yield-to-maturity; YTM) on the benchmark 10-year bond yield traded at around 5.93 per cent from April 2020 to June 2020, which rose to a high of 6.25 per cent on March 10, 2021, before falling.

The YTM is the annual return the investor can expect when a security is bought at a particular price at a specific time and held on until maturity.

The problem with this hefty Government borrowing is that the financial system can lend money up to a certain limit. When the demand for money in the market goes up, it is quite natural that the investors start demanding a higher rate of return on their lending. At the same time, it leads to the bond market asking for higher returns, thus pushing up the yield on the G-Sec.

The government is facing issues with increased bond yields as it will increase its expenses.

When the returns/bond yield on the existing securities go up, the RBI has to offer a higher rate of returns for the fresh securities it will be issuing in 2021-22, which will eventually push up the interest cost of the government.

G-Sec is the benchmark for any other form of borrowings in the country since it is deemed the safest form of investments. Once the G-Sec interest rates go up, all the different lending rates the RBI is not looking at will surge.

But the central bank acts as a debt manager to the government, which not only manages the borrowing programmes but it needs to ensure that debt is available at the lowest cost (interest rate)at the same time.

Hence, through G-SAP, the RBI is indirectly financing the government’s borrowing as it will print money and buy bonds at first. The demand for money/bond will get stabilized and interest rate will come down. Thus, in this way, it will put enough money in the financial system, which will ensure that the returns on G-Sec do not go up, and the RBI will borrow money for the government at a lower rate of interest after that.

The plan is to enable a stable and orderly evolution of the yield curve amidst comfortable liquidity conditions.

In addition to the G-SAP plan, the RBI will also continue to deploy regular operations under the LAF, longer-term repo/reverse repo auctions, forex operations and open market operations including special OMOs to ensure liquidity conditions evolve in consonance with the stance of monetary policy.

For the Government, it is a good news because the overall borrowing costs go down.

But, a section of economists aren’t comfortable with RBI artificially keeping the interest rates lower in the financial system as it will lead to distortions. In healthy economic system, the interest rates pricing should be driven by demand-supply, and shouldn’t be artificially suppressed by the central bank. It will have other consequences.

When the RBI is adamant to signal lower rates no matter what happens to support the Government borrowing, it will influence the financial system. Of course, cheaper rates will be good news to big, top rated companies who can issue bonds to raise money and to the government. But low interest rates coupled with high inflation is a systemic worry for savers. Already, savers are getting negative returns on their deposits if one takes into account the inflation adjusted rates or real rates.

Well, it is already having its effect on a weak Rupee. Government resorting to massive bond purchase to keep the rates low is not good news for the local currency as it will be under pressure. The Indian Rupee came under pressure after the RBI announced the massive Rs One lakh crore bond purchase programme. Economists say the fear of investors pulling capital out of India in a low interest environment is hurting the local unit.

© 2026 iasgyan. All right reserved