Disclaimer: Copyright infringement not intended.

Introduction

Behavioural Economics combines elements of economics and psychology to understand how and why people behave the way they do in the real world. It differs from neoclassical economics, which assumes that most people have well-defined preferences and make well-informed, self-interested decisions based on those preferences.

Shaped by Nobel laureate Richard Thaler, behavioural economics examines the differences between what people “should” do and what they actually do and the consequences of those actions.

What is Behavioral Economics?

Behavioral economics is grounded in empirical observations of human behavior, which have demonstrated that people do not always make what neoclassical economists consider the “rational” or “optimal” decision, even if they have the information and the tools available to do so.

For example, why do people often avoid or delay investing in 401ks or exercising, even if they know that doing those things would benefit them? And why do gamblers often risk more after both winning and losing, even though the odds remain the same, regardless of “streaks”?

By asking questions like these and identifying answers through experiments, the field of behavioral economics considers people as human beings who are subject to emotion and impulsivity, and who are influenced by their environments and circumstances.

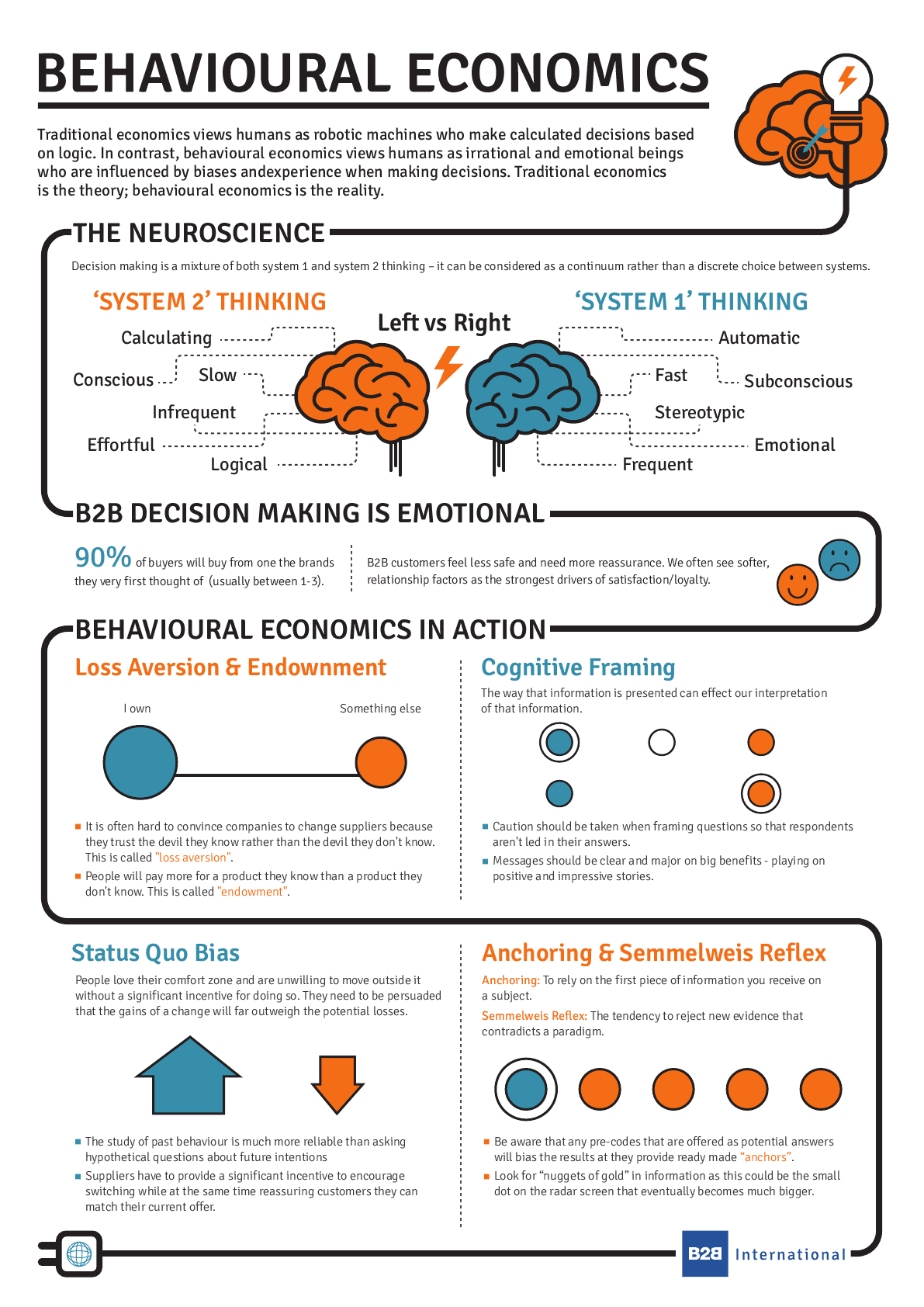

This characterization draws a contrast to traditional economic models that have treated people as purely rational actors—who have perfect self-control and never lose sight of their long-term goals—or as people who occasionally make random errors that cancel out in the long run.

Several principles have emerged from behavioral economics research that have helped economists better understand human economic behavior. From these principles, governments and businesses have developed policy frameworks to encourage people to make particular choices.

One can condense behavioral economics principles into the following points:

What are the origins of behavioral economics research, and who are Tversky and Kahneman?

Behavioral economics has expanded since the 1980s, but it has a long history: According to Thaler, some important ideas in the field can be traced back to 18th-century Scottish economist Adam Smith.

