MEDICAL DEVICE INDUSTRY

Disclaimer: Copyright infringement not intended.

Introduction

Vaccines, drugs and medical devices are the three vital pillars of the modern healthcare industry. The current market size of the medical devices sector in India is estimated to be USD 11 billion and its share in the global medical device market is estimated to be 1.5%. India is the 4th largest market for medical devices in Asia after Japan, China and South Korea and is amongst the top 20 markets in the world. Medical Device Industry has been recognized as a key industry under the Make in India initiative and accorded the status of ―Sunshine Sector. Indian medical devices industry has potential to reach 50 billion dollars by 2030.

History of Medical Devices

In the ancient time of Rome various types of medical devices were in widespread use and were indicated by the study of archeology and Roman medical literature. In the United States in 1938 the medical devices were regulated under the Federal Food, Drug, and Cosmetic Act (FD&C Act). Medical Device Regulation (MDR) is the regulation in Europe which is into action since 2017.

Medical device history in India

In the 1960s, the Indian medical devices were dominated by MNCs that had a 90% market share. After 1970 the government took control through the Indian Patent Act-1970 and Drug Price Control Order and gradually Indian companies started emerging. The medical device industry in India attained independent status after the launch of the “Make in India” program in 2014 under the government scheme. In the past, there were no regulations for medical devices until recently.

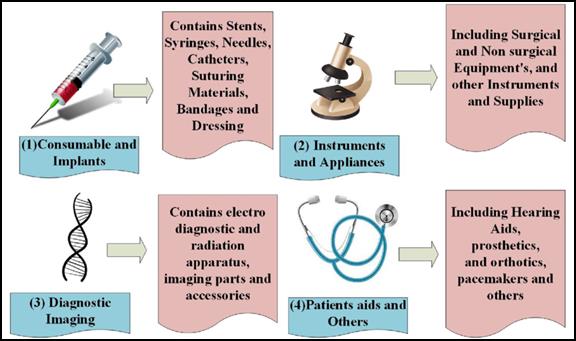

Segments of medical devices

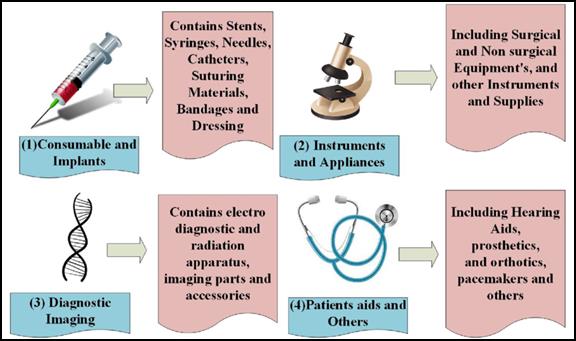

There are different segments into which the medical device industry is classified based on the type of products produced.

- Equipment and instruments: They contribute largely to the total market share and include devices like ophthalmic instruments, dental products, medical and surgical sterilizers, and therapeutic respiration apparatus.

- Diagnostic imaging: The total market share of this segment is the second and categorizes devices like electro-diagnostic apparatus, radiation apparatus, and imaging parts and accessories.

- Patient aids: This segment mainly depends on orthopedic and prosthetics, portable aids, wheelchairs, and hospital furniture and these contribute to a small amount of the total market share.

- Consumables and implants: These are devices that are used internally or for injecting into the patient, such as syringes, needles, catheters, bandages, suturing materials, etc., and a percentage of it contributing to the total market share is managed by these devices.

