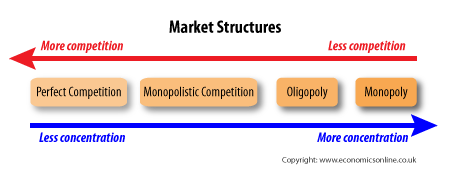

Market structure, in economics, refers to how different industries are classified and differentiated based on their degree and nature of competition for goods and services. It is based on the characteristics that influence the behavior and outcomes of companies working in a specific market.

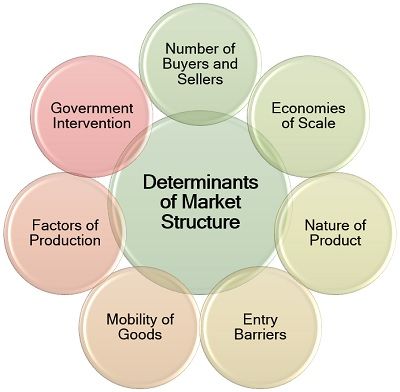

Some of the factors that determine a market structure include the number of buyers and sellers, ability to negotiate, degree of concentration, degree of differentiation of products, and the ease or difficulty of entering and exiting the market.

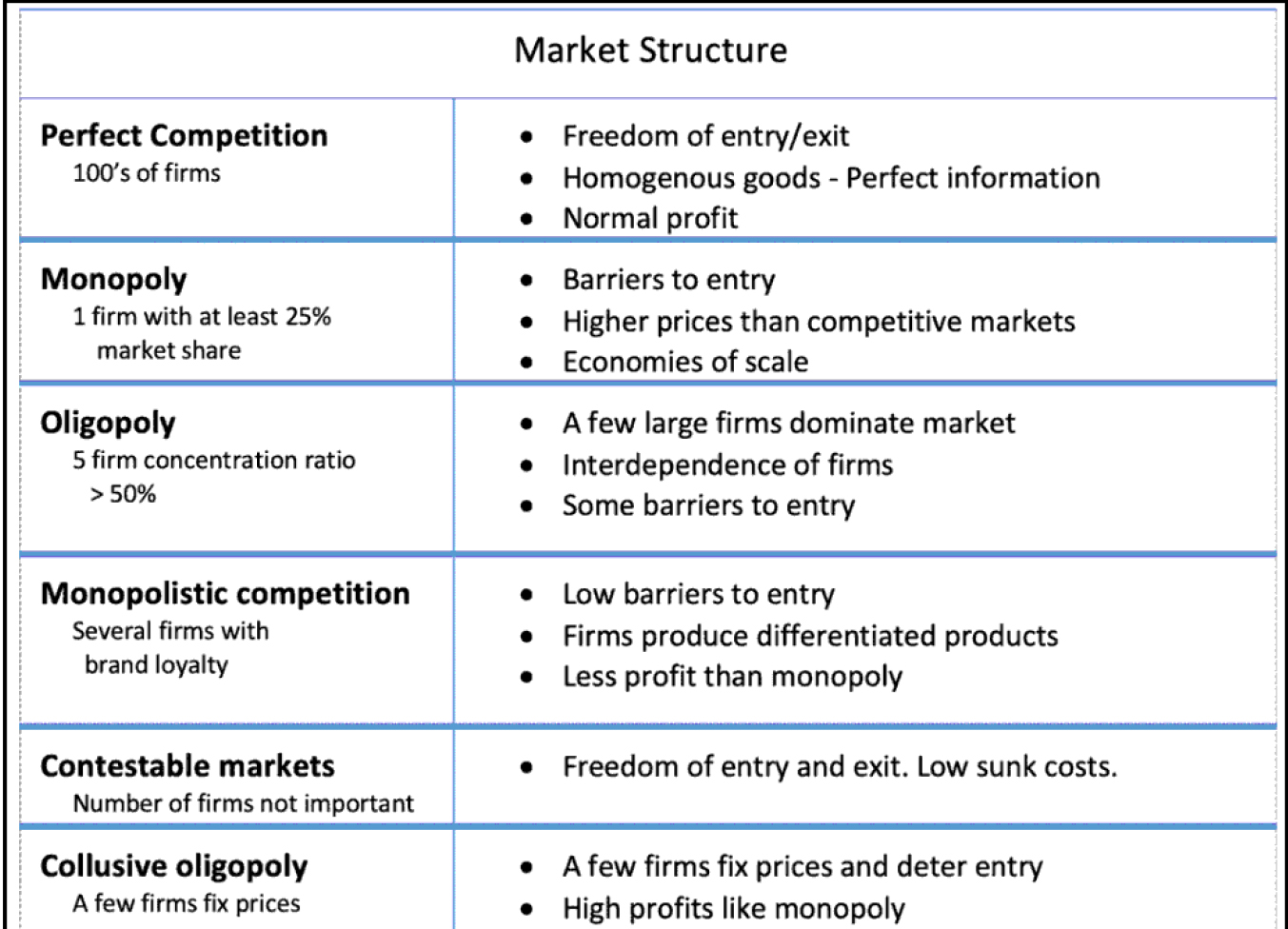

Perfect competition is a market structure where many firms offer a homogeneous product. Because there is freedom of entry and exit and perfect information, firms will make normal profits and prices will be kept low by competitive pressures.

Features of perfect competition

A pure monopoly is defined as a single seller of a product, i.e. 100% of market share.

When we speak of monopolies, the following conclusions are made:

An oligopoly is an industry dominated by a few large firms. For example, an industry with a five-firm concentration ratio of greater than 50% is considered an oligopoly.

The market framework of the oligopoly is based on the following assumptions:

Collusive behavior

Monopolistic competition is a market structure which combines elements of monopoly and competitive markets. Essentially a monopolistic competitive market is one with freedom of entry and exit, but firms can differentiate their products. Therefore, they have an inelastic demand curve and so they can set prices. However, because there is freedom of entry, supernormal profits will encourage more firms to enter the market leading to normal profits in the long term.

A monopolistic competitive industry has the following features:

An industry with freedom of entry and exit, low sunk costs. The theory of contestability suggests the number of firms is not so important, but the threat of competition.

In a nutshell,

A duopoly falls between a monopoly and oligopoly. A duopoly is a market structure dominated by two firms. For example, Android vs Apple.

A pure duopoly is a market where there are just two firms. But, in reality, most duopolies are markets where the two biggest firms control over 70% of the market share.

Characteristics of duopoly

© 2026 iasgyan. All right reserved