AIR Discussions (October 1st Week)

AIR SPOTLIGHT: MOODY’S CHANGES INDIA’S SOVEREIGN RATING

Context:

- Asserting that India’s downside risks from negative feedback between real economy and financial system are receding, ratings agency Moody’s changed India’s sovereign rating outlook from ‘negative’ to ‘stable’.

- It also affirmed that the country’s foreign-currency and local-currency long-term issuer ratings at Baa3.

- Last year, Moody’s downgraded India’s sovereign rating from ‘Baa2’ to ‘Baa3’, the lowest investment grade, saying there will be challenges in implementation of policies to mitigate risks of a sustained period of low growth and deteriorating fiscal position.

What led to an upgrade in the rating agency’s outlook?

- With higher capital cushions and greater liquidity, banks and non-bank financial institutions pose much lesser risk to the sovereign.

- And while risks stemming from a high debt burden and weak debt affordability remain, the economic environment will allow for a gradual reduction of the general government fiscal deficit over the next few years.

- Bank provisioning has allowed for the gradual write-off of legacy problem assets over the past few years.

What steps have been taken to strengthen the banking system?

- In the last six financial years, banks have recovered Rs 5.01 lakh crore of bad loans, enabling them to improve their financial metrics.

- The government has infused Rs 3.06 lakh crore in state-owned banks in five years between 2017-18 and 2021-22.

- Government approved extending a guarantee of Rs 30,600 crore to the National Asset Reconstruction Company Ltd (NARCL) to help clear the banking sector’s stressed assets of around Rs 2 lakh crore in a time-bound manner.

What is Moody’s assessment on growth?

- Following a deep contraction of 7.3 per cent in the fiscal year ending March 2021, India’s real GDP is expected to rebound to a growth rate of 9.3 per cent, followed by 7.9 per cent in fiscal 2022.

- Moody’s expects real GDP growth to average around 6 per cent over the medium term.

- Some analysts argued that Moody’s has underestimated India’s potential of real GDP expansion in the medium term, as there are enough levers in place for a higher growth.

What is the impact of the upgrade?

- Since overseas borrowing costs are tied to a country’s rating and the agencies’ outlook on the nation, an upgrade usually helps in lowering borrowing costs for the government as well as the corporate sector.

- With chances of default receding and improvement in overall debt service ability, foreign investors take comfort in subscribing to government and corporate bonds at lower rates.

What are Sovereign Credit Ratings?

- Sovereign credit ratings seek to quantify issuers’ ability to meet debt obligations. When favourable, these can facilitate countries access to global capital markets and foreign investment.

- Three key credit ratings agencies (CRAs) are S&P, Moody’s and Fitch.

- Sovereign credit ratings broadly rate countries as either investment grade or speculative grade, with the latter projected to have a higher likelihood of default on borrowings.

How this rating is calculated?

- Governments require ratings to borrow money, they are given ratings on their worth as investment destinations.

- This is done to position itself as a destination for foreign direct investment.

- A country requests a credit rating agency to evaluate its political risks and economic environment such as taxation, currency value and labour laws.

- Another is sovereign risk where a country's central bank can change its foreign exchange regulations.

- These risks are taken into account and ratings assigned accordingly.

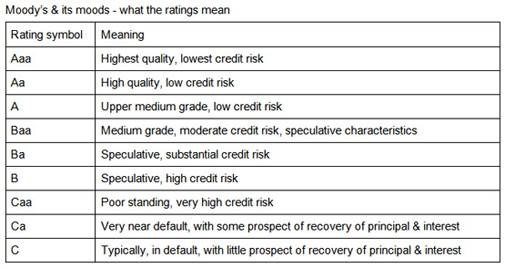

What does the ratings implies?

- Baa1 - The highest rating of speculative grade Moody's Long-term Corporate Obligation Rating.

- Obligations rated Ba1 are judged to have speculative elements and are subject to substantial credit risk.

- Baa2 - Obligations rated Baa2 are subject to moderate credit risk. They are considered medium grade and as such may possess certain speculative characteristics

The Bias Against Emerging Giants in Sovereign Credit Ratings

- Never in the history of sovereign credit ratings has the fifth largest economy in the world been rated as the lowest rung of the investment grade (BBB-/Baa3).

- China and India are the only exceptions to this rule – China was rated A-/A2 in 2005 and now India was initially rated BBB-/Baa3

- A similar trend is seen in PPP current international $ terms.

- CRAs find it more difficult to upgrade poor countries relative to rich countries, for any given improvement in ability and willingness to repay debts.

- There is “home bias” in sovereign credit ratings by CRAs.

- The respective home country of CRAs, countries with linguistic and cultural similarity, and countries with higher home-bank exposures received higher ratings than justified by their political and economic fundamentals.

Does India’s Sovereign Credit Rating Reflect Its Fundamentals?

- While a positive correlation between sovereign credit ratings and GDP growth rate is observed across countries, India is clearly a negative outliere., it is currently rated much below expectation for its level of GDP growth.

- Also, a negative correlation is observed between sovereign credit ratings and Consumer Price Index (CPI) inflation. However, India is rated much below expectation for its level of CPI inflation.

- Moreover, the outlier status remains true not only now but also during the last two decades.

- During most of the 1990s and mid-2000s, India’s sovereign credit rating was speculative grade despite Indian economy growing at an average rate of over 6%.