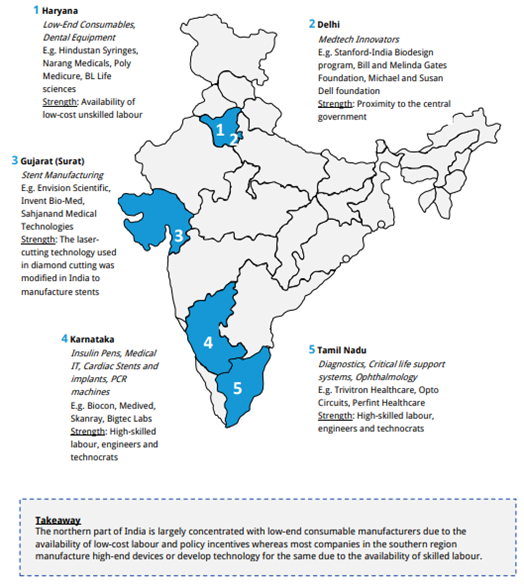

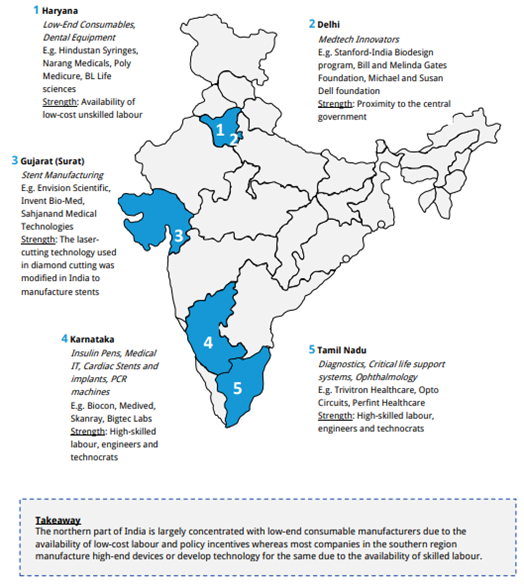

Clusters of medical devices in India

- Karnataka: Mainly focuses on the manufacture of Insulin Pens, Cardiac Stents and implants, Medical IT, PCR machines and these products are developed by manufacturers such as Biocon, GE Medical, Skanray, Bigtec Labs etc.

- Haryana: Focuses on the manufacture of consumables and dental equipment’s and the companies working are BD, Hollister and Poly Medicure.

- Delhi: Medtech Innovators such as Standford-India Bio design program.

- Gujarat: Manufacturing of stents is supported by Envision Scientific, Invent Bio-Med.

- Tamil Nadu: This is a large hub for production of diagnostics, critical life support systems, and Ophthalmology products. Companies manufacturing these are Trivitron Healthcare, Opto Circuits.

Factors that drive the growth of medical devices in the Indian scenario

- Expanding population

- Increasing age of the population

- Increase in the number of chronic diseases

- Rising health insurance benefits to the patients.

- International tourists for medical ailments.

- Rapidly increasing need for healthcare infrastructure.

- International quality standards adopted by Indian hospitals.

Regulatory authorities for medical devices in India

The Government of India has introduced Medical Device Regulation which has the task to regulate manufacturing and marketing of medical devices and the authorities governing it are:

- Central Drug Standards Control Organization: Main regulatory body for pharmaceuticals and medical devices

- The Drug Controller General in India is the crucial official under CDSCO

- Drugs & Cosmetic Act and Rules govern the manufacture, import, sales and distribution of medical devices.

Concerns

Industry Scenario

- India has only 18 certified medical device testing laboratories that have been approved by the CDSCOand that is grossly insufficient keeping in view the size of the country.

- There is a huge gap in the current demand and supply of medical devices in Indiaand this provides a significant opportunity for manufacturing devices in India.

- Around 65 percent of Indian manufacturers are domestic operators in the consumables sector, catering mostly to domestic consumption with negligible exports.With vast service networks, large multinational corporations dominate the high-tech end of the Medical Devices industry in India.

Import- Export Scenario

- India has a 75-80% import dependency on medical devices. Export of medical devices from India stood at US$ 2.53 billion in FY21, and is expected to rise to US$ 10 billion by 2025.

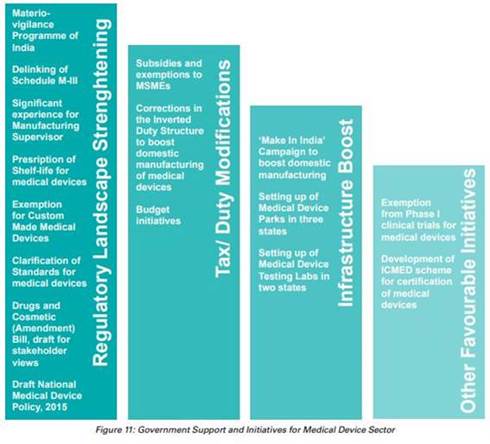

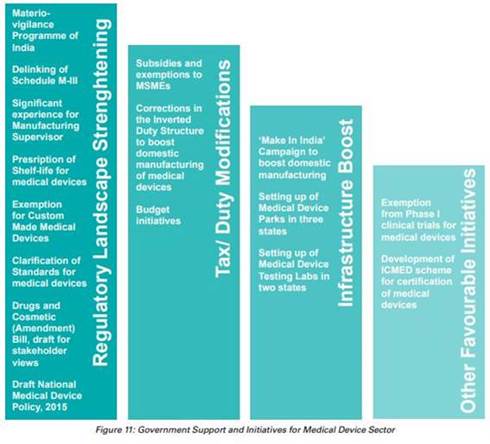

Initiatives being taken

The Government of India has promoted the manufacturing of the devices through initiatives like Make in India, Development of Medical Device Parks and Testing Labs. The Indian Government has introduced Medical Device Regulation to regulate Notified Medical Device.