Smith is often remembered for the concept of an “invisible hand” that guides an overall economy to prosperity if each individual makes their own self-interested decisions—a key concept in classical and neoclassical economics. But he also recognized that people are often overconfident in their own abilities, more afraid of losing than they are eager to win and more likely to pursue short-term than long-term benefits. These ideas (overconfidence, loss aversion and self-control) are foundational concepts in behavioral economics today.

More recently, behavioral economics has early roots in the work of Israeli psychologists Amos Tversky and Daniel Kahneman on uncertainty and risk. In the 1970s and ’80s, Tversky and Kahneman identified several consistent biases in the way people make judgments, finding that people often rely on easily recalled information, rather than actual data, when evaluating the likelihood of a particular outcome, a concept known as the “availability heuristic.” For example, people may think shark or bear attacks are a common cause of death if they’ve read about one such attack, but the incidents are actually very rare.

With “prospect theory,” Tversky and Kahneman also demonstrated that framing and loss aversion influence the choices people make. For example, if presented with an opportunity to win $250 guaranteed or gamble on a 25% chance of winning $1,000 and a 75% chance of winning nothing, most people will choose the sure win. But if presented with the chance to lose $750 guaranteed or a 75% chance to lose $1,000 and a 25% chance to lose nothing, most people will risk losing $1,000, hoping for the slim chance that they will lose nothing at all.

This classic example demonstrates that people are more willing to take a greater statistical risk if it means avoiding a $1,000 loss versus obtaining a $1,000 win, which contradicts expected utility theory. Prospect theory and other work by Tversky and Kahneman continues to inform many areas of behavioral economics research today.

What role have Richard Thaler played in the development of the field?

In the 1980s, Richard Thaler began to build on the work of Tversky and Kahneman, with whom he collaborated extensively. Now the Charles R. Walgreen Distinguished Service Professor of Behavioral Science and Economics at the Booth School of Business, he is today considered a founder of the field of behavioral economics.

Thaler’s research in identifying the factors that guide individuals’ economic decision-making earned him the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel in 2017. His ideas stem in part from a series of observations he made in graduate school that led him to believe that people’s behavior deviated from traditional economic models in predictable ways.