- India’s willingness to pay is unquestionably demonstrated through its zero sovereign default history. Yet, India is rated much below expectation for its number of sovereign defaults since 1990, making it a negative outlier.

- India’s sovereign external debt as per cent of GDP stood at a 4% (September 2020). Moreover, 54% of India’s sovereign external foreign currency denominated debt was owed to multilaterals and IMF, which is not expected to impact credit rating assessments.

- India’s forex reserves stood at US$ 584.24 as of January, 2021, greater than India’s total external debt. Despite this, India has consistently been rated much below expectation for its level of short-term external debt.

Effect of Sovereign Credit Rating Changes on Select Indicators

- Effect of ratings downgrade:

- Do not have strong negative correlation with Sensex return and exchange rate (INR/USD) in the short, medium and long term.

- G-Sec yields and spread are not negatively correlated with ratings downgrades in the medium term.

- Rating downgrades have a negative correlation with FPI (Equity and Debt) in the long term.

- When a country’s sovereign debt is downgraded, all debt instruments in that country may have to be downgraded.

- Commercial banks downgraded to sub investment grade will find it costly to issue internationally recognized letters of credit for domestic exporters and importers, isolating the country from international capital markets.

- There is evidence of procyclicality of credit ratings contributing to financial market instability in emerging economies.

- Effect of ratings upgrade:

- In the long term, Sensex return, Exchange rate, FPI are positively correlated with ratings upgrade.

- During years of India’s sovereign credit rating changes, the average performance of macroeconomic indicators (GDP growth, fiscal deficit, general government debt, overall debt, inflation and current account deficit) was better than or similar to the previous year

- All sovereign credit ratings upgrades occurred in years that witnessed lower fiscal deficit as compared to the previous year.

Way Forward:

- India’s fiscal policy should be guided by considerations of growth and development rather than be restrained by biased and subjective sovereign credit ratings.

- Developing economies must come together to address this bias and subjectivity inherent in sovereign credit ratings methodology to prevent exacerbation of crises in future.

- The pro-cyclical nature of credit ratings and its potential adverse impact on economies, especially low-rated developing economies must be expeditiously addressed.

- Ratings agencies should be forced to substantially increase transparency, including publishing a separate breakdown of the ‘objective’ and ‘subjective’ components of ratings, the minutes of the rating committees, and the voting records”.

https://indianexpress.com/article/explained/india-moodys-ratings-outlook-stable-explained-7555130/

https://www.indiabudget.gov.in/economicsurvey/ebook_es2021/index.html

NEWS IN BRIEF: PRELIMS SPECIAL

Electricity (Transmission System Planning, Development and Recovery of Inter-State Transmission Charges) Rules 2021

- Promulgated by Power Ministry.

- Paves the way for overhauling the transmission system planning, towards giving power sector utilities easier access to the electricity transmission network across the country.

- As per the new rules, while seeking transmission access, power plants will not have to specify their beneficiaries, rather, state power distribution and transmission companies will be able to buy electricity from short term and medium-term contracts and optimise their power purchase expenses.

- As of now, power generation companies apply for long term access (LTA) with transmission companies, depending on their supply agreements. Depending on the LTA application, additional or incremental transmission capacity is provided to them.

- With the government’s increasing thrust on renewable energy, the need for changing the current transmission system was realised and therefore the new rules were introduced.

World Animal Day

- World Animal Day celebrated by the Animal Welfare Board of India (AWBI) on 4th October, 2021.

- The Day is celebrated every year on 4 October internationally, on the feast day of Francis of Assisi, the patron saint of animals, to educate humans about how their actions impact animals and create awareness about the protection of animals all over the world.

- The first celebration of World Animal Day was observed in March 1925.

- This Day is observed globally to raise the status of animals in order to improve welfare standards.

- The theme for World Animal Day 2021 is “Forests and Livelihoods: Sustaining People and Planet.”

Mitra Shakti Exercise, Ex JIMEX, Exercise Ajeya Warrior

- The 8th edition of Exercise Mitra Shakti commenced at Ampara, Sri Lanka.

- The Indian Army contingent comprising 120 personnel of Infantry Battalion Group and a similar strength from a Battalion of the Sri Lankan Army are participating in the bilateral exercise.

- The fifth edition of India – Japan Maritime Bilateral Exercise, JIMEX, between the Indian Navy (IN) and the Japan Maritime Self-Defence Force (JMSDF) in October 2021.

- JIMEX series of exercises commenced in January 2012 with special focus on maritime security cooperation. The last edition of JIMEX (JIMEX 20) was conducted in September 2020.

- The 6th edition of the Indo-UK joint military exercise Ajeya Warrior has commenced at Chaubatia, Uttarakhand.

High Ambition Coalition (HAC) for Nature and People

- India joined the High Ambition Coalition (HAC) for Nature and People.

- It is a group of more than 70 countries encouraging the adoption of the global goal to protect 30×30.

- HAC members currently include a mix of countries in the global north and south; European, Latin American, African and Asian countries are among the members.

- India is the first of the BRICS bloc to join the HAC.

- HAC is an intergovernmental group co-chaired by Costa Rica and France and by the United Kingdom as Ocean co-chair, championing a global deal for nature and people with the central goal of protecting at least 30 percent of world’s land and ocean by 2030.

- The 30×30 target is a global target which aims to halt the accelerating loss of species, and protect vital ecosystems that are the source of our economic security.

- Currently, an estimated 15% of the world’s land and 7% of the ocean are protected.

1.png)