The Government of India has commenced various initiatives to strengthen the medical devices sector, with emphasis on research and development (R&D) and 100% FDI for medical devices to boost the market.

- In August 2022, the Department of Pharmaceuticals reconstituted the National Medical Devices Promotion Council (NMDPC) under the Chairmanship of the Secretary of the Department of Pharmaceuticals.

- In July 2022, the government tabled a draft for the new Drugs, Medical Devices and Cosmetics Bill 2022, to assure and offer thorough legal protections to ensure that the medical items sold in India are reliable, efficient, and up to required standards.

- In the Union Budget 2022-23, Rs. 86,200 crore (US$ 11.3 billion) was allocated as a budget for the pharmaceutical and healthcare sector.

- In October 2021, the government announced plan to draft a new drugs, cosmetics and medical devices bill to increase the acceptability of Indian medical devices in the global market.

- In October 2021, the government announced that 13 companies have been approved under the PLI scheme for medical devices, which is expected to boost domestic manufacturing in the country.

- In September 2021, the government sanctioned a proposal worth Rs. 5,000 crore (US$ 674.36 million) to build a medical devices park in Himachal Pradesh’s industrial township, Nalagarh, in the Solan district.

- In September 2021, the government approved a medical devices park in Oragadam (Tamil Nadu) that is expected to offer direct and indirect employment to ~10,000 people.

- In June 2021, the Quality Council of India (QCI) and the Association of Indian Manufacturers of Medical Devices (AiMeD) launched the Indian Certification of Medical Devices (ICMED) 13485 Plus scheme to undertake verification of the quality, safety and efficacy of medical devices

- To boost domestic manufacturing of medical devices and attract huge investments in India, the department of pharmaceuticals launched a PLI scheme for domestic manufacturing of medical devices, with a total outlay of funds worth Rs. 3,420 crore for the period FY21-28.

- The Medical Devices Virtual Expo 2021 showcased Indian products and enabled direct interaction between Indian suppliers and buyers/importers from participating countries; 300 foreign buyers from the healthcare sector participated in this event.

- On March 25, 2021, the Department of Pharmaceuticals released a revised notice on the Public Procurement Order (PPO), incorporating 19 medical devices in the revised guidelines of the PPO, which is expected to improve domestic medical devices manufacturing (and strengthen ‘Make in India’) and reduce import bills by ~Rs. 4,000 crore (US$ 538.62 million).

- In April 2021, in order to expedite the clearance of medical devices such as nebulisers, oxygen concentrators and oxygen cannisters, the government made it easier to import critical medical devices by easing the requirements for clearance under the Legal Metrology Act (Packaging Rules 2011).

- To increase export of medical devices in the country, the Ministry of Health and Family Welfare (MOHFW) and Central Drugs Standard Control Organisation (CDSCO) implemented the following initiatives:

- Re-examination and implementation of Schedule MIII (a draft guidance on good manufacturing practices and facility requirements)

- System for export labelling

- Clinical evaluation and adverse reporting clarification

- State licencing authority to extend free sales certificate validity from 2 years to 5 years to allow exports

- Create a list of manufacturers with export licencing for easy access to regulatory authorities worldwide.

- The Medical Devices Virtual Expo 2021 showcased Indian products and enabled direct interaction between Indian suppliers and buyers/importers from participating countries; 300 foreign buyers from the healthcare sector participated in this event.

Way Ahead

Policy Support

- Creating necessary bodies to drive the policies and the administrative department

- Creating an independent body with a permanent office and support staff to:

- Act as a single window for bodies involved/investors in this sector

- Provide access to all government departments

- Renaming the Department of Pharmaceuticals to ‘Department of Pharmaceuticals and Medical Devices’ with a separate post of Director for Medical Devices

- Preference to domestically manufactured medical devices for government procurement

- Additional preferences for medical devices manufactured under the MSME sector

Infrastructure

- Having adequate common infrastructure including accredited laboratories in various regions of the country for standard testing will significantly encourage local manufacturers to get their products tested for standard.

- Such measures undertaken will also help in reducing the cost of production which ultimately will improve the availability and affordability of medical devices in the market.

- Setting up manufacturing hubs/clusters/parks in the Public Private Partnership (PPP) model where the government invests in capital expenditure to develop the infrastructure and private players can bear recurring expenses that is proportionate to their usage.

- Setting up medical device parks that can offer conducive infrastructure to manufacture medical devices.