For example, Thaler observed that he and a friend were willing to forgo a drive to a sporting event due to a snowstorm because they had been given free tickets. But had they purchased the tickets themselves, they would have been more inclined to go, even though the tickets would have been valued at the same price regardless, and the danger of driving in the snowstorm unchanged. This is an example of the “sunk cost fallacy”—the idea that people are less willing to give up on projects they have personally invested in, even if it means more risk.

Thaler is also known for popularizing the concept of the “nudge,” a conceptual device for leading people to make better decisions. A “nudge” takes advantage of human psychology and a number of other concepts in behavioral economics, including mental accounting—the idea that people treat money differently based on context. For example, people are more willing to drive across town to save $10 on a $20 purchase than $10 on a $1,000 purchase, even though the effort expended and the amount of money saved would be the same.

What is a “nudge” in behavioral economics?

In behavioral economics, a “nudge” is a way to manipulate people’s choices to lead them to make specific decisions: For example, putting fruit at eye level or near the cash register at a high school cafeteria is an example of a “nudge” to get students to choose healthier options. An essential aspect of nudges is that they are not coercive: Banning junk food is not a nudge, nor is punishing people for choosing unhealthy options.

For example, automatically enrolling employees in 401k plans—and asking them to opt out rather than offering them the chance to opt in—is an example of a nudge to encourage better and more consistent saving for retirement. Another seeks to make organ donation standard practice, by requiring people registering for drivers’ licenses to indicate whether or not they are willing to donate.

The formal term Thaler and Sunstein use to describe a situation designed around nudges is “libertarian paternalism”—libertarian because it preserves choice, but paternalistic because it encourages certain behavior. In Thaler’s words: “If you want people to do something, make it easy.”

Guide to Behavioural Economics Terms

The availability heuristic refers to the idea that people often rely on easily recalled information, rather than actual data, when evaluating the likelihood of a particular outcome. For example, people may think shark or bear attacks are a common cause of death if they’ve read about one such attack, but the incidents are actually very rare.

Bounded rationality refers to the fact that people have limited cognitive ability, information and time, and do not always make the “correct” choice from an economist’s point of view, even if information is available that would point them toward a particular course of action.

This might be because they cannot synthesize new information quickly; because they ignore it and instead choose to “go with their gut”; or because they don’t have the time to fully research all options. The term was coined in 1955 by Nobel laureate and UChicago alum Herbert A. Simon, AB’36, PhD’43.

Bounded self-interest is the idea that people are often willing to choose a less-optimal outcome for themselves if it means they can support others. Giving to charity is an example of bounded self-interest, as is volunteering. While these are common activities, they are not captured by traditional economic models, which predict that people act mostly to further their own goals and those of their immediate family and friends, rather than strangers.

Bounded willpower captures the idea that even given an understanding of the optimal choice, people will often still preferentially choose whatever brings the most short-term benefit over incremental progress toward a long-term goal. For example, even if we know that exercising may help us obtain our fitness goals, we may put it off indefinitely, saying we will “start tomorrow.”

Loss aversion is the idea that people are more averse to losses than they are eager to make gains. For example, losing a $100 bill might be more painful than finding a $100 bill would be positive.

Prospect theory refers to a series of empirical observations made by Kahneman and Tversky (1979) in which they asked people about how they would respond to certain hypothetical situations involving wins and losses, allowing them to characterize human economic behavior. Loss aversion is key to prospect theory.

The sunk-cost fallacy is the idea that people will continue to invest in a losing project simply because they are already heavily invested, even if it means risking more losses.

Mental accounting is the idea that people think about money differently depending on the circumstances. For example, if the price of gas goes down, they may begin to buy premium gas, leading them to ultimately spend the same amount, rather than taking advantage of the savings offered by the lower price.

Case Study

Nudging and COVID-19

Behavioral economics stipulates that humans can be guided to making certain decisions through the use of nudges. During a pandemic, the decisions that we make and the actions we take are of utmost importance to global health, perhaps making nudging more important than ever. As we shift into this new kind of lifestyle, behavioral economics can be used to change our habits to better align with health practices. By being aware of cognitive biases, such as bounded rationality, that stipulate we have limited resources to make decisions, health professionals can adjust their messages to be simple, clear and straightforward, which reduces choice overload.