- Concessional power tariff for up to 5-10 years.

- Single-window facilitating body for financing support from Indian Council of Medical Research (ICMR), Department of Biotechnology (DBT), Council of Scientific and Industrial Research (CSIR), Department of Electronics and Information Technology (DEITY) and Department of Pharmaceuticals (DoP).

- Interest subsidy to Micro, Small and Medium Enterprises (MSME).

Surveillance System

- There is a dire need for developing a robust IT-enabled feedback-driven post- market surveillance system for medical devices to evaluate their efficiency.

Validation Centre

- Setting up government-run, common medical device testing facilities in PPP mode for testing/evaluating medical devices.

- Setting up Centres of Excellence (COE) to support product development, validation and certification of the medical use of the devices.

- Strengthening the ‘Made in India’ marking in medical devices in line with international standards such as CE and FDA.

Skill Development

- The setting up of a Skill Development Committee to address the grave shortage of skilled labour in the sector.

- Setting up committees and representation through National Institutes of Pharmaceutical Education and Research (NIPERs) and Healthcare Sector Skill Council, for identifying skill gaps and designing an appropriate curriculum for vocational training.

- Setting up satellite campuses for training and job placements.

R&D

- Setting up an IP exchange where technologies can be showcased and licensed for commercial benefits.

- Development of incubation centres whereby start-ups can share facilities for research and development.

- The government should provide seed capital and viability gap funding for research projects and start-ups.

- Enhanced tax benefits for R&D activities such as providing a long-term view of 10 years for 200% of weighted tax deductions.

Synergy with State governments

- Health Ministry needs to work in synergy with State governments and impart the necessary skills to the local medical device officers and also devise a mechanism to regularly designate State Medical personnel as Medical Device/Medical Device Testing Officers so that the mandate of the legislation can be implemented effectively.

Allow new Regulators

- Health Ministry should allow the new regulator to involve institutions such as IISC, CSIR, DRDO and network of IITs to test medical devices for safety and efficacy.

Single Window Clearance

- A single-window clearing platform for application of license for manufacturing, export, import shall integrate all these bodies involved in the regulation of medical devices.

- A single-window clearance for all the departments/Ministries would boost investment and would also reduce the time required for obtaining approvals from different Departments/Ministries.

Accessibility, Affordability

- Address the core objectives of accessibility, affordability, safety and quality, focusing on self-sustainability, innovation and growth in the medical devices sector.

Pricing Policy

The inverted duty structure, one of the key factors for import domination in the sector, be modified to promote domestic manufacturing of quality medical equipment and devices.

- Empowering the National Pharmaceutical Pricing Authority (NPPA) for fixing and monitoring prices.

- Creating a separate Price Control Order for medical devices.

- Developing an appropriate pricing policy for medical devices which ensure a sufficient return on investment.

- An independent price control body regulating and monitoring prices based on the principle of value for money.

Duty Structure

Modifying the inverted duty structure to promote domestic manufacturing

- Minimum/zero import duty on raw material and manufacturing equipment used in the medical device sector

- Introducing a prohibition or stringent restrictions to stop the import of second-hand diagnostic equipment

- Levy of taxes on the MRP to counter pegging MRPs at an unreasonably high rate

Regulatory Framework

Pain points:

- Medical devices are subject to laws and stringent penal provisions relevant to drugs

- Lack of regulatory guidelines for clinical trials

- Lack of risk-based classification systems

The proposed changes can add to the industry’s sustainability in the long term with the introduction of:

- Product quality standards

- Clarity on mechanism of clinical trials

- Rational pricing

- Checks on industry malpractices

Other

- Promoting Research and Developmentand Innovation.

- Human Resource Developmentto create manpower with required skills.

- Awareness Creation and Brand Positioningin creating awareness and positioning India as a hub for manufacturing of medical devices as part of the “Make in India, Make for the World” initiative.

- Giving effect to ‘Drug, Medical Devices, and Cosmetics Bill-2022’.

- A separate chapter for medical devices in the Drugs and Cosmetics Act.

- A dedicated regulatory body to devise guidelines and standards for medical devices and regulate various activities like sales and import of goods, quality standards assurance, assurance of availability and affordability of medical devices.

Significance of the Medical Device Sector in India

- The medical devices sector in India is an essential and integral constituent of the Indian healthcare sector, particularly for the prevention, diagnosis, treatment and management of all medical conditions, diseases, illnesses, and disabilities.

- The Indian medical devices sector’s contribution has become even more prominent as India supported the global battle against the COVID-19 pandemic through the production of medical devices and diagnostic kits, e.g., Ventilators, RT-PCR kits, IR Thermometers, PPE Kits & N-95 masks.