Factors Influencing Human Decisions

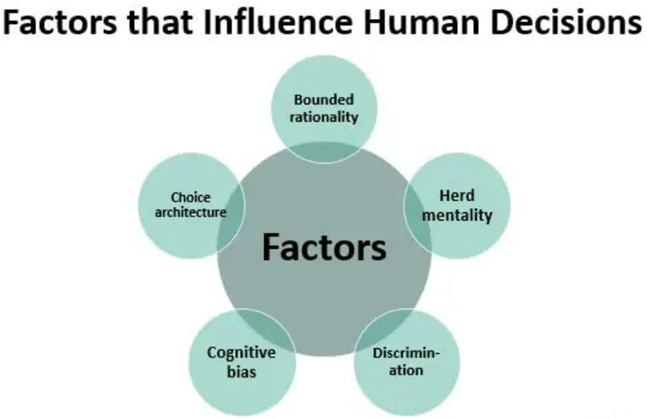

According to behavioral economics theory, human decisions are influenced by various factors such as:

#1 – Bounded Rationality

Individuals tend to make informed decisions based on their limited knowledge. They conclude that having the required amount of information is sufficient and create a “good enough” decision rather than the best possible one.

#2 – Choice Architecture

Presentation of goods has an impact on people’s decisions. Pens, and ink, for example, are complementary commodities, and presenting them together can help enhance ink sales more effectively than if sold separately.

#3 – Cognitive Bias

Individuals make choices based on their beliefs and values and how they interpret the world. For example, suppose a person likes a particular color. Then, they are likely to buy products that are particularly not useful because it is their favorite color and pleases their eyes.

#4 – Discrimination

Here, individuals tend to reject choices based on their dislike. Preconceived biases unrelated to the actual situation can play a huge role in discriminating against an idea. They can favor other decisions because of their aversion to the alternatives.

#5 – Herd Mentality

People like a sense of belonging, whether to faith, a country, a language, or even their favorite sports team! So people spend money they would not otherwise spend to fit in and be recognized as a group member.

The subject attempts to study these factors and behavioral economics principles mentioned above that influence an individual’s decision-making ability and prompt them to make better decisions.

Examples of Behavioral Economics

The following behavioral economics examples are provided to give readers a basic understanding of the concept:

Example #1

As a customer in a mall, Sam came across signs for a product that said $999 instead of $1000, and she chose to purchase it because the price was below $1000. There is no big difference in value between $999 and $1000. There was not much gain saving that $1, but what made her choose to buy that product was the satisfaction of purchasing a product under $1000. It was rather an emotional decision rather than a rational one.

There are countless behavioral economics examples, such as these, that we come across in our daily lives where industries take advantage of human behavior.

Example #2

Google promoted the consumption of widely disliked vegetables (beets, Brussels sprouts, cauliflower, etc.) through an experiment.

Instead of mailing the employees the benefits of Brussels sprouts, they advertised it as “vegetable of the day” and displayed colorful pictures and intriguing facts. Placing them right next to the dish made people choose it. As a result, the number of employees who tried the highlighted dish jumped by 74%, and the average amount each individual served themselves increased by 64%.

Experiments such as these are part of behavioral economics research. They demonstrate how little nudges can influence people’s behaviors. Positive changes such as these reduce consumption of junk food and keep them healthy. It decreases their chances of health issues and increases productivity. Many companies can also benefit economically from such changes.

Application of Behavioral Economics

There are various uses of behavioral economics across industries, for example:

#1 – In a market

Companies make use of the predictable behavioral tendencies of people. For example, if there is a product sold for $10, the chances of it gaining more sales are increased when it is advertised along with another product for a small increase in price. Two products for $12 will be a great deal in the customers’ minds.

#2 – Policy implications

Let’s say it is election time, and every vote counts. So the government can send a small text reminder to the people’s phones to come to do their duty as the country’s citizens. This will urge people to come forward to vote who otherwise would have ignored the opportunity. This little push can decide the fate of a country for a few good years and the economic policies to be framed in that period.

Studying people’s reasoning behind their decisions can reveal what they intend to achieve through that decision. It may be psychological satisfaction, economic relief, or other reasons. This knowledge helps various stakeholders guide the masses into choosing what they desire through encouragement such as free products and reminders, as mentioned above.

Marketing Applications in detail

Behavioral economics provides a framework to understand when and how people make decisions. Marketers can tap into Behavioral Economics to create environments that nudge people towards their products and services, to conduct better market research and analyze their marketing mix. Here are a few examples of how marketing professionals can leverage Behavioral Economic concepts in their marketing.

Confirmation Bias in Customer Retention Programs: Confirmation bias is the tendency to process and analyze information in such a way that it supports one’s pre-existing beliefs, ideas and convictions. One of the most important uses of Confirmation Bias in marketing is in customer retention or repeat buyer programs because there are several touchpoints along the customer journey where marketers can leverage Confirmation Bias to increase the customer retention rate and repeat purchase behavior.

Anchoring Effect in Negotiations: The Anchoring Effect plays a key role in every negotiation because it is all about first impressions. Therefore the person who makes the first offer sets the anchor. And, whoever sets the anchor helps determine the range of the negotiations. So if you put your offer on the table first, the odds are in your favor that you’ll end the negotiation in a place that you’re comfortable with.

Framing Effect in Targeted Messaging: Framing effect refers to the principle that information is not static, but fluid based on how, when and where it is communicated. Good marketers can leverage the framing effect by varying their marketing message to different target audiences to increase the level of engagement and, ultimately, the return on investment.

Indian perspective

The Economic Survey 2018-19 discussed in detail how application of ‘behavioural economics’ can prove to be a valuable instrument of change in a country like India where social and religious norms play a dominant role in influencing behaviour. This is based on the premise that decisions made by real people deviate from the impractical robots theorized in classical economics. “Drawing on the psychology of human behaviour, behavioural economics provides insights to ‘nudge’ people towards desirable behavior”, says the Economic Survey.

The Survey contained an in-depth chapter on policymaking for “Homo sapiens, not Homo economicus". This chapter’s purported rationale was to focus on how past policies have already leveraged insights from behavioural science, and also provided a road map for future policies to incorporate common psychological principles in their nudges. It concludes with a suggestion to set up a nudge unit in India, taking the popular view that nudges alone cannot be a policy panacea, but must be used alongside market mechanisms (called “laissez faire"), incentives and laws (called “mandates"). The budget presented on 5 July by finance minister Nirmala Sitharaman had a few references to behavioural principles in improving tax compliance and the Swachh Bharat Mission (SBM). This analysis aims to critically assess the report’s incorporation of behavioural science in policy, with special reference to past work already done in India.

As noted before, there is tremendous potential for using the insights of behavioural economics in Indian policy. According to the Organisation for Economic Cooperation and Development, there are more than 202 government institutions using behavioural insights around the world. With the exception of a few countries in Africa and South America, no nudge unit is based in a developing country. This might be due to design issues as well as state capacity in developing countries.

In such a context, it was refreshing to see the Economic Survey bat for nudges in India. However, in many cases, the applications of behavioural insights appeared to be a result of confirmation bias (to the extent that past policies were viewed with a behavioural lens). For example, the Give It Up campaign did not specifically target Above Poverty Line households with its messaging, and the give-up rate was under 10% on an average across states. Community-led sanitation schemes, part of the SBM, did include steps to change behaviour, but advertising campaigns such as the Beti Bachao Beti Padhao scheme did not target specific states where child sex ratios were already skewed (although past research indicates that it was effective in Haryana, which has a very poor sex ratio). Thus, although the policies appeal to the appropriate principles, their implementation does not necessarily follow the typical modus operandi of nudges as implemented elsewhere. This is particularly the case where the measurement of effects via causal mechanisms is feasible, but has not been pursued.