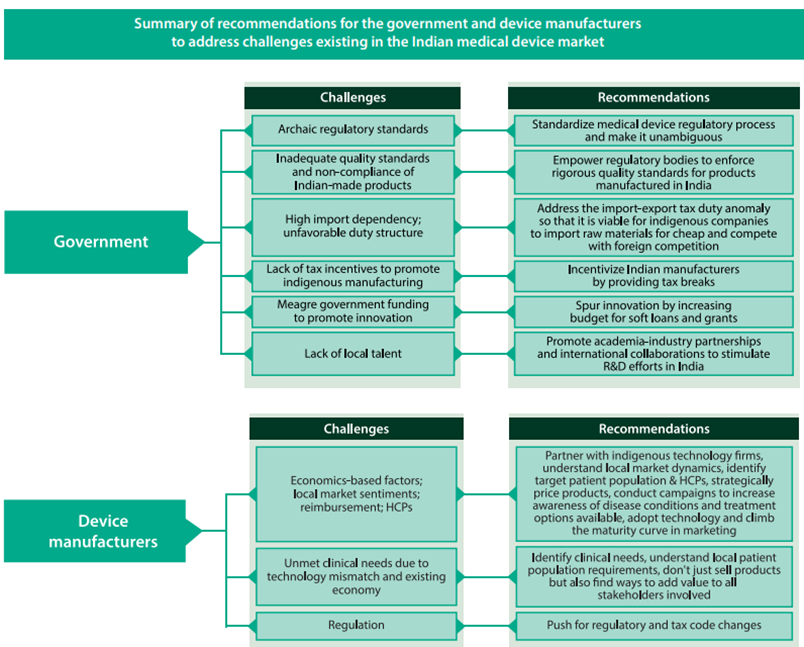

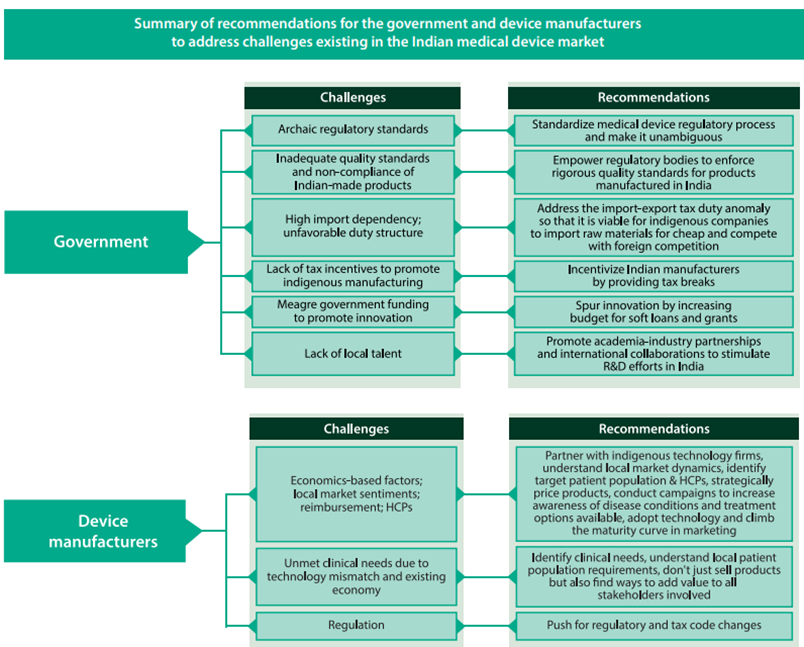

Policymakers in India will need to set out an action plan to reduce the country’s dependency on medical devices/technology imports.

Medical device companies should develop India as a manufacturing hub for domestic and international markets, undertake India-based innovation in combination with indigenous manufacturing, collaborate across the Make in India and Innovate in India schemes, and produce low to medium technology products to cater to the underpenetrated domestic markets.

SOURCES:

https://sansadtv.nic.in/episode/committee-report-medical-device-industry-in-sunshine-sector-03-november-2022

https://www.ibef.org/industry/medical-devices#:~:text=Market%20Size,times%20the%20global%20growth%20rate.

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1863861

https://rjptonline.org/HTMLPaper.aspx?Journal=Research%20Journal%20of%20Pharmacy%20and%20Technology;PID=2019-12-12-57

skp_the_medical_device_industry_in_india_.pdf

https://www.researchgate.net/profile/Manjusha-Choudhary/publication/358802313/figure/fig2/AS:1128892052054019@1646160247955/Medical-Devices-Industry-Segments-38.png