This can perhaps be related to the lack of targeting at specific subpopulations characterized by the policies cited in the Survey. For example, mass media and advertising campaigns (such as the Jan Dhan Yojana) with messages are often not aimed at any particular group (e.g. unbanked individuals), whose behaviour policy seeks to change. Furthermore, various suggestions in the Survey that are aligned with Mahatma Gandhi’s seven sins and religious scriptures are well appreciated, but come with caveats. For instance, complying with tax payments is often not seen as a debt to be paid (or an obligation to be fulfilled), but rather as an effortful chore that can be avoided.

Indeed, in this context, the Survey’s suggestions to improve tax compliance are worth examining. The chapter suggests the pre-filling of income tax forms as a useful way to reduce the effort associated with filing returns. As the finance minister announced in her budget speech, this is precisely what the government has now proposed for easing the process of filing tax returns, acknowledging that taxpayers are inherently cognitive misers, as behavioral economics suggests. There are, of course, other proposals that run counter to what behavioural science suggests would be effective and may also be against the current government policy stance. Consider the proposal to publicly recognize highest taxpayers in a circle by naming buildings after them; this could easily lead to a backlash among lower taxpayers, and hurt tax morale disproportionately. It also runs counter to the higher surcharge proposed in the budget on the country’s higher-earning taxpayers.

Finally, the earlier work done by organizations such as Final Mile finds no mention in the chapter. Having worked to reduce railway-related deaths, improve financial inclusion, among many others, existing efforts to incorporate behavioural science in policy must be acknowledged and taken as lessons for future interventions. Even as government tax agencies, such as the Central Board for Indirect Taxes and Customs, and the Central Board for Direct Taxes, propose to take up nudging in a major way in their policies, there is much to learn from experiences elsewhere.

Steps are being taken by the state governments of Maharashtra and Punjab to consider the role of behavioural economics in tackling issues where policy has thus far been stonewalled. One of the ways in which policy can learn is to test and pilot interventions at a smaller scale before being convinced of their utility. In this matter, the chapter in the Economic Survey provides many useful starting points (e.g. default flu shot appointment times, reminders of local social norms regarding banking behaviour, and pre-filling of tax returns) across a variety of policy domains. Indeed, it would appear that it is less of a problem of when to start, and now just a question of where.

Quoting the success of popular Government Schemes in recent times like Beti Bachao, Beti Padhao (BBBP) and Swatchh Bharat Mission (SBM), the Economic Survey said that these schemes have successfully applied behavioural insights to enhance policy impact. For example, ‘#SelfieWithDaughter’ on social media became a worldwide hit and the celebration of the girl child quickly became the norm to which more and more people wanted to conform. Similarly, use of socially and culturally identifiable names for various recent schemes like Namami Gange, Ujjawala, Poshan Abhiyan among others have helped to build the affinity of the people for the scheme.

The community-based approach to sanitation in SBM with the help of Swachhagrahis whose similarity with Satyagrahis, helped to reinforce the message. The gender empowerment component of SBM helped to become a complement the Beti Bachao, Beti Padhao scheme. According to the Economic Survey, the key principles of behavioural economics are ‘emphasizing the beneficial social norm’, ‘changing the default option’ and ‘repeated reinforcements’.

The Economic Survey opined that while several Indian programmes have applied the principles of behavioural economics, there is still ample scope for leveraging these insights to enhance the efficacy of programmes in India. Accordingly, the Economic Survey recommends setting up of a behavioral economic unit programs the NITI Aayog. It also strongly recommends that every programme must go through a ‘behavioural economics audit’ before its implementation.

© 2026 iasgyan. All right reserved